Digital Platform Tax Solution

Navigating Tax Legislation: Compliance for Digital Platforms and Gig Economy Workers

In recent years, the digital economy and gig work have reshaped how services are delivered, income is earned, and labor is organized. But with that transformation comes a major challenge: ensuring tax compliance in a world of fragmented, often invisible transactions.

In this post, we’ll explore the immense scale of the gig economy — and why that scale makes effective tax compliance essential. We’ll examine how tax noncompliance on digital platforms undermines public revenue and creates systemic risks. Finally, we’ll highlight why traceCORE Digital Platform Tax Solution stands out as a powerful, scalable solution for bridging the gap between digital innovation and tax accountability.

What Is a Digital Platform?

A digital platform is an online system or application that connects different user groups — typically service providers and customers — to enable seamless interactions, service delivery, and data exchange. Beyond just matching users, these platforms often handle essential functions like payments, scheduling, and increasingly, compliance with legal and tax regulations.

Most platforms rely on two main types of workers: self-employed individuals and independent entrepreneurs (IEs), both operating outside traditional employment structures.

-

Individual entrepreneurs sell goods and services on digital platforms and must maintain tax records as required by law. Unlike self-employed individuals, they can hire staff, issue certificates, and obtain business licenses.

-

Self-employed individuals are registered with tax authorities and pay tax on professional income. A low-rate tax regime encourages their shift from the informal to the formal economy.

The Gig Economy Market Is Massive

According to Business Research Insights, the global gig economy is projected to reach about $2.2 trillion by 2034. With such size, the potential tax base is huge — and so is the opportunity (or risk) of noncompliance. If only a fraction of gig transactions evades tax, governments will see millions or even billions in lost income.

Many gig workers also remain outside formal tax or registration systems. In India, for instance, 66.5% of delivery gig workers did not file income tax returns in 2024, as reported by Business Today. That kind of widespread non‑filing indicates serious structural issues in enforcement, registration, and incentives for compliance.

In short: the gig economy is too big to ignore, which leads us to the next point — how tax noncompliance at scale threatens both revenue and legitimacy.

Tax Noncompliance Undermines Government Revenue

When a significant portion of income earned via digital platforms is underreported or goes untaxed, governments lose revenue that could have been invested in public services, infrastructure, and social safety nets. This not only constrains the state’s ability to fund essential services, but also shifts a greater burden onto compliant taxpayers and larger firms.

In many jurisdictions, tax authorities struggle to monitor and enforce compliance among platform-based contractors. Transaction volumes are high, often small per transaction, and the participants may cross geographic or regulatory boundaries.

This enforcement gap exacerbates inequality: informal or unregistered workers often can’t access social benefits, nor can they fully contribute to welfare schemes — further weakening public institutions.

Key Challenges in Digital Platform Tax Compliance

Fragmentation of Income & Multiple Platforms

-

Gig workers often earn from multiple sources (rideshare and delivery services, task platforms, freelance marketplaces). That makes consolidating records, matching transactions, and tracking total income across platforms very complex, according to a June 2025 article published in the SINOMICS Journal.

-

Because no single entity “owns” the full income stream, it’s harder for tax authorities to monitor or for individuals to report comprehensively.

-

Many platforms only report transaction-level earnings, not net taxable income (after expenses) — leaving gaps.

Absence of Automatic Employer Reporting

- Traditional employment involves tax withholding and employer reporting, which greatly reduces under‑reporting. In contrast, gig work typically lacks withholding at source, putting the onus on the worker to self‑declare.

-

Without built-in deductions, many workers underreport or omit income, intentionally or not. Some studies suggest that underreporting by self‑employed may average ~36 %, according to Auditing Accounting.

-

The lack of “third-party reporting” makes independent audits harder.

Legal Ambiguity / Classification Issues

-

The IFS raised a valid question in their June 2021 article: Are gig workers independent contractors or employees (or something in between)? Tax, labor, and social security laws often diverge, leading to uncertainty.

-

Misalignment between tax and employment law can lead to “misclassification risk” and litigation.

-

As pointed out in a 2022 article published in the Global Research Network, in many jurisdictions, tax law is not fully adapted to the gig economy’s unique features, making “fit” imperfect.

Rapidly Changing Legislation

-

Tax rules — thresholds, deduction rules, reporting formats, withholding regimes — evolve frequently. Keeping a compliance engine current is nontrivial, according to a December 2022 article in Bloomberg Tax.

-

Across jurisdictions (or even within a federation), rules differ on what income is taxable, what counts as business expense, and what exemptions or regimes apply.

-

For global or cross-border platforms, conflicting tax treaties, double taxation, and jurisdictional disputes create additional complexity.

Platform Resistance or Operational Friction

-

Platforms may resist being treated as tax intermediaries (for legal, liability, or user experience reasons).

-

Bloomberg Tax pointed out that introducing tax registration or data collection early may discourage users or create friction in onboarding.

-

Platforms may not always have direct control over payments (e.g. payments handled via third‑party gateways), making withholding or tax capture harder.

-

Data standardization (ID formats, tax IDs) and validation are operational headaches. Tax ID formats differ, evolve, and sometimes are difficult to validate in real time.

Awareness, Literacy, & Behavioral Barriers

-

According to a July 2025 HMRC Research Report, many gig workers are not thoroughly familiar with tax rules, the process of registration, or allowable deductions.

-

Some deem the compliance burden too high or the risk of audit low, and thus deprioritize full reporting.

-

They may lack bookkeeping systems or accounting support, making it hard to substantiate deductions or maintain proper records.

-

In low-income segments, the incentive to “underreport just a little” is stronger.

Enforcement & Audit Limitations

-

Tax authorities often lack visibility into the micro‑level transactions on platforms and have limited capacity to audit many small actors, as reported by the OECD.

-

Without good data matching between platform‑provided records and taxpayer returns, enforcement is weak.

-

Jurisdictions with weak institutional capacity or digital infrastructure struggle to enforce compliance in a platform economy.

Revenue Leakage at Scale

-

Even if a small fraction of platform gig income goes untaxed, given the massive scale of the market, the absolute revenue loss can be huge.

-

In some estimates, the gig / zero-hours / precarious self-employment rise is already costing tens of billions in lost revenue. For example, the UK’s Trades Union Congress estimated that insecure / low-earning self-employment cost UK taxpayers some £4 billion ($5.3 million) annually.

-

When large segments remain informal, governments lose not only income taxes but also contributions to social insurance, pensions, unemployment, etc. This reduces fiscal space, increases inequality, and weakens public services funding.

To sum it up, here’s why the challenges matter:

-

When the digital economy grows, but tax systems lag, the formal fiscal base erodes.

-

Traditional employees, paying via payroll withholding, effectively subsidize unreported gig work.

-

Untaxed gig work tends to remain informal, making workers less able to access social protection or formal credit.

-

Firms or workers who can fly below the radar gain competitive edges, creating distortions.

-

If platform economies expand further without tax compliance, the gap can become unsustainable.

Given all this, there is a pressing need for a robust, scalable, and flexible compliance solution at the interface of platforms, workers, and governments.

How traceCORE Digital Platform Tax Solution Addresses the Challenges

Combatting tax underreporting on digital platforms requires the implementation of a solution that can build a unified system where all parties follow legal requirements.

What Is traceCORE Digital Platform Tax Solution?

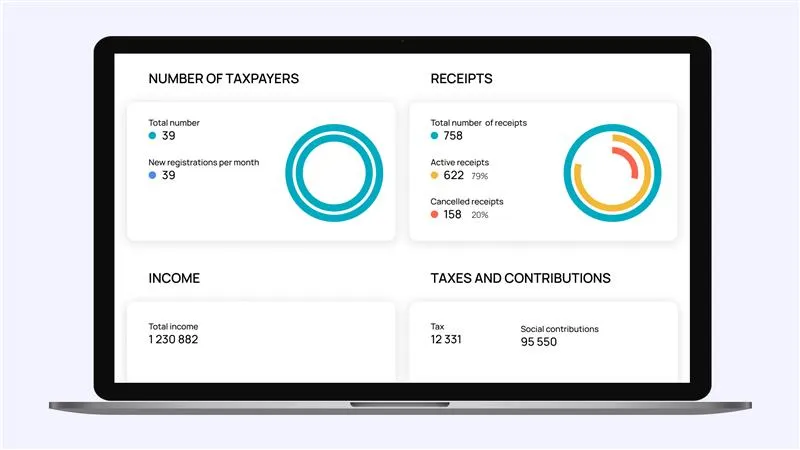

traceCORE Digital Platform Tax Solution is an automated tax compliance solution designed specifically for digital platforms. Instead of tracking the tax obligations of each self-employed user individually, the solution shifts regulatory oversight to the platform itself, making it responsible for ensuring legal compliance.

Acting both as a personal data operator and a tax agent, traceCORE Digital Platform Tax Solution enables platforms to seamlessly manage user data, calculate tax liabilities, and ensure timely tax reporting and payment — all in full compliance with local tax laws. This reduces administrative burdens, enhances transparency, and helps digital platforms meet their legal obligations more efficiently.

How Does It Work?

Start of Reporting

The contractor (self-employed worker or individual entrepreneur) begins work on the platform.

End of Reporting

The platform operator submits data to the electronic document management system to generate the Act of Work Performed (AWP).

Notification

The contractor receives a message with a link to review and sign the closing documents for the reporting month.

Document Signing

Using the link, the contractor opens the mobile app, reviews the report details, and signs the documents digitally.

Return to Platform

After signing, the contractor seamlessly returns to the platform.

Confirmation

A push notification confirms successful signing and provides a link to view the signed PDF documents in the system.

.webp)

Why Choose traceCORE

Professional Expertise

Platforms don’t need to become tax experts; traceCORE externalizes that complexity.

Scalable Solution

With most of the compliance burden handled by traceCORE, platforms can scale confidently.

Legal Monitoring

Automated legal monitoring and tax logic updates reduce the risk of non-compliance.

Worker Approval

A streamlined interface, low-friction onboarding, and built-in compliance lower barriers to adoption.

Cost Efficiency

An API-first model minimizes engineering effort and implementation costs.

Audit Transparency

All documents and actions are securely logged, making audits and regulatory reviews faster and more transparent.

Conclusion

The intersection of digital platforms and the gig economy presents both an enormous opportunity and a formidable tax compliance challenge. With trillions of dollars in projected gig‑economy value and widespread underreporting, governments and platforms alike stand to benefit from a robust, scalable compliance solution.

traceCORE Digital Platform Tax Solution offers a compelling path forward — shifting compliance to the platform layer, automating registration, reporting, and remittance, and easing the burden on gig workers.