VAT Return Operator

Give consumers the option to get VAT incentives and loyalty bonuses in return for registering their receipts.

Book a demo

Why is it important to encourage consumers to request receipts?

Many people rush to say “No” when asked if they want a copy of their receipt. However, there is always a risk that a certain unscrupulous business won’t conduct a transaction, and a consumer won’t be even aware of that. In addition, receipts are valid proofs of purchase that help consumers when they want to return or exchange goods and file complaints.

of consumers accumulate receipts without using them (Opinionway-Perifem)

of consumers ask retailers to throw their receipts away (Opinionway-Perifem)

How does traceCORE help?

Implementing traceCORE VAT Return Operator allows governments to build trusting relationships with consumers, improve tax compliance, reduce tax evasion, and, as a result, boost their countries’ tax revenues.

Helps governments combat fraud

Gives the option to reward consumers

Allows consumers to track their expenses

Boosts consumer protection

Improves tax compliance

Serves as a powerful marketing tool

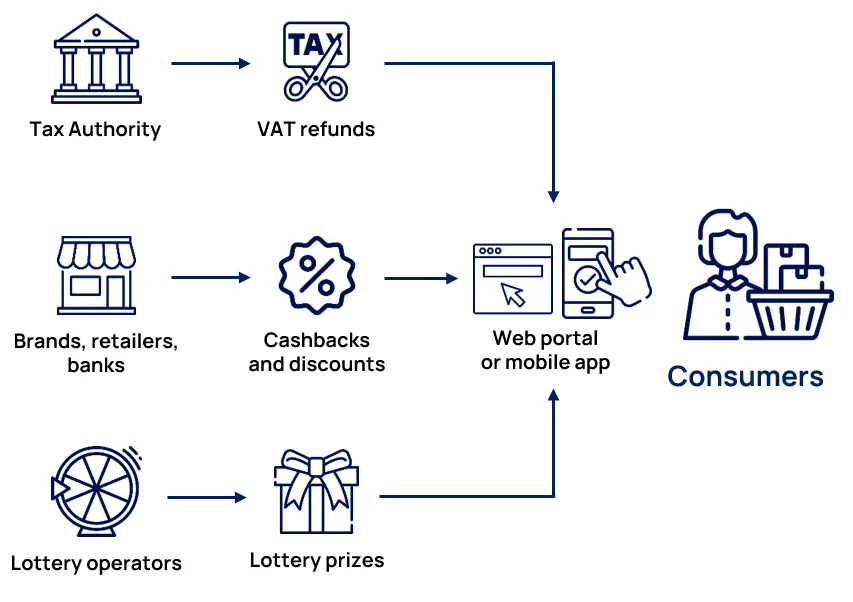

What is traceCORE VAT Return Operator?

- traceCORE VAT Return Operator is a digital solution that allows consumers to receive partial refunds of VAT, cashback, discounts, and other benefits in exchange for registering their receipts on a website or mobile app.

- The incentives are provided by the tax administration and partners.

- A system of incentives for consumers to demand their receipts can help ensure that every item sold is reflected in the receipt and that each receipt is passed on to the consumer.

- Possible incentive tools include special partial VAT refund, participation in a state lottery, loyalty bonuses, and discounts.

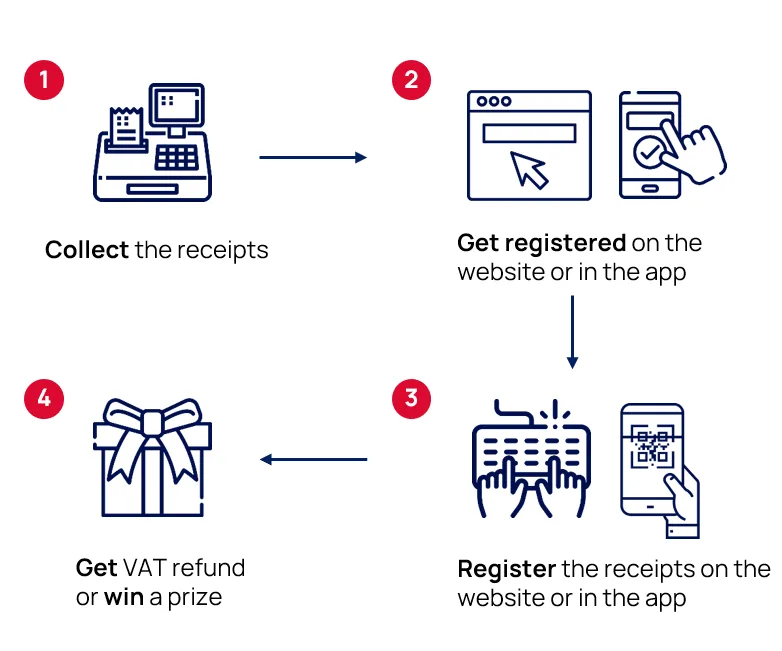

How does it work?

- Collect the receipts that you are given after paying for goods and services.

- Register in the mobile application or on the website of the VAT Return Operator.

- Scan the QR code or enter the receipt details manually.

- Receive a partial refund of VAT or the opportunity to participate in the state lottery, as well as bonuses from retailers, brands and financial institutions.

Key features

QR code scanner

The app allows consumers to either scan QR codes in receipts or enter receipt details manually.

E-receipt storage

The app eliminates the need to keep paper receipts as it allows consumers to store their electronic versions instead.

Tax system integration

After adding a new receipt, the system automatically verifies the data it contains with the Tax Authority’s database.

Partial VAT refund

Consumers are able to receive partial refunds of VAT after paying for goods and services.

Desktop and mobile versions

Consumers can register their receipts either on the VAT Return Operator website or in the official app.

Various rewards

Besides partial VAT refunds, there can be other rewards, such as state lottery participation and various bonuses.

A win-win solution for all stakeholders

By rewarding consumers for their cooperation and trust, governments can build stronger relationships with citizens, reduce counterfeiting, improve tax compliance, and grow their revenues.

- Boost tax revenue through increased compliance and reduced tax evasion.

- Obtain valuable data on consumer spending patterns and economic activity.

- Strengthen trust and cooperation between the government and taxpayers.

- Detect and deter fraudulent activities, such as falsification of receipts or misuse of cashback incentives.

- Expand service offerings and attract new customers through participation in cashback programs.

- Generate revenue from transaction processing fees and other financial services.

- Strengthen trust and credibility as a reliable financial partner.

- Increase sales and customer retention through loyalty programs.

- Mitigate the risk of audits and fines by ensuring compliance with tax laws.

- Obtain valuable market insights to optimize product offerings and marketing strategies.

- Receive benefits, such as VAT refunds, prizes, loyalty bonuses or discounts, for participating in the program.

- Increase financial and tax literacy.

- Enjoy convenience and organization by storing receipts digitally and accessing them easily.

- Contribute to a more transparent and accountable business environment.

.png)

.webp)

.webp)