Payment Solutions

How Implementing QR Code Payments Can Improve Tax Compliance

We live in an increasingly fast-paced world where convenience is essential for people of all ages. The introduction and evolution of QR code payment technologies significantly expanded options for executing transactions. In fact, millions of people across the globe use QR codes to pay for goods and services on a daily basis as it’s easy and efficient. All you need is a smartphone with a camera that can scan QR codes and stable internet connectivity (mobile data or Wi-Fi).

Read further to learn more about QR code payment technology, and how traceCORE SoftPOS can transform the retail industry as well as tackle the shadow economy and improve tax compliance.

What Are QR Codes?

QR codes (short for quick response codes) are a type of 2D matrix barcode that can store large amounts of information and be scanned with a digital device. Invented in 1994 by a Japanese company called Denso Wave, they were initially used to label automotive parts during manufacturing. But because this technology is so versatile, it was quickly integrated into many other industries, including finance.

Not only can QR codes contain a lot of data, but they can also be read from different angles, making it possible to use them for payments.

Types of QR Codes

Static QR Codes

The data stored in static QR codes can’t be changed after the code is generated. Such codes can be read anytime by any number of users. As a rule, static QR codes contain information that doesn’t have to be altered, such as contact details, a website URL, or a Wi-Fi password. If there’s a need to change the encoded information, it can only be done by generating a new QR code.

Dynamic QR Codes

Dynamic QR codes, in turn, allow for the alteration of the stored data once the code is generated. The QR code itself doesn’t contain the information but acts like a bridge between a person with a smartphone and an online location where the data is stored. This way, it becomes possible to track the scan in real-time and determine the time and place of the operation as well as the type of device that was used to perform it. For those reasons, dynamic QR codes are widely used for marketing campaigns and measuring their success.

The Emergence of QR Code Payments

Due to the accessibility of camera-equipped mobile devices that can be used to scan QR codes, more and more people are starting to use QR code payments in their daily routines. This technology reduces or even eliminates the need for other payment methods, such as cash and debit or credit cards.

As QR codes have become the norm for both companies and clients, more businesses are implementing them for payments. When the COVID-19 pandemic hit the world, the popularity of contactless payments significantly increased, leading to more people discovering the benefits of using them.

Research on the Use of QR Codes

MobileIron (was acquired by Ivanti on December 1, 2020), an American software company, conducted research on the use of QR codes in several countries, which showcased the evident surge of people’s interest in this technology. Initially the U.S., the UK, France, Germany, and the Netherlands were chosen.

According to this survey, three in 10 respondents opted for QR code transactions at least once in September 2020. However, this changed to eight in 10 by April 2021. By 2021, MobileIron decided not to count responses from the Netherlands and included consumers from China and Japan instead. This decision might have majorly influenced the results.

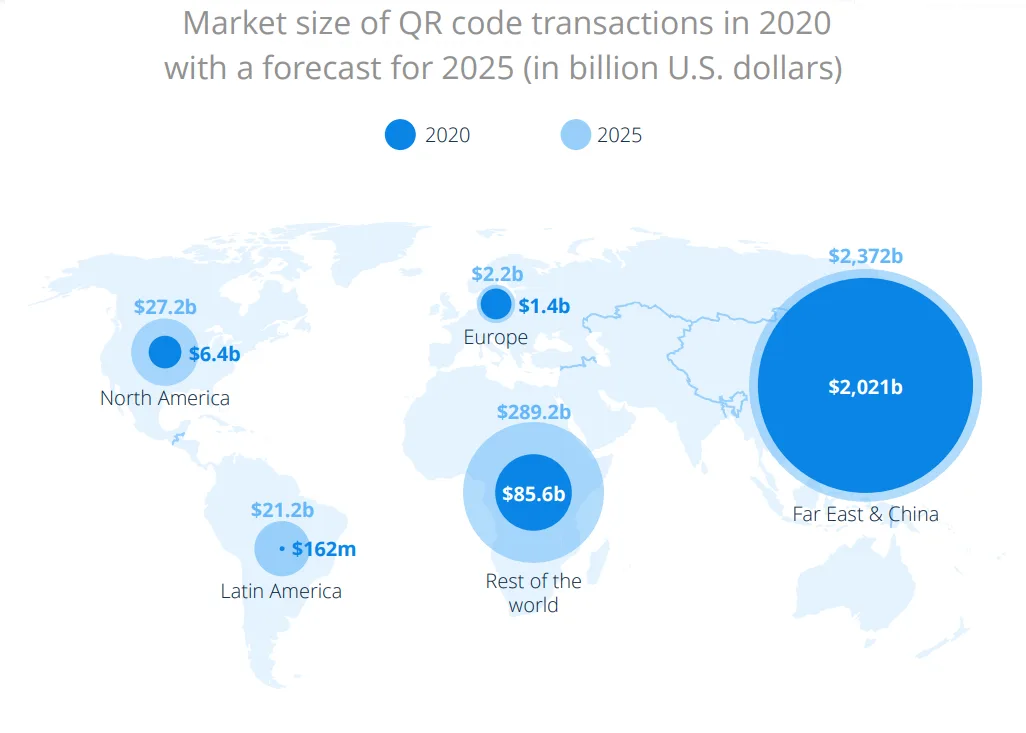

The graphic below shows that QR code payments are most popular in the Far East and China. It’s also important to mention that QR codes have been widely used in China since the early 2000s, which is one of the main reasons why QR code mobile payment services have become so advanced. Such payment services allow businesses to accept payments without having to purchase any hardware, such as point of sale (POS) terminals.

In addition, a market research company called AMI noted the increase in QR code use in Latin America, although it hasn’t become popular there quite yet.

The Main Benefits of QR Сode Payments

Accessibility

While traditional payment methods require investing in hardware or infrastructure, the only two things that a person would need for QR code payments are a smartphone with a camera that has the function to scan QR codes and stable internet connectivity. Because of that, all businesses, no matter how small, can have access to that technology.

Efficiency

Transaction time can be significantly reduced by implementing QR code payments as they replace traditional payment methods, such as cash and credit or debit cards. By scanning QR codes, merchants can quickly accept payments from their customers and ensure they don’t have to wait in lines for longer than necessary.

Security

Each QR code that is generated during a transaction is unique, and the data that it stores is encrypted, which minimizes the risk of fraud and financial information leaks. Moreover, biometric verification or PIN entry can also occur during authentication, giving an additional layer of security.

Advanced Analytics and Tracking

By integrating QR code payments with digital systems, merchants can analyze transaction information in detail and learn more about consumer behavior as well as spending habits. This approach helps businesses elevate their marketing strategies.

Cross-Border Payments

QR code technology makes sending and receiving payments internationally quick, easy, and affordable, especially compared to traditional options.

Contactless Transactions

QR code payments limit person-to-person interaction and help follow social distancing guidelines better.

Challenges When Using QR Codes in Developing Markets

Developing markets (for example, those on the African continent and Indian sub-continent) have been exploring the possibility of implementing QR code payments on a large scale for quite a while and made great progress despite many challenges.

These are the three main barriers that individuals have to face in developing markets:

-

High unbanked or underbanked populations.

-

Inaccessibility or poor quality of internet connectivity.

-

Lack of affordable smartphones.

Some markets successfully overcame many of the problems that arise from those challenges. For example, a lot of people across India now have access to online banking.

Why Adopting QR Code Payments Is Beneficial for Developing Markets

As mentioned above, high unbanked and underbanked populations are some of the biggest issues in developing markets. That also includes business owners who mainly accept cash as payment for their goods or services. Popularizing QR code payments among merchants can help reduce illicit trade and improve excise tax collection.

QR code payment technology allows the owners of even the smallest businesses to easily accept payments using just one digital device.

What is traceCORE SoftPOS and How Does It Work?

The traceCORE SoftPOS solution allows individuals to turn simple smartphones into point of sale (POS) terminals.

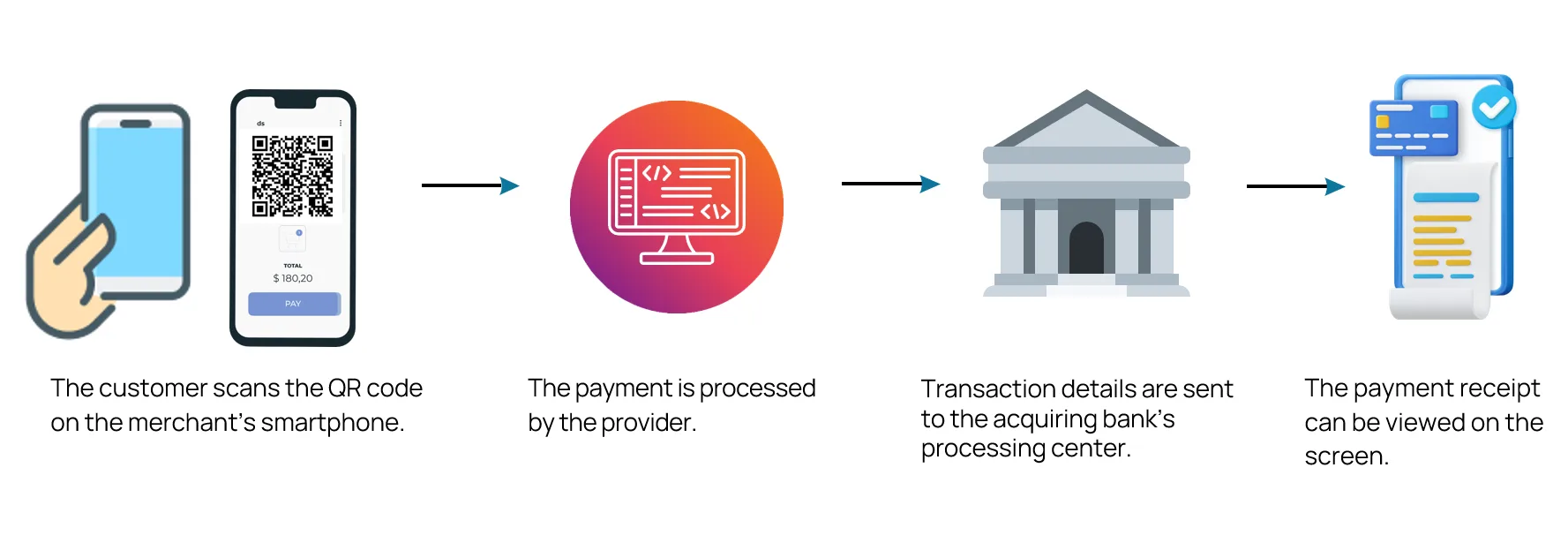

Here is how it works:

-

A merchant creates a QR code on their smartphone and shows it to a customer.

-

A customer scans the QR code with their smartphone and pays via a preferred mobile banking option or uses a mobile payment app, debit/credit card, or even a smartwatch.

-

A merchant can view the list of all payments on the app or in the personal area of the software’s desktop version.

The SoftPOS system can also be integrated with traceCORE B2C E-Invoicing. This is how tax authorities can receive QR code transaction data in real-time, either directly or through the Fiscal Data Operator (FDO). By doing so, tax authorities are able to determine the number of sales realized by a certain business as well as the exact sum of the taxes that business is required to pay. In addition, consumers have the option to receive e-receipts via email, messengers, or SMS.

Benefits of Implementing traceCORE SoftPOS

For Governments

By implementing traceCORE SoftPOS that allows retailers to accept cashless payments using a smartphone, governments can:

-

Improve tax compliance and tackle the shadow economy, which can help create a transparent business environment.

-

Help tax authorities reduce the time and effort spent on business audits and give them the option to monitor tax revenues online.

-

Provide retailers and consumers with modern and convenient tools for making and accepting payments.

-

Increase the level of trust in cashless payments and boost people’s digital literacy.

For Retailers

traceCORE SoftPOS includes an online checkout app available for Windows and Android as well as a personal cloud account where a merchant can view analytics, track inventory, create a loyalty program, and more.

-

Online checkout as a valuable tool for retail businesses. Merchants can easily manage employees, sales, markup, remaining goods and much more on the screen of their smartphone or laptop anytime, 24/7.

-

The solution is perfect for retail stores (and even retail chains) or public catering facilities, such as cafes, bars, and street food vendors.

-

Implementing SoftPOS eliminates the need to purchase additional hardware.

-

Compared to acquiring, using QR code payments is more beneficial for retailers as the fees are lower in that case.

-

The software reduces time and effort spent by retailers on keeping accounting.

The Future of QR Code Payments

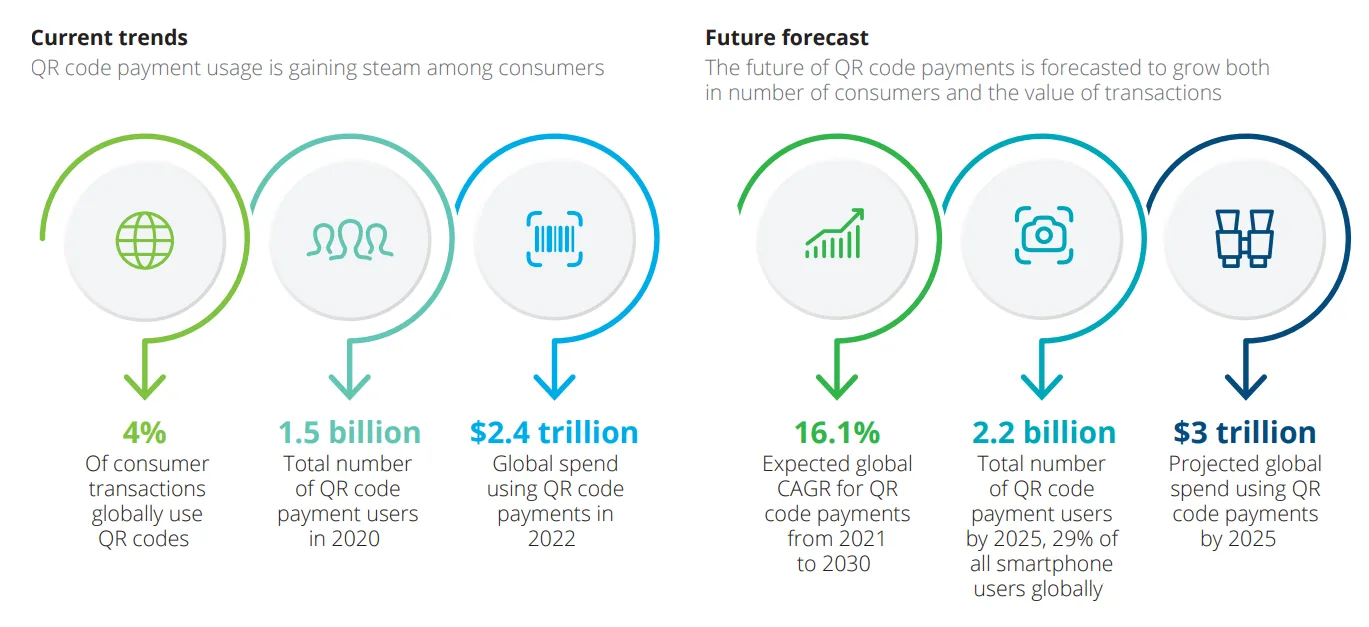

According to Deloitte’s 2023 study on QR code payments, more and more consumers are discovering the benefits of QR code payments. This payment type is predicted to grow both in number of consumers and the value of transactions.

QR Code Payments: Trends and Challenges

Internet Connectivity

QR code payments can be performed only with stable internet connectivity, which is still a big problem in some regions.

Interoperability

Interoperable QR codes allow people to make payments from anywhere using various mobile payment apps.

Government Interest

Governments and regulators in developing regions are showing great interest in implementing QR code payments as they can help reduce the use of cash and counterfeit as well as increase the banked population.

Biometric Payments

Biometric payment methods are slowly gaining profile around the world, which could lead to biometrics (fingerprint and/or facial recognition) replacing QR codes and smartphones for payments.

Lower Fees and Costs

The popularization and development of QR code payments can potentially help reduce costs and fees associated with merchant payment acceptance, including POS hardware.

Feature Phone Use

Smartphones are necessary for performing QR code payments. However, the lack of affordable options in some regions (e.g., across Africa) results in the popularity of feature phones instead.

The Growth of Alipay and WeChat Pay

Chinese market leaders Alipay and WeChat pay continue improving their QR code payment systems and making them more interoperable for cross-border transactions.

Different Market Approaches

It’s essential to develop multiple approaches to QR code payments worldwide because there's no such thing as the universal solution that could be used in different markets.

Conclusion

QR code payments offer unmatched simplicity and convenience, which are crucial in the digital age. Both businesses and consumers can benefit greatly from using this technology all across the world, including developing markets, such as those on the African continent and Indian sub-continent.

By adopting QR code payments on a large scale, governments can reduce illicit trade as well as improve excise tax collection, financial inclusion, and literacy.

As QR code payment systems continue to develop, this technology is a massive step towards a future where fast and secure payments are accessible to everyone.