.webp)

In many developing economies, the majority of workers are self-employed in the informal sector or in seasonal jobs like farming and construction.

While self-employment offers flexibility, it also brings challenges like tax obligations and limited security. To support these workers, policies must provide social protection and help transition them into formal employment.

For governments, it is critical to address the needs of such workers. One way to do this is by developing solutions that prioritize their stability and opportunities. But first, decision-makers must grasp what self-employment entails and how tax policies affect them.

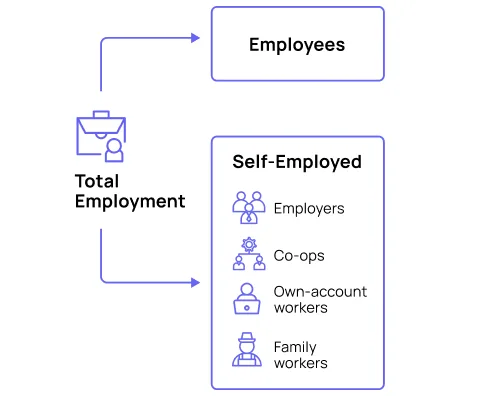

Who Is Considered Self-Employed?

Self-employed individuals in contrast to employees do not get any fixed salary or wages. Their income is directly related to the profits that they get from their business.

Self-employed workers earn income from independent economic activities, which contrasts with individuals who work for employers. Even freelancers with a single client can be considered self-employed.

Types of Self-Employed Workers (Based on Definitions by ILO)

Employers

Work on their own account or with one or a few partners in a setting where their financial compensation depends on the profits, while hiring one or more employees.

Members of producers' cooperatives

Workers who hold self-employment jobs in a cooperative producing goods and services.

Own-account workers

Working on their own account or with one or more partners, hold the type of jobs defined as a “self-employment jobs” and have not engaged on a continuous basis any employees to work for them.

If the proportion of own-account workers (self-employed without hired employees) is sizable, it may be an indication of a large agriculture sector and low growth in the formal economy.

Contributing family workers

Workers who hold self-employment jobs as own-account workers in a market-oriented establishment operated by a related person living in the same household.

Generally unpaid, although compensation might come indirectly in the form of family income. A high proportion of contributing family workers may indicate weak development, little job growth, and often a large rural economy.

For governments, the informal sector means loss of tax revenue. For businesses, informal employment means low productivity and limited access to finance. For self-employed workers, informality means the lack of protection.

Visit this page to learn how traceCORE Self-Employment Tax Solution solves these problems.

State Interest in Self-Employed Individuals

Tax revenue growth

Governments target self-employment because it’s largely informal in developing countries, which results in tax revenue loss.

To formalize self-employed workers, they have to employ various policies like tax incentives, health insurance programs, and simplified tax reporting.

Fair social protection

Informal self-employed workers strain social protection systems because they do not contribute to social welfare.

In contrast, if you formalize these workers, it helps distribute the social protection burden evenly.

Flexibility and reduced costs

Governments see value in having part of their workforce as self-employed for economic flexibility and supporting small businesses. When more people choose self-employment, it allows businesses to manage their workforce more flexibly.

By lightening the tax load on employers, the trend towards self-employment helps create more job openings and ultimately brings down the unemployment rate.

Small business support

Self-employed individuals, often running as sole proprietors or small business owners, add diversity and energy to the business world.

Policymakers can boost the growth of these enterprises and their economic impact by offering resources, support, and favorable regulatory conditions for self-employed entrepreneurs.

Advantages of Introducing Self-Employment Tax Regimes

As the number of self-employed individuals continues to rise, taxation has become a critical area of concern for both workers and governments alike.

Unlike traditional employees, self-employed individuals face unique tax challenges that can be solved only if there's a special tool for that.

traceCORE Self-Employment Tax Solution helps governments across the world build the system that brings millions of workers out of the shadow.

Increased tax base

These measures expand the tax base, which leads to higher revenue for public services and development.

GDP growth

Simplifying taxation reduces administrative costs, which contributes to economic growth.

Improved tax compliance

Clear regulations and reporting mechanisms encourage compliance.

Online tax information

Accessible online platforms provide self-employed individuals with valuable tax information and statistics.

Reduced informality

Special taxation measures formalize the self-employment sector.

Streamlined auditing

Clear regulations simplify auditing for both tax authorities and self-employed workers.

Self-Employed Workers Around the World

EU

Self-employed workers in the EU contribute approximately 5% of budget revenues from taxes, but their share varies a lot across countries. For instance, in some countries like Slovakia, Estonia, Latvia, and Croatia, it is less than 1%, ranging from 0.3% to 0.8%. In contrast, Poland leads with an 11.6% share. Italy, Austria, the Netherlands, and Germany also have relatively high shares, which range from 5.5% to 7.7%.

Interestingly, in Poland, self-employed individuals make up about 20% of all employees, and their contribution to tax revenues is notably high. This suggests that many high-income people (contract workers and skilled professionals) tend to choose self-employment to pay lower taxes. However, in countries like Greece and Italy, which also have high rates of self-employment, their contribution to the state budget is much lower.

North America

In the USA, self-employed individuals may manipulate reported business expenses or income on their filings to avoid the alternative minimum tax. As they get closer to the AMT threshold, their business expense ratios increase by 0.02% for every $1,000. However, once they exceed the AMT threshold, additional changes in the AMT gap no longer impact their business expenditure ratio.

In Canada, increasing the top income tax rate is associated with fewer self-employed individuals starting up. For every one-percentage-point rise in the top tax rate, there’s a 0.06-0.21 percentage-point decrease in how many people start out a new venture.

Latin America

The threshold for simplified tax regimes, which are beneficial for self-employed individuals, varies across countries in Latin America. In Brazil, the threshold is quite generous, which is set at 26 times the average income. Similarly, Ecuador, Peru, and Mexico have high thresholds compared to their respective GDP per capita. For instance, in Peru, the threshold is calculated at 4.9 times the median annual sales of firms in the general regime. In Mexico, it’s even higher and translates to 17 times the median annual sales.

The example of Latin America shows that simplified tax regimes can lead to lower tax revenues and distort various aspects of the economy. When these regimes subsidize social security contributions, larger formal firms near regulatory thresholds may under-report their size to avoid extra taxes. This could also discourage talented individuals from choosing entrepreneurship and lead to less optimal talent allocation in the economy.

Why Choose traceCORE Self-Employment Tax Solution?

Takeaway

With the majority of the global workforce operating informally, particularly in low-income countries where many are self-employed, formalizing self-employment becomes key to leveraging its advantages. Therefore, governments must align the tax system to support business growth, social welfare, and overall societal well-being, including for the self-employed.

In recent years, there have been notable improvements in tax systems worldwide, which partially contribute to bringing some of the workforce out of the informal sector. These improvements have led to increased tax collection, more efficient tax processes, and the introduction of new measures to address evolving economic and social needs. That said, there are still some gaps that remain to be filled.

To achieve better tax collection from the self-employed and make sure more workers are employed legally in your country, check out traceCORE Self-Employment Tax Solution and learn more about its benefits.