SoftPOS Payment Solution

traceCORE SoftPOS Payment Solution helps involve small and microenterprises in online fiscalization.

Book a demo

VAT is a major source of revenue for most countries.

Retailers, especially those dealing with cash transactions that do not leave an audit trail, often fail to report all sales, leading to an underestimation of taxable income. This results in a substantial VAT Gap.

Without an effective mechanism to ensure compliance, governments lose out on revenue, hampering their ability to fund public services, infrastructure, and social programs.

is the average global VAT Gap.

was the overall EU VAT Gap in 2022 (EU Commission).

How does traceCORE help?

traceCORE SoftPOS Payment Solution allows governments to increase VAT revenue by facilitating online fiscalization in retail using a convenient digital payment solution.

Online fiscalization helps enhance transaction transparency and increase VAT revenue.

Easy start for new entrepreneurs

Fast billing and payment receiving process

Customer service enhancement

Automated accounting of goods and sales

Improved availability of financial services

Simple and convenient tax accrual

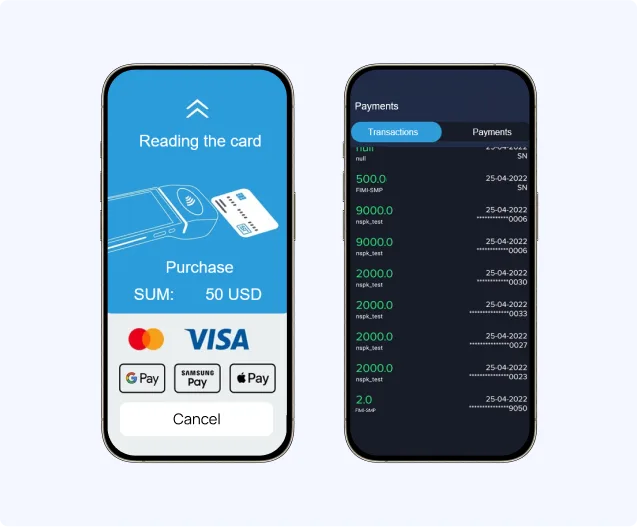

traceCORE SoftPOS Payment Solution turns a regular smartphone into a payment terminal.

What is traceCORE SoftPOS Payment Solution?

- traceCORE SoftPOS Payment Solution is a modern technology for receiving cashless payments with a smartphone.

- The system does not require expensive equipment or a new smartphone and is easy to scale, maintain and upgrade.

- It makes payment acceptance at points of sale accessible and controllable for each entrepreneur.

- All payments are accounted for, the receipts are securely encrypted and sent to tax authorities and consumers.

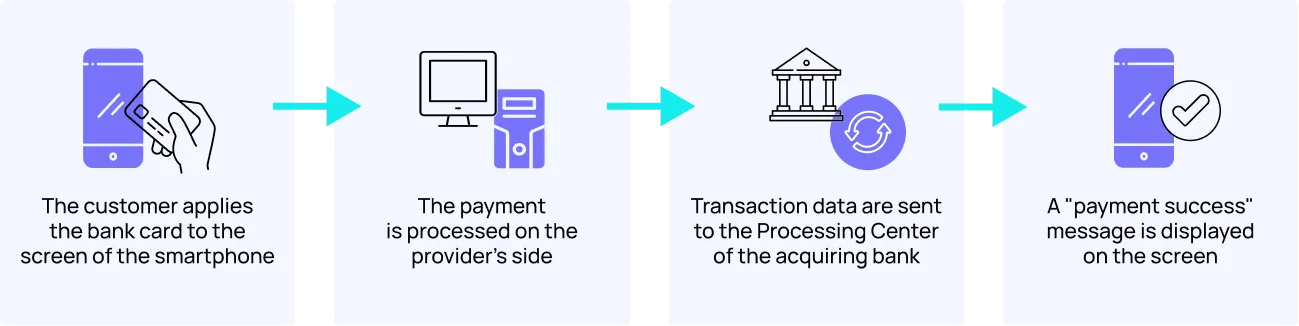

How does it work?

The payment process repeats the mechanism of a regular payment with a terminal, but the cashier is more mobile, using a smartphone instead of the usual hardware.

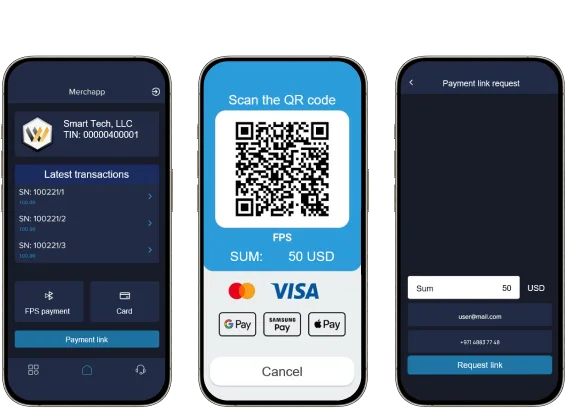

Payment acceptance options

Acquiring

- To accept a payment, the seller presents a smartphone displaying the payment screen to the buyer.

- The buyer taps their card on the device, initiating the purchase.

- While the buyer completes the usual payment steps, the seller can simultaneously monitor all transaction details live on the smartphone screen.

- To activate the service, the merchant follows the same process as setting up traditional merchant acquiring through a bank.

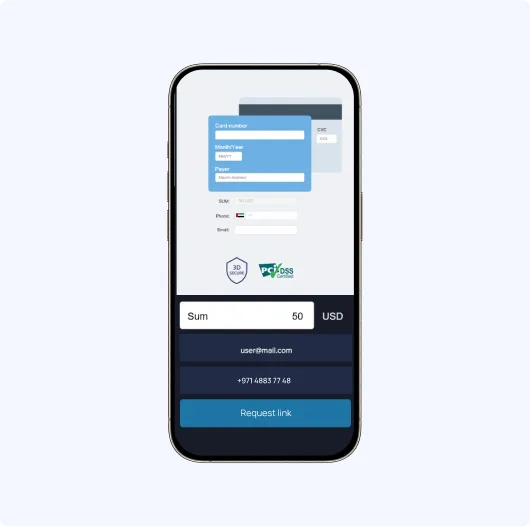

Payment Link Invoice

- With the app, the seller can generate an invoice and send it to the buyer via email or text message.

- Invoicing is often a convenient way to accept payments, especially in certain situations.

- You can create an invoice for the ordered goods directly within the app and send it to the buyer by email or SMS.

- Once the buyer receives the payment link, they are directed to a secure payment page to enter their card details.

- This payment method operates using Internet acquiring technology.

QR code payment

- The QR code payment method, rapidly gaining popularity, is also available in the app.

- The seller simply generates a QR code displayed on the smartphone screen and shows it to the buyer.

- The buyer scans the QR code, selects their internet banking app from the list installed on their smartphone, and completes the payment.

- The merchant can view the full list of payments both within the app interface and in their personal account online.

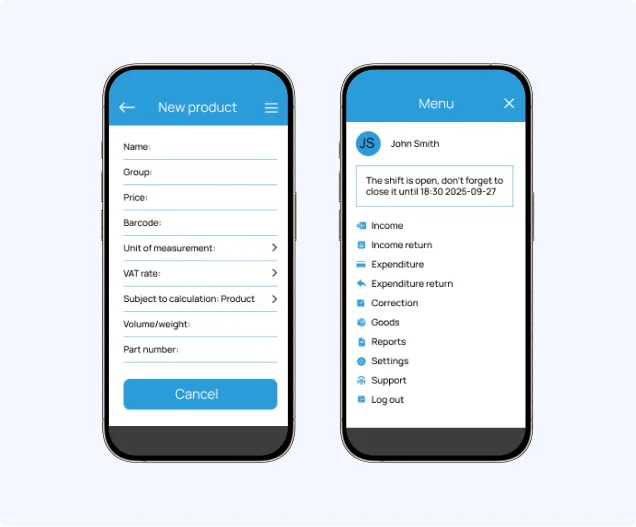

Inventory management and goods accounting

The product catalog system is designed for cashiers to perform inventory management and accounting.

It includes:

- The list of products, the options to add, delete, and search items.

- Payment choice: cash/non-cash, confirmation, refund.

- Counting change when paying in cash.

- Interim report, shift closing report.

- Choice of the applied tax system, rate display.

- Application to the service engineer.

Key features

Payment acceptance

The payment software provides the ability to use a smartphone as a payment terminal.

Data protection

Data cryptography protects the payment solution on an open smartphone platform.

Cash registration

Cash registration is included in the business software for PCs and smartphones.

Fiscalization

Fiscal receipts are transferred to the Fiscal Data Operator databases for their storage and subsequent transfer to the Tax Authority.

Goods accounting system

The business software helps manage inventory and keep sales records.

Catalog management

The product catalog includes relevant information about the products, their categories, measure units, manufacturers and applicable VAT rate.

A win-win solution for all stakeholders

Online fiscalization ensures compliance in retail revenue reporting and doubles VAT collection in retail.

- Increased tax collection.

- Bringing businesses out of the shadow.

- Increased the number of participants in economic activity.

- Reduced time and labor costs for audits, providing the opportunity for online monitoring of tax revenues.

- Modern and convenient tools for making and accepting payments for businesses and customers.

- Improved trust in non-cash payments and general digital literacy of citizens.

- Real-time data collection and enhanced tax compliance.

- Automated VAT/GST calculation and improved audit efficiency.

- Reduced cash economy and informal sector activity.

- Data transparency and analytics.

- Fraud prevention.

- Seamless integration with e-invoicing and e-filing.

- Cost savings and resource optimization.

- Public trust and fairness.

- No additional equipment purchase costs.

- Quick launch and easy installation: the seller registers with the Fiscal Data Operator, downloads the application and enters credentials.

- Mobility due to the option to accept payments using QR codes on a smartphone (delivery, exhibitions/markets, transport).

- Simple and convenient tax compliance due to automated tax accrual.

- Reduced time and resources for accounting.

- Receipt transparency and protection against fraud.

- Easier returns and exchanges.

- Engagement in public control.

- Increased consumer trust and protection of consumer rights.

- Access to loyalty programs and digital services.

- Environmental benefits.

- Fair pricing.

.webp)

.webp)