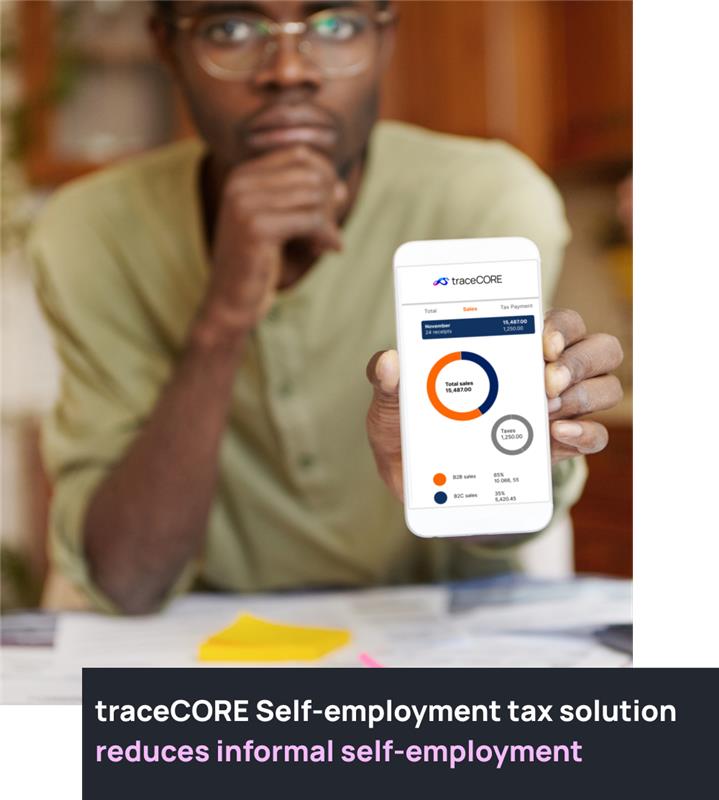

Self-Employment Tax Solution

Bring millions of workers out of the shadow by providing regulation and technology to properly tax self-employed workers.

Book a demo

How big is informal self-employment?

Self-employment refers to people who work for themselves, as members of co-operatives or as unpaid family workers. Some self-employed workers provide consultancy or services in addition to their formal employment. While self-employment forms a significant share of the national workforce, many self-employed are part of the informal sector.

How does traceCORE help?

traceCORE Self-Employment Tax Solution provides self-employed workers with access to government digital services, including online tax registration, automatic tax filing, and electronic fiscal receipts.

Promotes digital tax services

Increases tax revenue from self-employment

Engages job platforms into the tax system

Removes the barriers to tax compliance

Improves tax audit efficiency

Leverages partnerships with key stakeholders

How does it work?

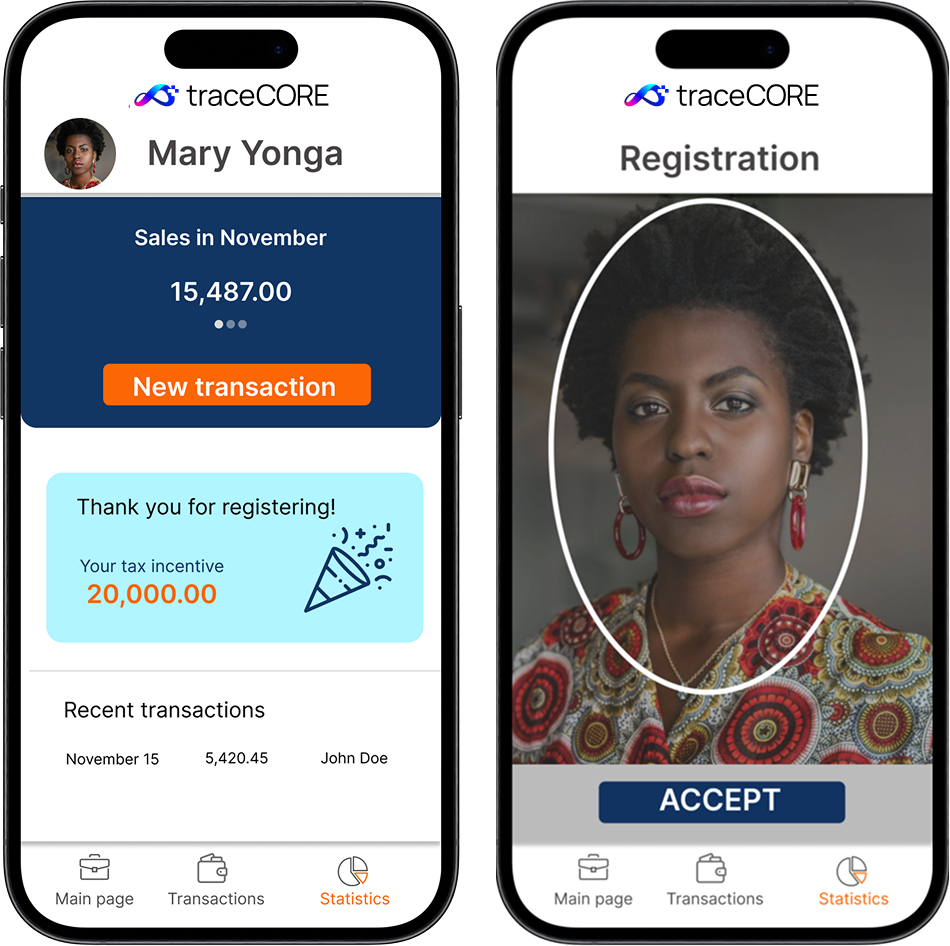

- A self-employed worker registers as a taxpayer on the website or in the app.

- They make a sale, register it in the app and issue an electronic receipt.

- The receipt data is sent to the central database and used for tax accrual later.

- At the end of the tax period (1 month), the system calculates the tax payable.

- The self-employed worker pays the tax via the website or in the app.

- Social security contributions or heath insurance are available as an option.

- Tax authorities get access to all the data and can automate tax audits.

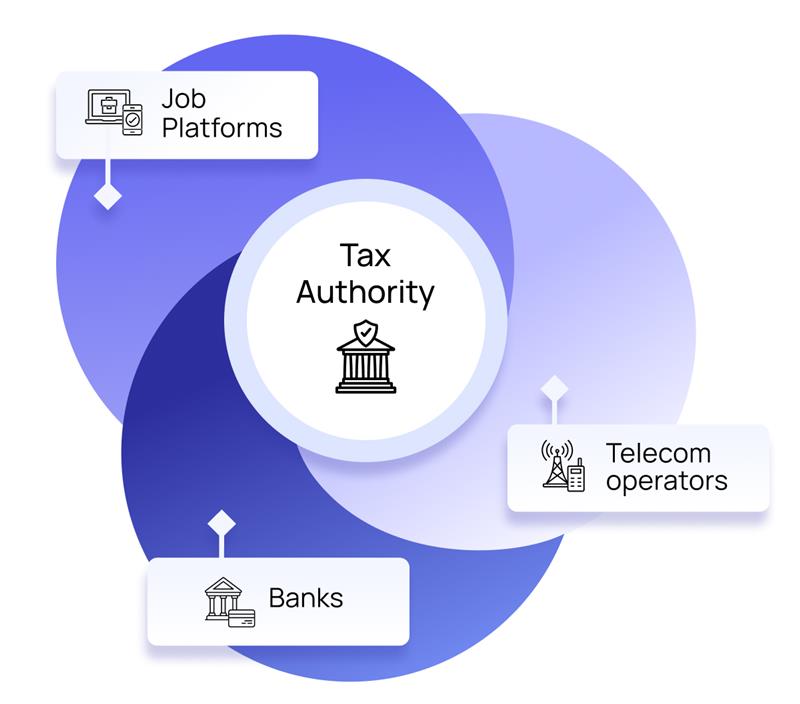

Partnerships help attract new self-employed taxpayers

traceCORE provides an interface to connect various types of partners to the Self-Employment Tax Platform.

- Banks can integrate self-employment tax registration in their digital services and offer tax registration to new clients.

- Telecom operators can take advantage of the system to integrate mobile payments into tax payment options.

- Job platforms can act as taxpayers’ agents by registering the self-employed and taxing the online jobs.

Through partnerships, tax authorities can speed up the adoption of the self-employed tax regime and reach out to larger audiences of self-employed workers.

Key features

User-friendly interface

The app is easy to navigate, anyone familiar with a mobile phone can learn how to use it. No advanced ICT skills are required.

Automatic tax calculation

There is no need to file taxes, fill in declarations, or do any calculations. The app does all the work!

Remote taxpayer registration

Taxpayer registration does not require visiting the tax administration and takes 5 minutes via the website or mobile app.

Electronic fiscal receipts can be issued within the app

The app allows registering sales and issuing electronic receipts without installing a cash register, helping workers save money and protecting consumers.

Digital tax audits and business intelligence

Taxpayer profiles are available online in the system. Connection to the tax authority's information system helps identify discrepancies and fraud.

Consumer engagement tools can improve compliance

Customers who purchase goods or services from the self-employed will get a tax cashback or other incentives by scanning a code printed on the receipt.

A win-win solution for all stakeholders

Tackling informal employment is an important goal for governments, businesses, and employees.

- Reduced informal employment.

- Increased tax base and tax revenue.

- GDP growth due to higher availability of funds and lower administrative burden on businesses.

- Reduced cost and effort of auditing self-employed workers.

- An additional source of tax revenue due to improved tax compliance.

- Access to online self-employment tax information and statistics for informed decision-making.

- A financially attractive reduced preferential tax rate.

- Additional options like tax deduction, reduced loan rates, voluntary health and pension insurance.

- Legal coverage and proof of income (for loans, visas, etc.).

- Easy-to-use tax registration and payment mechanisms.

- Less administrative barriers for businesses to work with self-employed people.

- Cost savings as there is no more need for cashing in.