Track and Trace for Governments

Digital Tax Stamps and Track and Trace: Is There a Difference?

Illicit trade and counterfeiting might seem like problems limited to fake handbags or cheap cigarettes — but their true cost runs far deeper. From depriving countries of tax revenues to endangering lives, underground markets are wreaking havoc on both governments and ordinary citizens.

Two commonly used technologies to combat those issues are Digital Tax Stamps and Track and Trace systems. While they may appear similar on the surface, they function in fundamentally different ways — and only one offers transparency, accountability, and protection from counterfeiting in real time.

Read further to see why Track and Trace is not only more effective, but also more sustainable and scalable than relying solely on Digital Tax Stamps.

The Hidden Cost of Illicit Trade and Counterfeiting

Here’s the truth: Illicit trade and counterfeiting have severe, long-term impacts on both government tax revenue and public health.

Let’s take a closer look at what happens if these issues go unaddressed.

Impact on Government Tax Revenue

Illicit trade and counterfeiting directly undermine a country’s ability to collect taxes — especially in sectors like tobacco, alcohol, fuel, pharmaceuticals, and consumer goods.

Massive Tax Leakage

-

Illicit goods bypass taxation entirely. Products are smuggled, produced off-the-books, or sold using fake documents and labels.

-

For instance, illicit tobacco trade alone causes US $40–50 billion in lost tax revenue globally each year, according to the IMF.

Weakened Public Services

-

Lost revenue means less funding for healthcare, education, infrastructure, and law enforcement.

-

Honest taxpayers bear the burden, while those who are involved in illicit trade damage public trust in institutions.

Distorted Market Competition

-

Legitimate businesses pay taxes, follow regulations, and incur compliance costs.

-

Illicit traders undercut them with untaxed, often cheaper products — discouraging investment and shrinking the legal economy.

Impact on Public Health

Counterfeit and illicit products often do not meet safety standards, putting citizens at serious risk — especially in low- and middle-income countries.

Illicit Alcohol and Tobacco

-

Illicit alcohol often contains methanol or other toxic chemicals — causing serious health complications, severe poisoning, or death.

-

Unregulated tobacco can contain higher levels of harmful chemicals and is often sold to minors.

Counterfeit Medicines

-

The WHO estimates that 1 in 10 medical products in low-income countries is substandard or falsified.

-

These fakes may contain the wrong ingredients, no active ingredients, or toxic substances — leading to treatment failure, resistance, and death.

Unsafe Consumer Goods

-

Counterfeit cosmetics, food, baby formula, and electronics can cause burns, rashes, infections, and fires.

-

Fake personal protective equipment (PPE) — such as masks, gloves, and hand sanitizers — may offer little to no protection, increasing the risk of exposure to harmful pathogens, especially during health emergencies.

Without proper tracking and regulation, recalls are impossible — leaving dangerous products in circulation. Approaches to combating illicit trade and counterfeiting are evolving, but not all are created equal.

If you're seeking the most effective way to protect citizens from illicit trade and counterfeiting — while preventing the loss of billions in tax revenue — contact traceCORE today. Our team will carefully assess your country’s specific needs.

Let’s take a look at two of the most popular solutions governments worldwide consider in such cases — Digital Tax Stamps and Track and Trace — and what makes the latter stand out.

What Are Digital Tax Stamps?

Digital Tax Stamps are advanced excise stamps embedded with secure digital elements — such as encrypted markers — primarily designed to authenticate that a product is legitimate and taxed.

Affixed to products (e.g., medicines, alcohol), Digital Tax Stamps allow verification via scanning. The stamp typically contains product identifiers and registration data.

However, there are major drawbacks to the Digital Tax Stamp technology:

Expensive and inefficient

The Digital Tax Stamp technology requires professional printing equipment, special materials, and holograms.

All of that drives up costs.

Complex preparation process

Market participants have to order stamps directly from the service providers instead of printing them themselves, then wait for the delivery and figure out storage options.

There's also the risk of ordering too many or too few.

No real-time monitoring

Once a stamp is applied, there's no way to automatically follow where the product goes next.

Market participants have to record product movement manually, which creates additional work. Manual reports can be submitted days or even weeks later, so it becomes impossible to confirm the exact location of a product and prevent various issues or take action immediately.

Moreover, there’s always risk of errors if the reports aren't generated automatically.

Risk to businesses and consumers

With no automated traceability, companies risk buying and reselling counterfeits unknowingly.

Consumers can’t verify authenticity themselves — trust is based on packaging alone.

To sum it up: Digital Tax Stamps are too expensive and burdensome for businesses.

This technology doesn't provide the government with real-time tracking of products. Moreover, due to the lack of automated data exchange, market participants have to manually enter reports about the movement of goods on the service provider's platform.

As a result, the system may contain incorrect or outdated information, which often leads to revenue losses.

What Is Track and Trace?

Digital Track and Trace systems are built on serialized, scannable DataMatrix codes and are connected to a central database. Every time a product moves — from manufacturer to distributor to retailer — its status is recorded in real time.

Here's why Digital Track and Trace is a game-changer:

Full traceability

Due to the Electronic Data Interchange (EDI) support that allows market participants to exchange invoices, the system knows who currently owns each product, and where it came from.

If a counterfeit code appears, it can be flagged instantly.

Instant fraud detection

Since every code is registered in a central system, duplicate or invalid codes are immediately rejected.

Authorities and even consumers can scan products to confirm authenticity.

Online cash register integration

The system is integrated with online electronic cash registers and prevents the sale of products with invalid DataMatrix codes or expired shelf life, which helps protect consumers.

Lower ongoing costs

While the initial setup (equipment and software) requires investment, the codes themselves are cheap — and often printed directly on the packaging, along with expiry dates and batch numbers.

Business protection

With a verifiable trail, businesses can be confident they are buying legitimate goods.

No more unknowingly distributing fakes.

Consumer empowerment

With verification tools, consumers can scan product codes themselves to instantly verify authenticity, access product information, and report suspicious goods — creating a new layer of public oversight and trust.

Powerful integrations

Digital Track and Trace systems integrate with tax authority databases, customs systems, and even market analytics platforms — enabling smart tax collection, border enforcement, and economic analysis.

Market transparency support

Because every product is tracked, authorities gain insights into real market volumes, pricing trends, and distribution flows — allowing for better regulation and strategic planning.

The Difference Between Digital Tax Stamps and Track and Trace

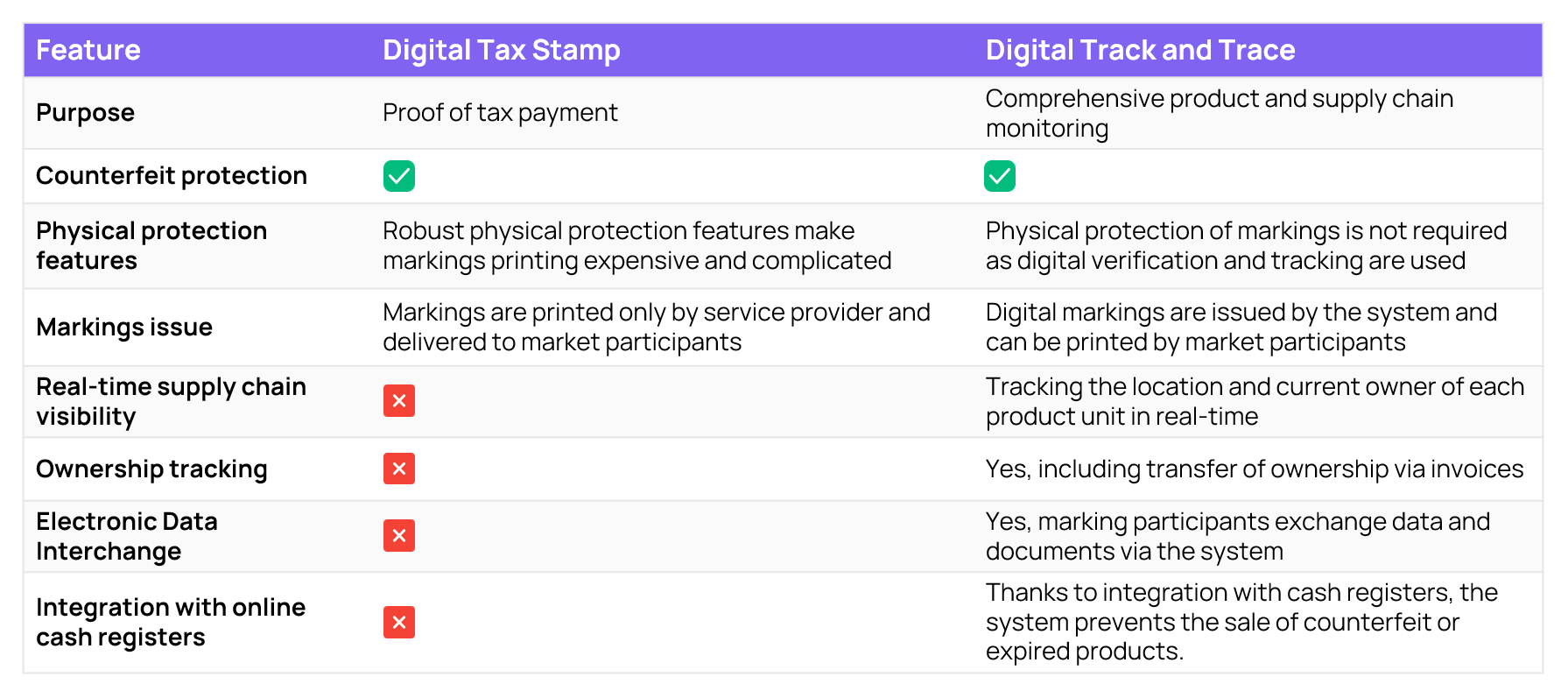

In the table below, we highlighted key differences between Digital Tax Stamps and Digital Track and Trace to see the full picture better.

The benefits of choosing Digital Track and Trace are remarkably clear.

Why Choose Digital Track and Trace by traceCORE

traceCORE Digital Track and Trace is a cutting-edge solution that can help countries reduce the share of illegal products in the market by 30–50%.

After its implementation, governments can also increase excise tax collection by 30-90% annually, depending on the product category, and VAT collection by up to 60%.

The image below shows common product categories where countries typically apply this technology — but with traceCORE Digital Track and Trace, the possibilities are limitless.

traceCORE is more than a team of developers; we are experts in our field, ready to support governments at every stage of solution implementation, from regulations revision to promotion of solution advantages to citizens. Moreover, we train local teams to continue the system support to bring long-term results.

Visit this page to connect with our experts and explore how traceCORE can support your country's goals.

Conclusion

Illicit trade in counterfeit goods is skyrocketing, undermining public health, economies, and trust in industries worldwide. Digital Tax Stamps offer a superficial layer of protection — but cannot match the comprehensive security, traceability, and government integration that Digital Track and Trace systems deliver.

When protecting consumers, tax revenues, and national security, there is no substitute for full traceability. Digital Track and Trace isn’t just a better option — it’s essential.

.webp)

.jpg)