B2B Sector E-Invoicing

Digital VAT administration can increase annual tax collection by up to 150%.

Book a demo

How big is VAT underreporting in the B2B sector?

VAT / GST is a major source of revenue in most countries. On average, VAT underreporting and fraud can do significant damage to government revenues.

is the average VAT Gap worldwide

is the estimated overall damage suffered by EU countries in 2023 as a result of VAT fraud (EPPO)

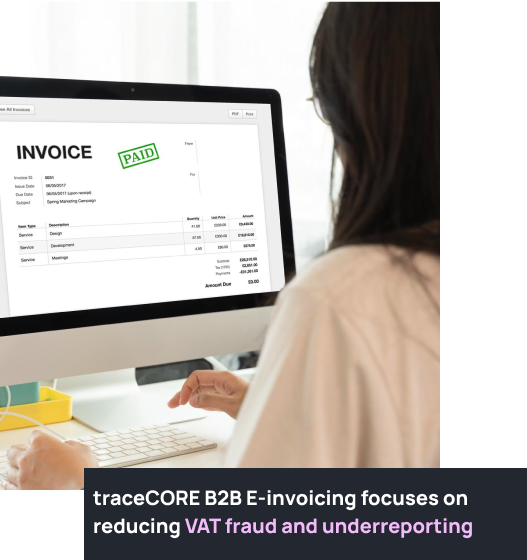

How does traceCORE help?

traceCORE B2B E-Invoicing automates VAT reporting and tax accrual for transactions between legal entities and entrepreneurs subject to VAT.

Automatically generates and transmits invoices

Increases VAT collection by addressing major VAT avoidance schemes

Allows automatic communication with taxpayers

Improves VAT accrual and audit efficiency

Helps increase operational efficiency and tax compliance

Serves as a single point of integration with the Core Tax System

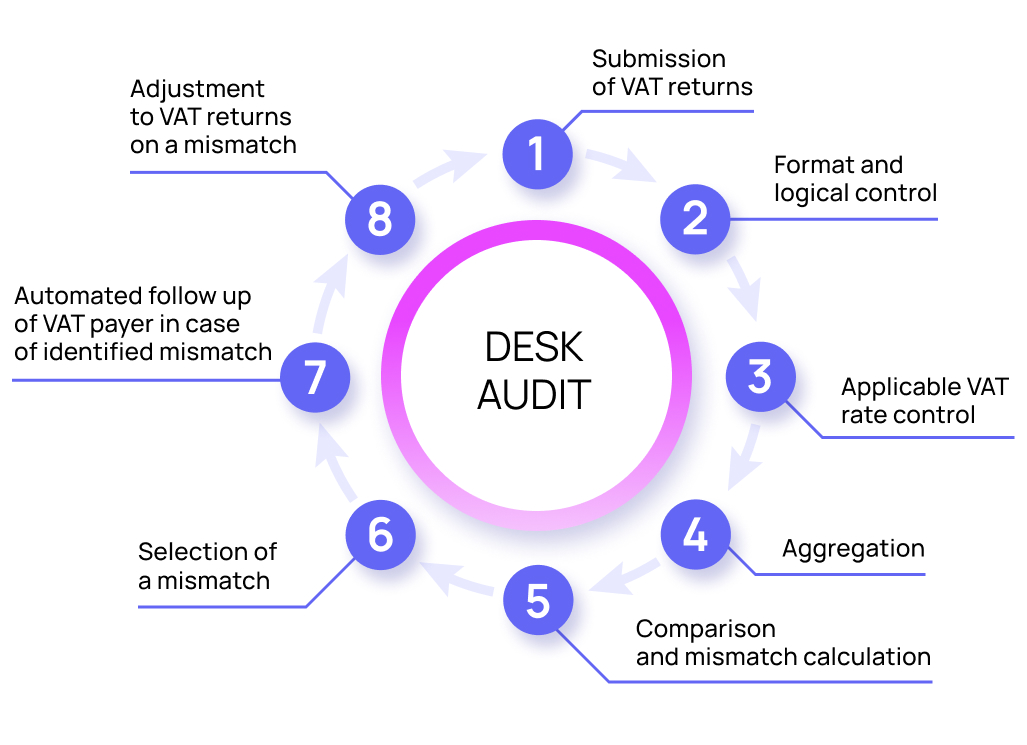

How does traceCORE work?

- The taxpayer submits VAT invoices via tax portal, or from their accounting software using APIs.

- The system provides format and logical verification of incoming data.

- The system double-checks VAT rates, aggregates the data and calculates the gaps.

- When the gaps are discovered, electronic claims are created and sent to the taxpayer for justification.

- The taxpayer submits adjustments to VAT returns or provides justification.

- The system closes the audit with a decision to refund the taxpayer.

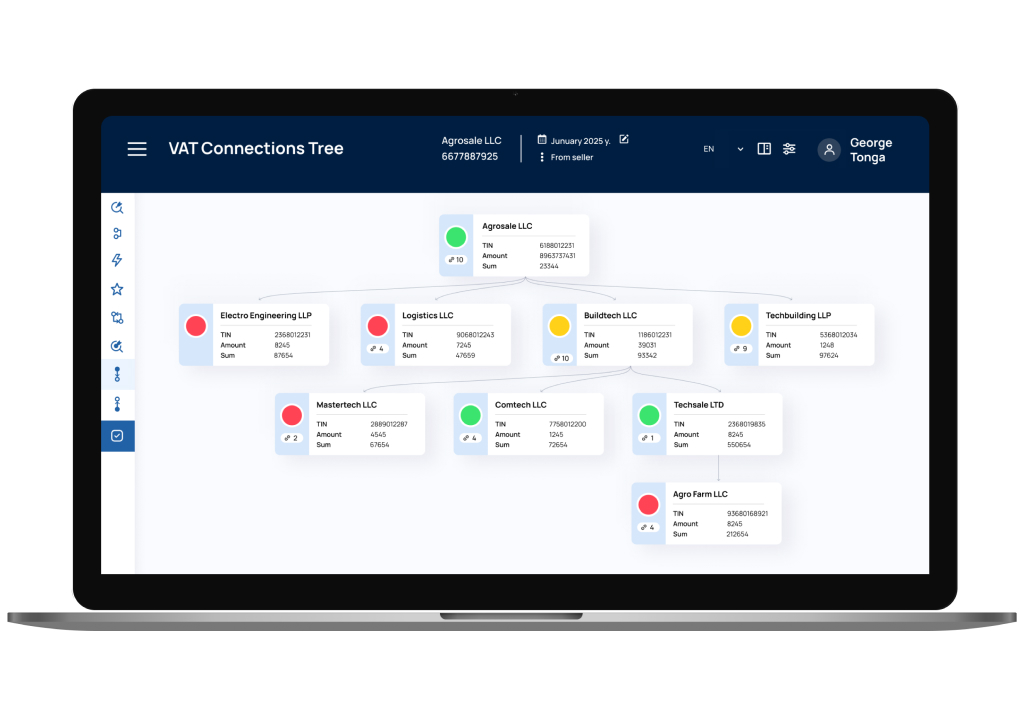

VAT Connections Tree helps identify fraud schemes

- Manual or automatic fraud identification mode available.

- Counterparties matching tool helps identify complex VAT optimization schemes.

- Traceability function reveals transaction sequences from where the tax gap occurred to the end beneficiary.

- Taxpayer’s risk estimations available for deeper analysis.

Key features

Automatic VAT Fraud Detection

A variety of tools available to identify most common VAT fraud schemes that lead to VAT leakage.

ERP Integration

Data upload and filing from ERPs to avoid human errors and streamline the tax filing process.

Dashboards and Reporting

Fully customizable dashboards and reports provide valuable insights for data-driven decision-making.

Taxpayer Communication System

The system is integrated with the Core Tax System and allows to automatically communicate with the taxpayer.

Complex VAT Gap Administration

traceCORE B2B E-Invoicing automates VAT accrual and audit.

Integration with the Core Tax System

traceCORE B2B E-Invoicing serves as a single point of integration with the Core Tax System.

A win-win solution for all stakeholders

E-invoicing revolutionizes the traditional invoicing process by decreasing expenses, enhancing accuracy and enabling quicker payment transactions to the benefit of all parties.

- Improvement of VAT collection which is a major source of revenue in most countries.

- Reduced administrative pressure on compliant businesses, which benefits the country’s investment climate.

- Traceability function reveals the chains of related counterparties and can be used to identify fraud schemes and to build taxpayer’s risk profiles.

- Mandatory B2B e-invoicing helps create a digital model of the country’s economy.

- Macro indicators can be automatically calculated and analyzed by region, inspectorate and taxpayer.

- The system helps detect fraud and take immediate action on violations.

- VAT audit becomes faster and more efficient compared to post-audit approach.

- Improved accuracy in VAT reporting contributes to a more robust and sustainable tax system.

- Reduced risk of human error and improved data quality.

- By embracing e-invocing, businesses minimize the risks of non-compliance to the tax legislation.

- Streamlined processes lead to better transparency and reduced risks in B2B transactions.

- The cost of VAT administration is reduced compared to traditional invoicing.

- Increased competitiveness between businesses by accelerating document flow.

- Reduced risk of human error and improved data quality.

- Going digital supports ESG compliance and reduces paper-related costs.

.svg)