B2C Sector E-Invoicing

Reduce the number of unreported transactions at POS and boost VAT collection in retail.

Book a demo

Retail transactions account for up to 60% of the VAT gap

Cash has always been a facilitator of the shadow economy and tax evasion, since transactions in cash do not leave an audit trail. While cash still accounts for large proportion of total payments, tax authorities all over the world have been losing revenue due to non-compliance.

of payments in Africa and the Middle East are made in cash (Worldpay GPR 2025)

of global transaction value is accounted for by cash (Worldpay)

How does traceCORE help?

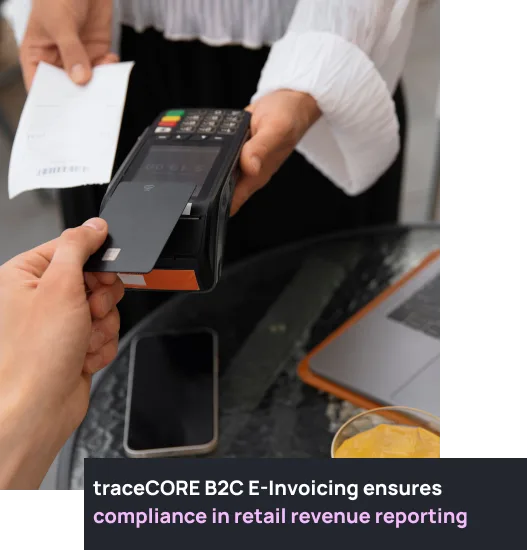

traceCORE B2С E-Invoicing automates VAT reporting and tax accrual by retailers when products or services are being sold to individuals or other VAT non-payers.

Enforces completeness of revenue reporting

Helps keep record of all transactions and fiscal receipts

Allows the use of online electronic cash registers as a cloud service

Provides real-time monitoring and reporting

Reduces tax audit cost and effort compared to traditional audit

Ensures data encryption at all stages to avoid the alteration of records

How does traceCORE work?

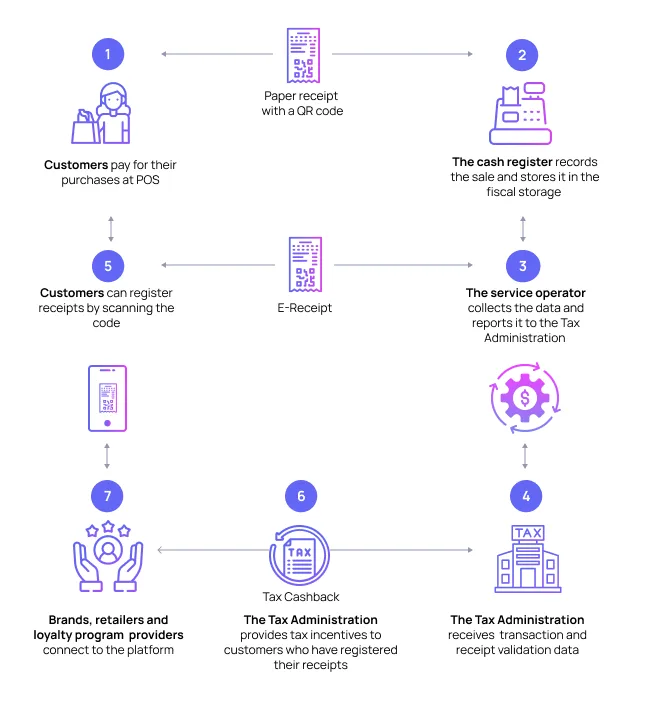

- A consumer makes a purchase at POS and receives a paper receipt with a QR-code.

- The OECR at POS processes the transaction and stores the data in the Fiscal Storage.

- The OECR sends the data to the Tax Authority (directly or via Fiscal Data Operator).

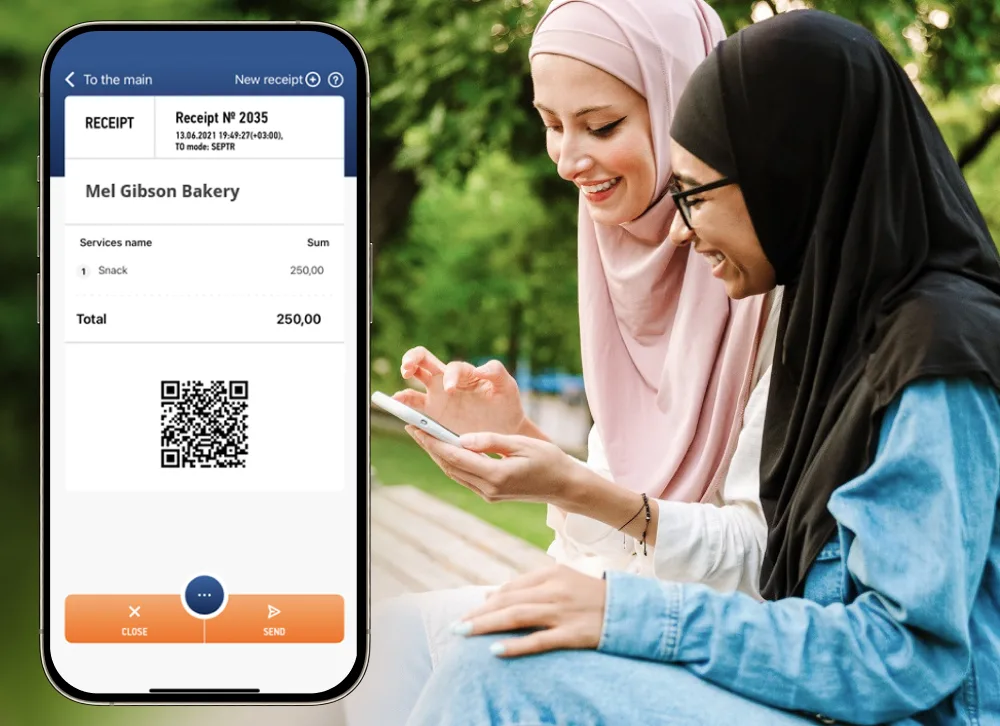

- The consumer verifies the receipt by reading the QR-code. Bonuses, cash back and tax incentives are provided in return for receipt validation.

- The electronic receipt can be delivered to the consumer via the mobile app, tax portal, by email, text message or in a messenger.

Customers receive incentives for registering fiscal receipts

Paper receipts have QR codes which can be scanned by the customer. After reading the code and verifying the transaction, customers can apply for a tax cashback, bonuses and incentives from brands, retailers, banks, and other providers.

Incentives increase awareness among consumers and stimulate them to take an active role in sales transparency control.

Key features

Online transaction reporting

A digital version of each receipt is transmitted to the Tax Authority.

OECR as a service

OECRs are available as a cloud-based service.

Enhanced data protection

The system ensures data continuity and protects it during transmission.

API for partner engagement

Approved partners can use transaction data to create marketing campaigns, cashback, and loyalty programs.

E-invoicing for online retailers

Customers can receive e-invoices from online stores, including international online retailers.

OECRs to fit any budget

Businesses can choose from various fiscal cash registers and cloud services depending on the available budget.

A win-win solution for all stakeholders

Enforcing control over cash transactions increases government revenue and protects consumers.

- Governments can collect up to 165% more revenue from VAT / GST.

- Public monitoring helps detect non-compliance.

- New digital services increase citizens’ satisfaction.

- Transaction data can be used for reporting, analysis and fraud prevention.

- Tax authorities establish efficient control over cash transactions, which leads to improved compliance and increased revenue collection

- Close to real-time transmission of transaction data reduces the cost and effort of traditional tax audit.

- Combined with traceCORE Digital Track and Trace, the B2C E-Invoicing solution helps reduce counterfeiting, grow revenue and profits.

- Brands can use the platform to create tailored marketing campaigns and engage consumers in brand loyalty programs.

- Reduced cost of tax compliance, no more audits and reporting.

- Various types of cash registers are available, including cloud solutions. Easy installation and integration with POS systems.

- Remote cashier control prevents revenue loss due to fraud at checkout.

- New opportunities to improve consumer loyalty.

- E-invoices (electronic receipts) can be emailed, texted or accessed in a mobile app with just a few clicks.

- There is no more need to keep paper records. Digital receipts can be used for returns when a paper receipt has been lost.

- Consumers receive cashback, discounts and bonuses from loyalty service providers, brands, retailers, banks and tax authorities.

.webp)

.webp)