B2B E-Invoicing

How to Tackle Tax Fraud and Tax Evasion Using traceCORE Digital Desk Audit

Governments everywhere face a persistent and costly problem: tax revenue that should be collected but isn’t due to fraud, evasion, or non-compliance.

In most countries, value-added tax (VAT) is a major revenue source. The VAT gap not only reflects gaps in compliance but also broader challenges in tax administration.

For governments, these missing revenues mean fewer resources for public infrastructure, health care, education, and social services — and increased pressure to raise taxes on compliant taxpayers or cut essential programs.

In this article, we’re going to explore the benefits of traceCORE Digital Desk Audit, and how it offers a promising pathway to improve compliance, target abusive actors, and close revenue leaks before they grow into systemic shortfalls.

What Is the VAT Gap?

The VAT gap is the difference between the VAT that should theoretically be collected under full compliance and the VAT that is actually collected. It arises when taxpayers fail to report sales, misstate liabilities, or engage in fraud schemes that evade tax obligations altogether.

In the EU’s 2023 VAT Gap Report, the VAT compliance gap was estimated at €128 billion (approximately $138 billion), which is about 9.5% of the VAT Total Tax Liability (VTTL).

The VAT Total Tax Liability (VTTL) represents the estimated total amount of VAT that should be collected if all taxpayers fully complied with current tax laws. In other words, it is the theoretical maximum VAT revenue a government expects to receive under existing legislation, assuming there are no errors, evasion, or fraud.

Why It Matters

VAT is a major tax base in many jurisdictions. For example:

-

In EU countries, VAT accounts for a significant share of total tax revenue — comparable to income and corporate taxes combined.

-

Lost VAT revenue directly affects government budgets and delays investments in public services.

When a large share of economic activity escapes proper tax reporting, governments face reduced fiscal space, making it harder to balance budgets without raising rates or cutting expenditure.

Root Causes of Tax Fraud and Evasion

Tax gaps emerge when taxpayers (individuals or businesses) fail to meet their legal obligations, whether intentionally or accidentally. Key causes include:

Deliberate Fraud and Schemes

Fraudulent activities, such as carousel fraud or abusive intra-community VAT schemes, involve complex cross-border transactions designed to avoid VAT remittance while exploiting loopholes in reporting frameworks.

These schemes can cost tens of billions in uncollected revenue each year, particularly in high-volume trade sectors.

Administrative Gaps and Limitations

Legacy systems and siloed data inhibit real-time monitoring of commercial activity and make it more difficult to identify mismatches or suspicious trends.

This is where digital transformation can produce meaningful gains, including automated desk audits.

Underreporting and Evasion

Some taxpayers deliberately understate sales or inflate deductions to minimize VAT liabilities, especially when enforcement resources are limited.

Informal and Cash-Based Economies

Cash transactions that go unreported or are inadequately tracked also widen the compliance gap, making it tougher for revenue authorities to reconcile declared activity with economic reality.

Minimizing the VAT Gap Using traceCORE Digital Desk Audit

What Is traceCORE Digital Desk Audit?

traceCORE Digital Desk Audit is a digital solution for the automated administration of VAT. It includes VAT payment accuracy control, tools for detecting fraudulent schemes, and automated communication tools for interacting with taxpayers.

Modern tools apply data analytics, machine learning, and risk scoring to identify irregularities worthy of follow-up. Key capabilities include:

Centralized Data Processing

Automated ingestion of taxpayer filings, financial transaction records, and other data allows revenue authorities to compare hundreds of thousands of records quickly and accurately.

Machine Learning Risk Detection

Algorithms flag unusual patterns (for example, mismatches between supplier and customer records), which helps compliance teams prioritize investigations.

Prioritized Compliance Tasks

Modern desk audit systems assign risk scores to taxpayers, enabling authorities to allocate audit resources to the most potentially non-compliant parties while reducing burdens on low-risk filers.

Taxpayer Assistance and Communication

Automated communication tools (email, SMS notifications, and secure online portals) enable tax authorities to interact with taxpayers quickly and consistently.

traceCORE Digital Desk Audit operates in conjunction with traceCORE B2B and B2C E-Invoicing, and together these solutions form a unified system for digital VAT administration.

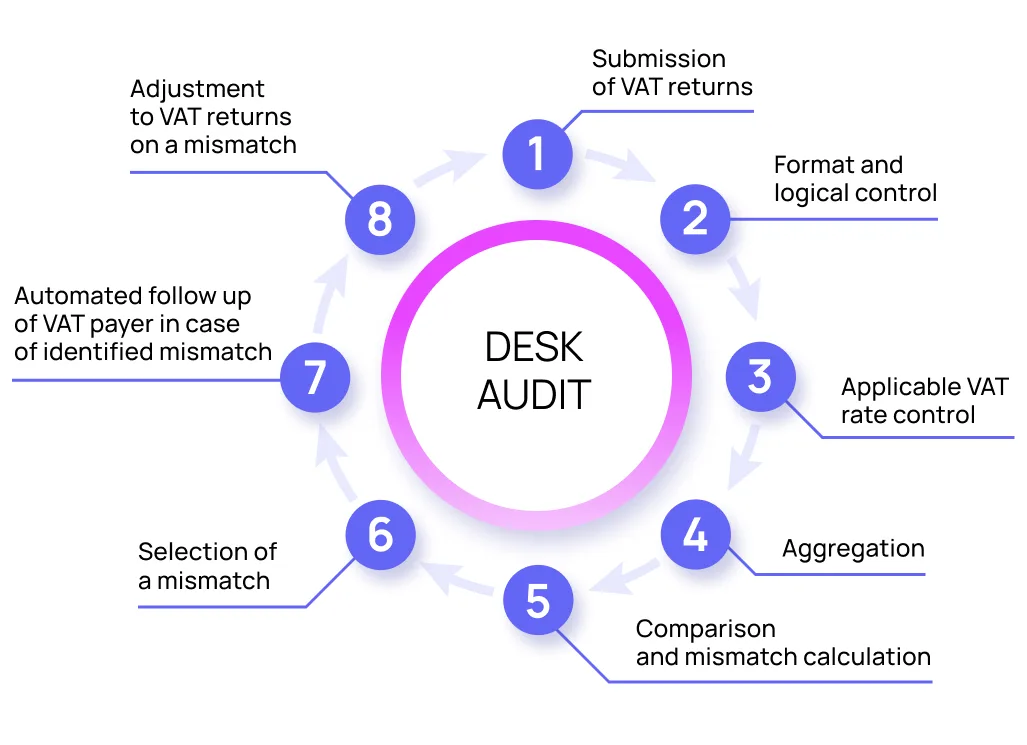

How Does It Work?

By leveraging data digitalization, its format and logical control as well as the use of the immutable Golden Invoice Record format, traceCORE Digital Desk Audit detects discrepancies, assesses risks, and initiates corrective actions efficiently and transparently.

The process is fully automated and occurs without the involvement of a tax officer, which ensures both high accuracy and rapid execution of the Digital Desk Audit.

1. Data Collection

The system consolidates transaction data from electronic invoices, digital receipts generated by online electronic cash registers (OECRs), and VAT returns into a single integrated dataset.

Data is stored in core registers (taxpayers, invoices, returns, VAT rates, personal accounts) and consolidated in a central data warehouse for analysis.

2. Format and Logical Control

Incoming data undergoes automated validation to ensure correct format, completeness, and accuracy. Clean data enables fully automated processing.

3. VAT Rates Control

Declared VAT rates are automatically verified against the official VAT rate register. Any inconsistencies are recorded in a discrepancy register.

4. Data Aggregation and Tax Gap Detection

The system compares invoices and returns to identify three key gaps:

-

Mismatch between declared VAT in returns and invoices

-

Missing VAT return

-

Declared but unpaid VAT

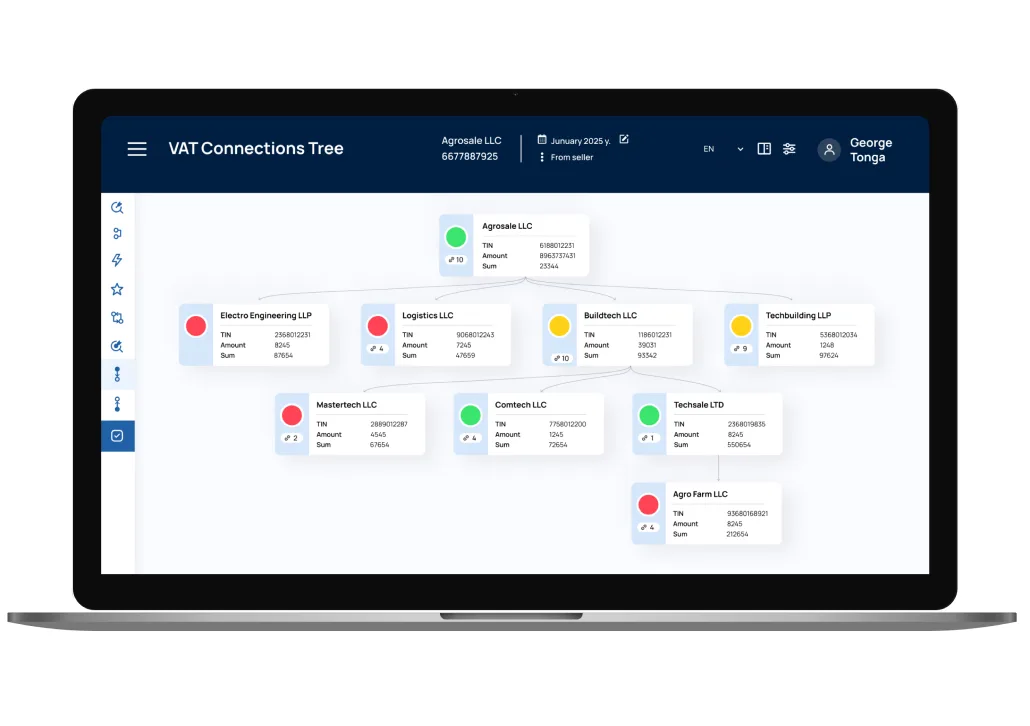

Violations are recorded, taxpayers are flagged, and transaction chains are analyzed through the VAT Connection Tree to detect proxy entities, beneficiaries, and fraud schemes.

5. Creation of Electronic Claims

If a violation is detected, the system automatically generates an electronic claim describing the issue and potential penalties.

6. Communication with the Taxpayer

Claims are delivered to the taxpayer’s personal account, with optional email and SMS notifications to ensure timely response.

7. Submission of Adjustments or Justification

Taxpayers can digitally submit corrected VAT returns or provide explanations and supporting documents.

8. Closing the Audit

Once discrepancies are resolved and deadlines expire, the system closes the audit automatically and, if applicable, issues a VAT refund decision.

Result: a transparent, risk-based, and fully digital VAT compliance process that reduces manual workload and strengthens tax control.

Visit this page to learn more about how traceCORE helps governments adopt digital VAT administration.

Conclusion

traceCORE Digital Desk Audit transforms traditional post-filing control into a continuous, automated compliance process.

By combining clean data architecture, cross-matching algorithms, and transaction traceability tools, tax administrations can detect tax gaps in near real time, reduce manual workload, improve transparency and fairness, combat complex VAT fraud schemes, and enhance voluntary compliance.

For governments pursuing digital transformation, this approach represents a scalable and data-centric model for modern VAT administration.