Fiscal Data Operator

Enable real-time control of retail transactions and combat the shadow economy.

Book a demo

How does the widespread use of cash fuel the shadow economy?

While the number of people who primarily use digital payment methods continues to grow, cash remains the chosen option for billions of people around the world. Despite the convenience it may offer, cash is the source of great risks for governments, businesses, and consumers, such as support of illicit financial flows, counterfeiting, and global tax abuse.

is the estimated global VAT Gap (USAID)

was the overall EU VAT Gap in 2021 (EU Commission)

How does traceCORE help?

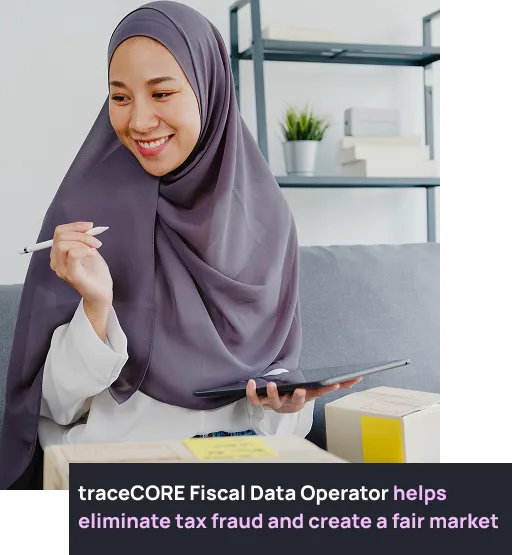

A reliable FDO solution that will collect, process, protect, and store fiscal data and securely transfer it to tax authorities is crucial to any business, regardless of the chosen cash register type. That’s what traceCORE Fiscal Data Operator is for.

Helps adopt electronic document flow

Offers more transparency

Makes Big Data analytics possible

Improves tax collection

Makes data collection more efficient

Allows online registration

What is traceCORE Fiscal Data Operator?

- traceCORE FDO helps tax authorities receive information regarding goods sold and services provided by businesses in real time.

- The system performs independent and permanent reception, processing, cryptographic protection and storage of accepted fiscal data online.

- It integrates with tax administration systems and provides opportunities for analytics, forecasting and decision-making based on fiscal data.

- traceCORE FDO allows implementing online fiscalization — a significant step towards modernizing the tax system and reducing the shadow economy.

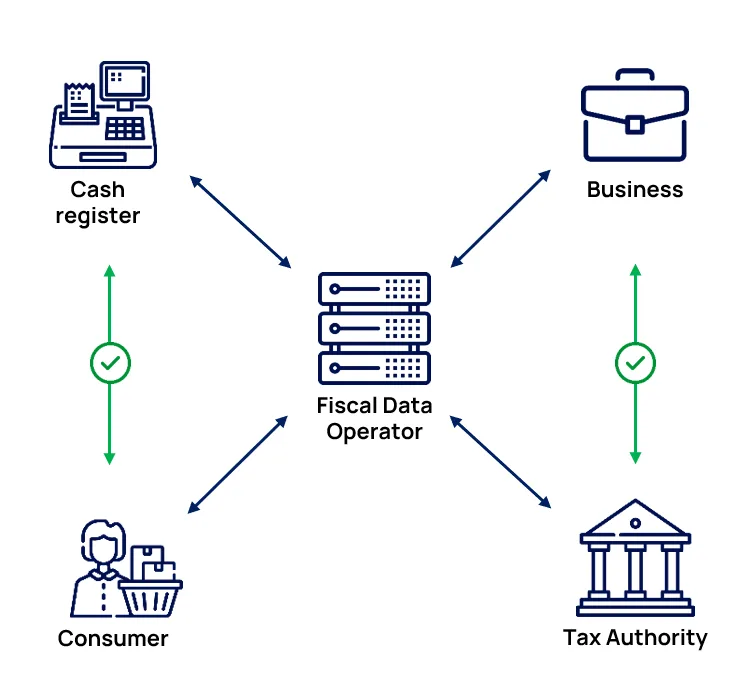

Role of traceCORE Fiscal Data Operator

- The Fiscal Data Operator by traceCORE plays a pivotal role in ensuring the reliability, security, and accessibility of fiscal information.

- By integrating modern technologies and approaches, the online fiscalization system effectively administers taxes, enhancing transparency and trust among businesses and citizens.

- traceCORE FDO allows business owners to register cash registers online, set tax regimes and other vital parameters. The system will collect, process, and store sales data, providing tax authorities with up-to-date financial information.

- Analyzing fiscal data to calculate taxable income simplifies tax administration and reduces errors.

Key features

Online registration

Cash registers can be registered online without submitting them or visiting the tax office in person.

Data analysis

Preliminary data analysis to detect anomalies and violations, enabling prompt action by tax authorities.

Security assurance

The use of advanced cryptographic technologies to protect data from unauthorized access and alterations.

Seamless system integration

Easy integration of online fiscalization with popular e-commerce and financial platforms.

Data reception and storage

Secure receipt and storage of fiscal data from cash registers while maintaining its integrity and availability for tax authorities.

Support for various cash registers

Support for traditional and modern cash register solutions, such as software-based registers for desktop and mobile.

A win-win solution for all stakeholders

Taking action to eliminate the shadow economy helps increase government revenue and improve tax compliance, allows businesses to develop quicker, and protects consumers.

- Access to sales data, including accrued taxes, in real time.

- Convenient cash and non-cash transaction monitoring,

- Implementation of an automatic risk assessment system.

- Enhanced visibility of tax procedures.

- Decrease in the need for tax audits.

- Increased tax revenues from retail sales.

- The use of data analytics, machine learning, and AI for tax reports and fraud detection.

- Direct feedback from citizens and more opportunities for the implementation of new digital technologies.

- Legalization of shadow operations creates a level playing field.

- Functional service and mobile app for analytics and sales management.

- Simplified registration of cash registers using an FDO client’s personal account.

- Significantly less time is spent on reports and paperwork.

- The option to send receipts to customers by email and SMS.

- Digitalization of retail sales provides valuable business insights.

- Online fiscalization enhances transparency and trust among businesses and citizens.

- If a business uses online cash registers, consumers can receive e-invoices (digital receipts) via email and SMS, keep track of their purchases and analyze expenses.

- Loyalty service providers, brands, retailers, banks and even tax authorities often offer cashback, discounts and bonuses.

.webp)

.webp)