Self-Employment Tax Solution

Self-Employment on Digital Labor Platforms and Its Impact on Tax Compliance

The traditional 9-5 workday is not for everyone. For some people, following such a schedule is actually a lot more inefficient than sticking to a less structured routine. That’s why many choose to become self-employed and seek alternative ways to make money, such as freelance jobs and side hustles. This kind of work resembles short-term “gigs” rather than traditional long-term employment and falls under the term “the gig economy.”

When we talk about the gig economy, we often mean platform work, where tasks are mediated through digital platforms. In this post, we’ll focus on the rise of the gig economy through these digital platforms and how traceCORE’s Self-Employment Tax Solution can be used to bridge the gap between informality and formality in tax compliance.

The Growing Importance of the Gig Economy

Different terms have been used to talk about the gig economy, like “platform work,” “collaborative economy,” “sharing economy,” “on-demand economy,” and “crowd employment.” The number of labels keeps increasing along with the businesses and people involved in this area. Such working arrangements have existed for a long time, both within formal job contracts and in informal sectors like domestic work.

Why Do People Choose to Become Self-Employed?

According to the 2022 research conducted by McKinsey, there are four main reasons why people prefer self-employment to traditional job contracts:

Over 25% of respondents shared that they take on independent work “out of necessity to support basic family needs,” which is a huge increase over the 14% of respondents in McKinsey’s 2016 research who stated that they chose self-employment to supplement their income.

The percentage of casual earners who do independent work for extra cash, however, has decreased by half since 2016. This change shows that a lot more people are serious about becoming self-employed and making such jobs their primary source of income.

Public policymakers need to consider the needs of all these groups, monitor the changes, and adapt policies to fit the digital era.

Preconditions Shaping the Gig Economy on Digital Labor Platforms

Woodcock and Graham outlined several main preconditions that led to the emergence of the gig economy, including technological advancements, societal attitudes, political regulations, and their interplay.

The Growth of Technology

Gig platforms have advanced due to the development of key technologies, such as 4G connectivity, cloud computing, and GPS networks. Certain tasks, such as delivery services, can be easily organized through digital platforms. All that people really need is access to affordable smartphones and reliable internet connectivity.

Public Reaction to Gig Work

Historical associations of certain types of work with specific genders and races influence employment patterns and societal attitudes toward the gig economy. It’s also important to note that while not as many people might engage in online gig work, a lot more of them have become consumers and use such services on a daily basis.

State Regulation and Worker Power

Government regulations can either facilitate or hinder the growth of the gig economy, impacting worker protections and industry standards. The strength of labor movements and unions can influence the balance of power between workers and gig platforms.

Globalization of Gig Work

The rise of the gig economy presents opportunities and challenges, with some tasks being completed remotely and others requiring physical presence. The development of online gig work also faces more barriers due to the lack of high-tech environment in some regions and other reasons.

These and other factors led to the global gig economy market being valued at $355 billion in 2021 and projected to reach $1,864.16 billion by 2031.

Challenges Faced by Self-Employed Workers

The gig economy is getting attention not just for its growth and economic benefits but also for the concerns it raises about protecting consumers and workers and labor policies.

The 2022 research performed by McKinsey shows that self-employed workers face various challenges. Those include the lack of affordable healthcare and health insurance as well as problems accessing better housing, childcare, transportation, and nutritious food.

In addition, according to the International Labour Organization, precarious work involves employers shifting risks onto workers. This means uncertainty about how long the job will last, potential for multiple employers, lack of benefits, low pay, and difficulty joining unions. This insecurity is caused by various social, economic, and political factors, and it affects workers not just at work but also in their ability to participate in other aspects of society.

For these workers, managing tax compliance requires significant time and resources despite their relatively small incomes. This burden may discourage them from staying in the gig economy or even lead to tax evasion.

Unlike traditional employees, gig workers have to handle various legal and financial responsibilities on their own. They must navigate payroll taxes, including income tax and social security contributions, and provide their own benefits like health insurance and disability coverage.

Categories of Digital Platforms for Gig Workers

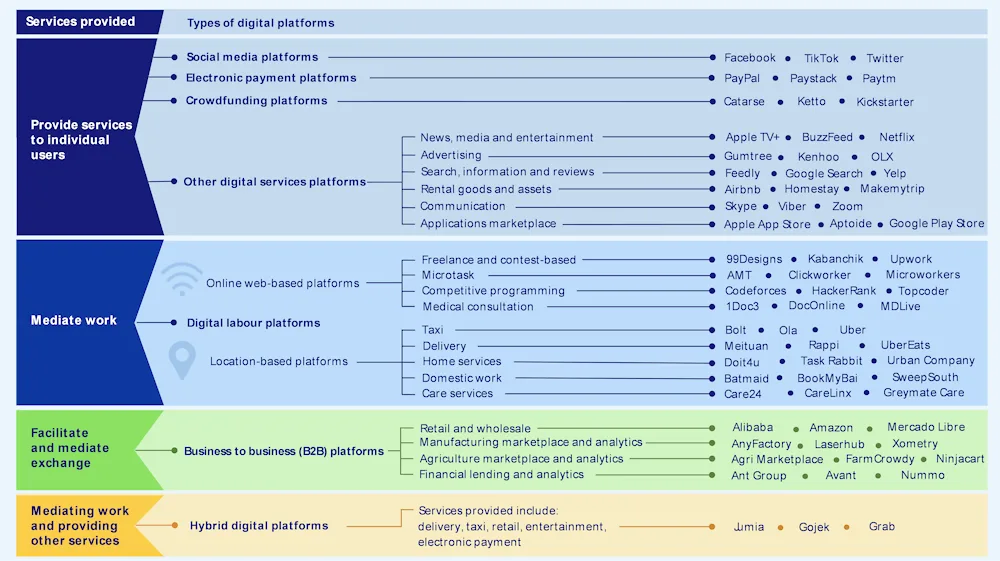

There are many ways to group digital platforms, but according to the 2023 OECD library publication, this specific typology could be suggested.

The number of online and location-based platforms grew from 142 in 2010 to over 777 in 2020. In 2021, about 14 million workers were active on the five biggest English-speaking online platforms.

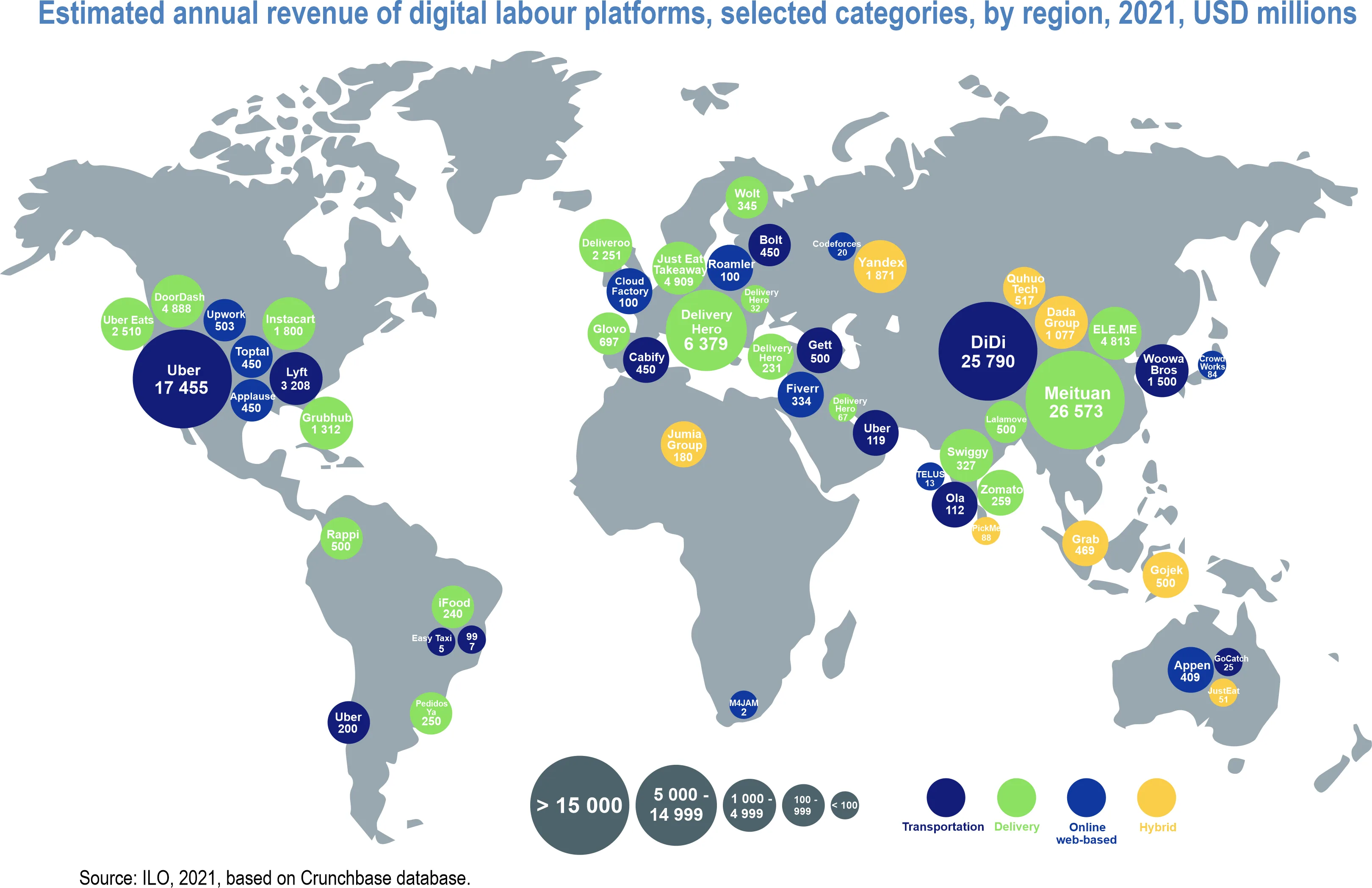

Digital Economy Landscape Across Regions

Self-employment through digital labor platforms is expanding into many parts of the economy across all regions. However, the number of people working on these platforms is still quite small.

In Africa, digital work is becoming more important, although it’s happening slower than in other places. In 2021, Ghana had 60,000 to 100,000 workers using digital platforms for income, while Kenya had over 35,000. However, according to the 2023 research conducted by the Humboldt Institute for Internet and Society (HIIG), it is difficult to count the exact number of online gig workers in Kenya. One of the main reasons for this is that most of their accounts on digital labor platforms are set up by people who hire multiple employees to work for them. Furthermore, some Kenyan independent workers choose to conceal their identity to avoid encountering legal difficulties, including tax compliance issues. That’s why policymakers and digital platform owners estimate that the true number of online gig workers in Kenya is closer to 1 million. The Federation of Kenya Employers (FKE) also stated that this number will grow rapidly in the near future as more and more people discover the flexibility of the gig work.

South Africa’s digital labor platform workforce grows by over 10% annually, possibly reaching millions by 2030. In Egypt, Uber alone had over 200,000 registered drivers in 2020.

Latin America and the Caribbean are also seeing more digital work due to factors like wealth inequality and migration. For example, Ecuador had about 40,000 digital platform workers in 2020, which supported 1.5 million users. Spanish being common in the region helps online work grow.

In Eastern Europe and Central Asia, Russian-language online platforms had at least 8 million registered workers by 2019, spread across 14 countries in the region. Local platforms, especially in Serbia and Ukraine, are doing well in digital work.

The Role of Digital Labor Platforms

Digital labor platforms have become pervasive across various sectors and benefited from the digital economy’s core elements. These platforms have flourished thanks to the widespread use of information and communication technologies such as smartphones and computers. Such growth is accelerated by factors like accessible cloud infrastructure and ample venture capital, which have made it easier for new players to enter the market.

Cloud infrastructure is particularly vital for digital platforms, as it allows them to operate without heavy physical assets. Unlike traditional businesses that invest in tangible assets like cars or hotels, platforms invest in digital infrastructure and rely on user-provided resources like data and skills. Take Uber, for example, which expanded to 69 countries in just 11 years with minimal investment in vehicles. Instead, it leverages a vast network of over 7 million drivers who either own or lease their cars.

Cloud services allow digital labor platform businesses to operate without physical constraints, meaning users can be located anywhere. This has created opportunities for tech start-ups and developers to innovate and create new products and services on these platforms, which is driving further digital transformation.

Leveraging Digital Platforms for Formalization and Tax Compliance

Integrating tax authority systems with job platforms offers an opportunity to tackle the epidemic of informal employment and formalize the status of digital labor platform workers within tax and social security frameworks. Being able to use digital accounts to track their output and earnings, these workers can transition into the formal economy. Not only does it help with tax compliance, but it provides these workers with access to essential social security benefits.

Connecting different technological tools drives the push towards formal work. For instance, freelance marketplaces offer gigs, but gig workers will then need a tool to report earnings. Since they’re already working digitally, it’s natural for them to handle taxes the same way.

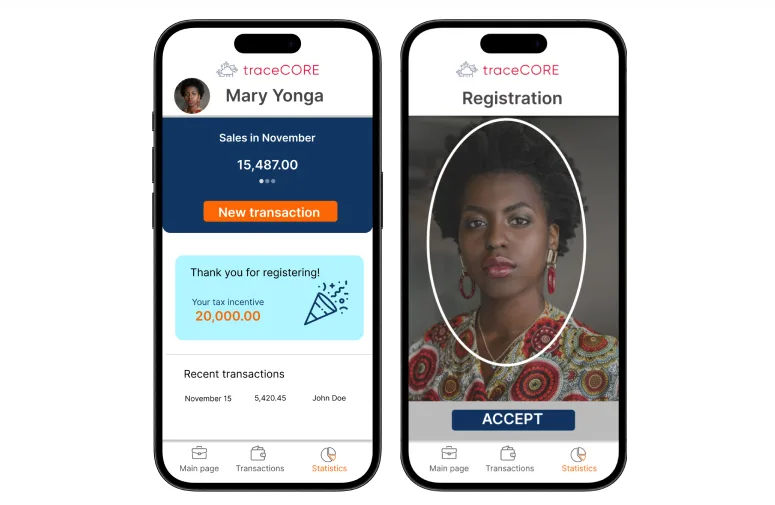

A prime example is traceCORE’s Self-Employment Tax Solution, a digital tool that connects tax administration with job platforms to facilitate tax payments directly through the platform. This streamlined process eliminates the need for taxpayers to file tax returns manually and makes compliance easier. By also making tax evasion more difficult or impossible, it results in a truly win-win situation.

Moreover, digital job platforms easily integrate into this setup. Job platforms act as agents for taxpayers and facilitate the registration and taxation of self-employed individuals involved in online work. Through partnerships, tax authorities can then swiftly implement the self-employed tax system and effectively engage with a larger population of self-employed workers.

Why Digital Platforms, Governments, and Tax Authorities Should Collaborate

There needs to be political commitment, collaboration between platforms and government agencies, and a regulatory environment that safeguards both workers and data privacy.

A noteworthy example is the collaboration between the Estonian Tax and Customs Board and Uber. Connecting digital payment systems directly to taxation infrastructure in this partnership helped cut down on undeclared income, simplified administrative procedures, and created a fairer environment between digital platforms and traditional sectors. Ultimately, it led to increased tax revenues.

Further, Estonia is exploring partnerships with digital labor platforms to use workers’ online accounts for social security. They’re also developing a digital tax system that could access platform transaction data directly through banks. However, for these collaborations to move forward, platforms will need to agree or be legally obligated to share data, all while adhering to data protection regulations and potentially adjusting existing laws.

Collaboration among digital platforms, governments, and tax authorities forms a symbiotic relationship. Digital platforms benefit from clear tax guidelines and compliance support, which allows them to grow and innovate without legal complications. In return, governments and tax authorities receive valuable data to boost tax revenue and combat evasion. This fair and transparent tax system fosters public trust and economic stability, benefiting both the public and the platforms.

Revolutionizing Tax Collection With Real-Time Data Sharing

Real-time reporting offers benefits to tax agencies, not just businesses sending invoices. It allows for faster payments and better tracking of overdue payments, including potential tax deductions for bad debts. With access to all invoices, tax agencies can process VAT refunds more quickly, within 40 days instead of 60, according to EY.

Currently, tax agencies deal with a high volume of manual work related to invoicing, which real-time invoice reporting can reduce. Although the benefits might not be immediately apparent due to stakeholder involvement and initial IT costs, the benefits are clear.

E-invoice reporting in real time ultimately reduces manual work, simplifies accounting processes, and decreases human errors, thanks to standardized invoice templates. This standardization makes it easier for tax agencies to process invoices efficiently.

Check out traceCORE’s B2B E-Invoicing and B2C E-Invoicing solutions to learn how you can improve VAT collection and reduce the number of audits by automating transaction control in both B2B and B2C sectors.

The introduction of mandatory e-invoicing in Poland in 2024, for instance, promises improved efficiency for tax agencies by transitioning from manual invoicing to the National e-Invoicing System (KSeF). This shift will reduce errors, ensure tax compliance, and enhance data quality. Compliance with KSeF rules will be critical to avoid penalties.

Ensuring Fairness and Inclusion for Gig Workers

In the job market, the urgent issue we’re facing globally is the widespread loss of jobs. That’s why self-employed workers turn to these opportunities — because they serve as essential income sources, especially in developing nations and in trying times. Also, self-employment provides a vital safety net during times of crisis. It offers individuals a means of sustaining themselves when traditional employment options are limited.

This is a critical moment for policymakers worldwide to move past the traditional divide between contractors and employees and set up a strong safety net that covers all types of workers. Policymakers need to anticipate and respond to this challenge with a range of reforms. They must adopt a comprehensive approach that goes beyond traditional employment categories.

This means establishing a safety net that gives gig workers access to benefits like health insurance and retirement plans. Tax policies also need a rethink to ensure fairness for gig workers and prevent them from being burdened with excessive taxes. Also, efforts should be made to create a more stable income environment for gig workers by discouraging practices that drive down wages.

Ethical Dilemmas in Algorithmic Governance

Algorithms are key in matching gig workers with jobs and deciding how much they get paid. However, because these algorithms aren’t transparent, they can be biased. The lack of transparency in decision-making leaves people unaware and possibly results in unfair treatment based on gender, race, or wealth. This worsens existing inequalities.

Also, the constant tracking of gig workers through data collection tools can invade their privacy. From keeping tabs on where they are to evaluating how well they’re doing their job, this level of surveillance can feel like an invasion of privacy and take away personal freedom. Plus, the data collected could be misused, which raises concerns about privacy and the potential for abuse.

To address these issues, people are calling for ethical rules and regulations to govern the gig economy. Finding a balance between giving workers flexibility and making sure they’re treated fairly is essential. Making algorithms transparent, protecting data privacy, and ensuring fair pay are all important steps in dealing with the ethical problems of the gig economy.

Strategies for Fairness, Diversity, and Protections

Skill development and training programs

The government should create training programs specifically for gig workers to help them improve their skills and become more employable. These programs should adapt to the changing job market.

Fair wage regulations

It’s important to establish clear rules about pay to ensure gig workers are fairly compensated for their work. This includes setting minimum wage standards.

Worker rights and protections

Gig workers need legal protections to prevent exploitation, ensure reasonable working conditions, and provide ways to solve disputes.

Access to financial services

Gig workers should have easier access to services like credit and banking to help them manage their finances and become more financially secure.

Technology integration for skill enhancement

Gig workers need to keep up with technological changes in their industries. Using online courses and training can help them learn new skills.

Collaboration with platforms and companies

The government and gig economy platforms should work together to create a fair and supportive working environment for gig workers.

Community engagement and awareness

It’s important to educate both gig workers and the public about the challenges and opportunities in the gig economy to build a supportive community.

Increased Transparency

Gig workers need to be informed from day one of all important aspects of their employment contracts to ensure they are aware of their duties and schedules.

Case Studies and Examples of Gig Economy Jobs

Governments should find new ways to cover informal employment and self-employment, including gig work. One way is to work directly with digital platforms. Other steps include simplifying registration and payment processes, using technology for easy integration, and creating customized tax and social security schemes. Here are a few real-life examples:

Digital Ride-Hailing Industry in Russia

To simplify tax procedures for the self-employed, the Federal Tax Service of Russia surveyed 9,000 informal workers earning income through digital platforms like taxi services and freelance work. Results showed that 76% were ready to legalize their income, 67% preferred tax authorities to calculate taxes, and 70% wanted tax rates below 6%.

In 2017, certain professions, like nurses and tutors, received a three-year personal income tax exemption upon submitting a notice to tax inspection. However, only around 4,000 people registered nationwide.

Based on this, a special tax regime was introduced in select regions in 2019. For example, YanGo supports self-employed drivers with benefits, such as priority points and tax bonuses. This system allows self-employed individuals to register and manage taxes online within minutes. Taxes can be paid through the app using a linked credit card, which eliminates the need for tax returns.

Monotax System for Gig Workers in Argentina and Uruguay

In Argentina, platform workers enjoy simplified procedures through monotax, thanks to a specialized portal and mobile app developed by the Tax Administration. This setup simplifies registration and contribution payments for platform workers.

The tax scheme in the country combines health and social welfare obligations into one monthly payment. It’s called “monotributo”, meaning a single tax payment. Workers under this scheme can access three out of five social security components: insurance for old age (retirement), disability, and death; family allowances; and health insurance.

Similarly, in Uruguay, ride-hailing platform workers benefit from a monotax mechanism with social security coverage. With a dedicated phone application, contributions are automatically paid through the platform’s connection with the contribution collection agency.

Social Security Integration and Simplified Mechanisms in France and Germany

In France, the focus is on ensuring that worker income information is shared with social security agencies. This means platforms share detailed income data, and workers can choose to let platforms handle contribution payments to the relevant agency. Also, there are simplified procedures for self-employed individuals categorized as auto-entrepreneurs.

France and Germany employ a special model to finance social security for artists and creatives, recognizing the similarities in short-term engagements shared by these groups and platform workers. Artists and writers covered by the Artists’ Fund pay only half of their overall contributions for pension, health, and long-term care, similar to dependent employees. The rest of the contributions are divided between user companies (30%) and the government (20%).

In 2016, approximately 180,000 artists and writers were actively insured. In 2013, the Artists’ Fund received around 16,000 applications annually, with about 75% of them being accepted. However, access is still limited to certain occupations.

Entrepreneur Account and Informal Work Formalization in Estonia

In 2019, Estonia launched the Entrepreneur Account to streamline tax processes for private entrepreneurs. This account follows a uniform tax system, dividing income tax, social tax, and mandatory pension contributions. It facilitates direct remittance of pensions and health insurance contributions to the social security administration. Also, it accommodates income from multiple platforms collectively since many digital workers are registered on several platforms.

In industries like construction, manufacturing, and small-scale services, such as hairdressing, informal work arrangements were more common. The employers’ registry made registration easier, particularly in these sectors. In the first year alone, over 21,000 workers were formalized, which resulted in an estimated increase of 11.8 million euros in tax revenue.

Social Contributions and the CPF in Singapore

In Singapore, some platforms choose to transfer contributions to social insurance institutions voluntarily. However, Grab’s initiative is noteworthy for matching social contributions made by self-employed workers. Also, direct contribution payments can be facilitated through interconnection with electronic fund transfer services.

Contributions to the Central Provident Fund are anticipated to become mandatory for gig workers and broaden in scope in the future. The CPF savings scheme boosts national savings and reduces the government’s social spending, which is essential for economic growth.

Proposals for Platform Workers in Brazil and India

Brazil’s government intends to broaden the monotax system to cover digital platform drivers and provide them with access to various benefits such as sickness, maternity, disability benefits, and old-age pensions.

Meanwhile, India proposes financing social security by taxing platforms’ turnover, which mirrors existing levies in sectors like construction. These funds would be channeled through sectoral Worker Welfare Funds to support social security initiatives for platform workers.

Conclusion

Lots of gig workers aren’t officially registered as self-employed, often because they don’t think it’s necessary. Getting them to sign up with tax and social security authorities is the first step. And simplifying tax rules for small-scale entrepreneurs where possible can make it easier for them to understand and follow.

Teaming up digital labor platforms, governments, and tax authorities is key to getting gig workers properly recognized. Digital labor platforms hold valuable data to track transactions and earnings, which helps with regulatory compliance and worker protections. Governments enforce simplified tax rules and educate workers on formalization benefits, while tax authorities ensure platforms contribute fairly.

By using tech tools like tax software and e-invoicing solutions, the process can be smoothed out, hitting goals like better tax compliance and moving into the digital age. Keeping digital records of what workers do and earn can help them be part of the system and get social protection. But it’ll only happen if everyone, from politicians to platform owners, is on board.

Since different platforms treat workers differently, they have a big role to play. By encouraging competition and making sure users know about working conditions, platforms can protect workers. While some platforms around the world are trying to improve conditions, there’s still a long way to go, and more changes need to be pushed for.