Digital Platform Tax Solution

Create conditions that enable digital platforms and gig workers to comply with legal requirements and pay taxes.

Book a demo

The hidden cost of untaxed gig work

As gig work grows globally, much of the income remains unreported and untaxed — leading to lost revenue, unfair tax burdens, and weakened social systems.

Without proper oversight, the gap between gig work and tax compliance continues to widen, undermining economic fairness and government capacity.

of delivery gig workers in India had not filed income tax returns (Business Today)

is the projected size of the gig economy by 2034 (Business Research Insights)

What is a digital platform? Who works on digital platforms?

A digital platform is an online service or software that enables interactions between distinct user groups — such as customers and providers. It facilitates the exchange of information, delivery of services, and management of tasks including legal or tax‑regulatory processes.

Typically, these platforms work with two main types of performers: self‑employed individuals and independent entrepreneurs.

Individual Entrepreneurs (IEs)

Individual entrepreneurs offer their goods and services on digital platforms and are required to maintain tax records in accordance with applicable laws.

Unlike self-employed individuals, individual entrepreneurs have broader business opportunities, including the ability to hire employees, issue product certificates, and obtain licenses.

Self-Employed Workers

The self-employed are individuals officially registered with the tax authorities who provide services or perform work while paying tax on professional income.

Although many self-employed individuals traditionally operate in the informal sector, a special tax regime with a low tax rate helps incentivize them to transition into the formal economy.

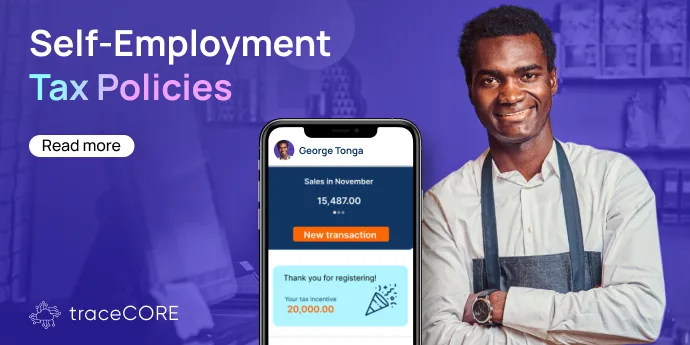

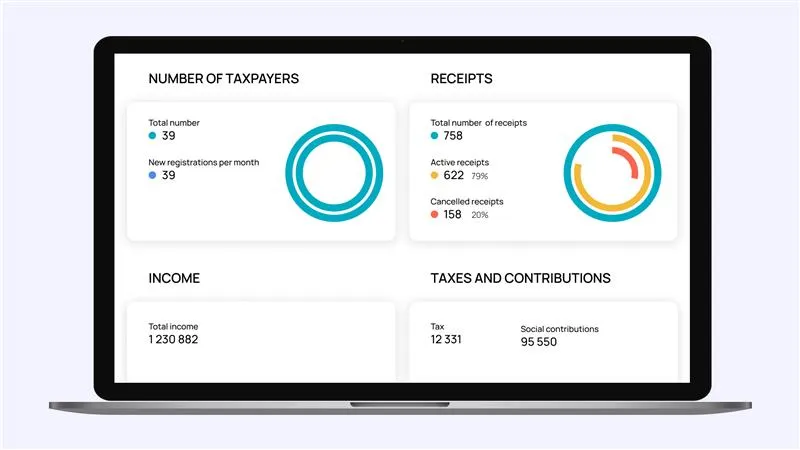

What is traceCORE Digital Platform Tax Solution?

traceCORE Digital Platform Tax Solution helps automate taxation on digital platforms.

Instead of monitoring each self‑employed person individually, oversight is imposed at the digital platform level, making the platform responsible for ensuring legal compliance.

In this case, our solution acts as both a personal data operator and a tax agent.

Streamlined registration for platform users

Secure income data transfer to government systems

Auto-reporting of taxes and payments on bank activity

User account oversight for tax and benefits

Simplified special tax regime selection via mobile app

Automated income reporting, tax and benefits processing

traceCORE Digital Platform Tax Solution helps digital platforms and performers comply with legal requirements:

- Registration as an individual entrepreneur (IE) or self-employed worker

- Creation/cancellation of receipts and income generation

- Calculation of tax and social deductions

- Formation of consolidated registers for the payment of taxes and deductions

- Payment of taxes

.webp)

How does traceCORE Digital Platform Tax Solution work?

Start of Reporting Period: The contractor begins work on the platform.

End of Reporting Period: The operator sends data to the electronic document management system to generate the Act of Work Performed (AWP).

Notification of Signing: The contractor receives a platform message with a link to sign the closing documents for the reporting month.

Document Signing: The contractor opens the document management mobile app via the link, reviews the reporting period and amounts, and signs the documents.

Return to Platform: After signing, the contractor returns to the platform.

Signing Confirmation: A push notification confirms successful signing and includes a link to view the signed documents (PDF) in the document management system.

Document signing process in the mobile app

.webp)

Key features

All-in-one solution

Acts as both a tax agent and personal data operator for digital platforms, ensuring compliance and secure data handling.

Government agency integration

The platform ensures seamless integration with government agencies for automated data exchange.

Accurate tax calculation

Precise calculation of taxes for the self-employed and IEs in compliance with legislation.

E-invoice issuance

Generation of electronic invoices in compliance with legal requirements.

API connection

Simple and fast connection to any platform through a unified API.

Legislation monitor

Automatically tracks legal changes and adjusts the system to stay compliant.

A win-win solution for all stakeholders

Empowering digital platforms with a scalable and highly efficient tax solution.

- Increased tax revenue through automated tax collection from the self-employed and IEs.

- Enhanced transparency in the digital services market.

- Reduced risks associated with tax legislation.

- Lowered costs for developing and maintaining in-house tax accounting solutions.

- Ability to focus on core business development.

- Legal coverage and proof of income (for loans, visas, social benefits, etc.).

- Easy-to-use tax registration and payment mechanisms.

- The self-employment regime will operate more effectively in the country.