B2C E-Invoicing

Combatting Tax Fraud and Counterfeit Goods with traceCORE Receipt Verification

Tax fraud and counterfeit goods are major and rapidly growing issues that significantly impact governments, businesses, and consumers worldwide. Tax fraud involves illegal practices where individuals or businesses intentionally engage in various fraudulent schemes to avoid paying taxes, while counterfeit goods refer to fake products that imitate genuine brands and products. Both of these problems can have serious consequences for consumers, from financial losses to safety risks.

Governments and organizations across the globe are working to address these issues, and encouraging consumers to take and verify their receipts whenever they pay for goods or services is one of the strategies that actually work.

Read on to learn more about the reasons why consumers should verify their receipts, how this system works, and the benefits of using traceCORE Receipt Verification in particular.

How Tax Fraud and Counterfeit Goods Harm Governments, Businesses, and Consumers

Governments may experience long-term economic instability due to tax fraud, as it erodes trust in the tax system and discourages honest taxpayers from complying with tax laws and regulations. The sale of counterfeit goods also results in lost revenue from legitimate sales and taxes, can pose significant risks to consumers and harm legitimate businesses.

Loss of Public Revenue

Governments around the world suffer revenue losses due to both tax fraud and counterfeit goods distribution. Tax fraud results in underreporting of taxable income, while counterfeit goods deprive governments of tax income from the legitimate sale of goods.

With reduced revenues, governments can struggle to fund public services, which inevitably affects citizens' access to healthcare, education, and infrastructure.

Health and Safety Risks

When consumers purchase counterfeit products, they often face significant risks. Counterfeit goods, especially in categories like pharmaceuticals, electronics, and food, are often made from low-quality materials or in unsafe conditions.

For those reasons, consumers can develop serious health issues, suffer accidents, and even fatalities. In addition, consumers don’t have any warranty and return options when purchasing counterfeit goods, which means that they can’t get a refund or any help if something goes wrong.

Lack of Fair Market Competition

Tax fraud creates uneven conditions for businesses, as those who evade taxes can price their goods and services lower than businesses that comply with tax laws.

Counterfeit goods undercut legitimate products, negatively affecting businesses that rely on their intellectual property and innovation. This damages the broader economy, discouraging entrepreneurship and investment.

Erosion of Consumer Trust

Both tax fraud and counterfeit goods undermine trust in the marketplace. If consumers question the authenticity and safety of certain products, they hesitate to make purchases, which slows down economic growth.

When tax fraud becomes a common thing, people lose trust in their countries’ governments, leading to a breakdown in the relationship between the state and its citizens.

According to the EU Tax Observatory, the global tax gap is in the range of $500 billion to $600 billion annually. While this includes corporate tax evasion, a substantial portion comes from personal income tax evasion, particularly in both developed and developing nations.

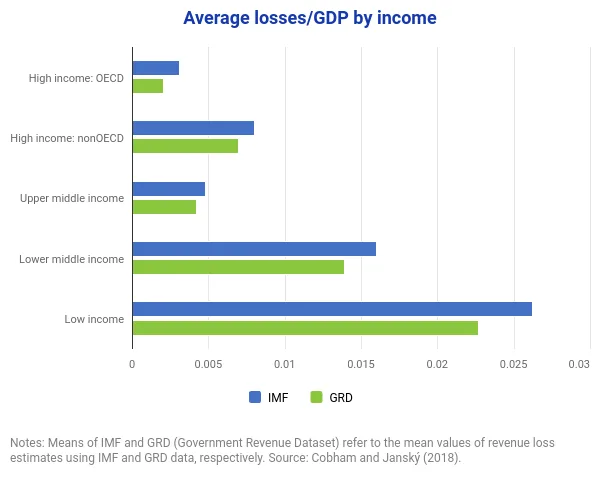

The most severely harmed by base erosion and profit shifting are middle-income and low-income countries. 14 countries in those two groups face losses of 3-7% of their GDP. It was determined that Sub-Saharan Africa, Latin America and the Caribbean, and South Asia face the biggest tax revenue losses as a percentage of GDP.

Improving tax compliance is a crucial task for governments across the globe as it helps increase countries’ revenues. Check out digital transformation solutions by traceCORE to learn how exactly it can be done in the modern world.

What Is Receipt Verification?

According to Green America, more than 37% of consumers throw away or lose nearly all or all paper receipts they receive. However, the role of purchase receipts shouldn’t be undermined.

Receipt verification is a process where consumers check their purchase receipts after completing a transaction, ensuring that the prices and items listed are correct.

While this practice is commonly seen as an individual consumer activity, it can also have broader benefits for governments, businesses, and consumers. By encouraging consumers to collect and review receipts, it enhances transparency, reduces errors, and can help curb issues like tax evasion, price misrepresentation, and fraudulent business practices.

Consumer involvement not only promotes better market practices but also supports government efforts in tax compliance and consumer protection, enforcing public control and helping identify illegal goods and unlawful transactions.

How Receipt Verification Helps Governments, Businesses, and Consumers

For Governments

Enhanced Tax Compliance

Receipt verification can help uncover instances of tax evasion or incorrect tax reporting. When consumers check their receipts and identify discrepancies, such as missing taxes or incorrect price listings, they can alert authorities to potential issues. This leads to more accurate reporting of sales taxes and helps governments enforce compliance among businesses.

Reduced Fraud

By actively reviewing receipts, consumers can detect fraudulent activities or unreported transactions. This decreases the likelihood of businesses engaging in dishonest practices such as underreporting sales to evade taxes. Governments benefit from this improved transparency, which supports fair taxation systems.

Better Consumer Protection

Receipt verification helps ensure that businesses adhere to regulations related to pricing, promotions, and taxes. It reduces the chances of consumers being misled or charged unfairly, strengthening consumer protection laws and reducing the burden on government agencies tasked with handling disputes.

For Businesses

Improved Accuracy

By encouraging receipt verification, businesses are incentivized to be more careful in their pricing and sales practices. This reduces the likelihood of mistakes such as incorrect pricing, improper tax application, or overcharging, helping businesses maintain a positive reputation.

Deeper Consumer Trust

When customers verify receipts and find accurate pricing, they are more likely to feel confident in the business's integrity and reliability. This fosters customer loyalty and satisfaction, which can lead to increased sales and repeat customers.

Prevention of Financial Disputes

Receipt verification by consumers can prevent disputes between businesses and customers over charges. It helps identify errors early on, ensuring that issues are resolved quickly and efficiently, thereby reducing the likelihood of costly legal claims or customer complaints.

For Consumers

Fair Pricing and Tax Accuracy

Consumers benefit directly from verifying their receipts by ensuring that the items they purchased are billed at the correct price and that taxes are properly applied. This reduces the risk of being overcharged or subjected to hidden fees.

Consumer Empowerment

By regularly checking receipts, consumers become more informed about the pricing structure, taxes, and promotions offered by businesses. This empowerment enables better decision-making and enhances consumers' understanding of their rights in the marketplace.

Greater Sense of Security

If consumers identify issues with receipts, they have the information needed to challenge incorrect charges or report potential fraud. This gives consumers a greater sense of security and confidence that businesses are held accountable for their practices.

traceCORE Receipt Verification: What Is It?

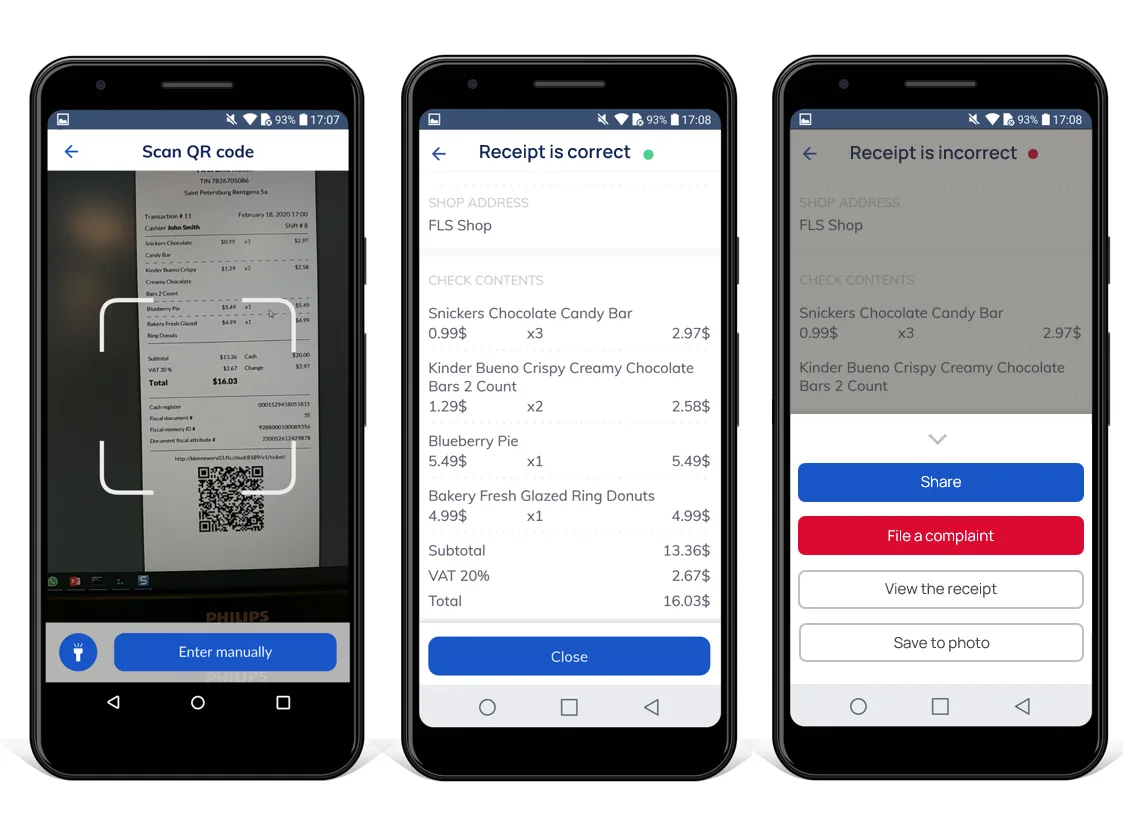

traceCORE Receipt Verification is a digital solution that helps consumers quickly identify incorrect receipts and dishonest sellers, as well as get more details about their purchases.

Consumers can verify paper receipts by scanning QR codes in them via a special mobile app, or by entering receipt details manually at a web portal. After doing that, paper receipts can be discarded, as they can be replaced by their digital versions.

(1).webp)

With verification, consumers can compare the purchase data indicated in the paper receipt with the data that the seller sent to tax authorities.

In addition to verification, the solution allows consumers to file complaints about violations of cash register legislation to tax authorities and store receipts in the mobile app.

Here’s how it works:

-

Download the app and log in using your mobile number / tax account / government service account.

-

Scan the QR code or enter the receipt details manually.

-

Verify the receipt and get additional information on your purchase.

-

File complaints if the receipt is absent or incorrect and get replies from tax authorities.

-

Store and download your receipts.

How Governments, Businesses, and Consumers Benefit from Using traceCORE Receipt Verification

Governments

Businesses

Consumers

Conclusion

Tax fraud and counterfeit goods have widespread negative effects on governments, businesses, and consumers.

For governments, these practices result in lost revenue, increased enforcement costs, and weakened public trust. For businesses, they create unfair competition, damage reputations, and expose companies to legal risks. Consumers face health, safety, and financial risks when purchasing counterfeit goods or bearing the costs of tax fraud.

traceCORE Receipt Verification can help combat these issues through consumer involvement and public control enforcement, which is crucial to creating a fair and secure marketplace. With this solution, businesses can build consumer trust and obtain powerful marketing tools, while consumers can improve their budgeting and expense tracking.

Related Posts

All postsHow a Fiscal Data Operator Can Reduce the Workload of Tax Authorities

By implementing a Fiscal Data Operator (FDO), governments can transform their methods of collecting, analyzing, and reporting fiscal data. Read this post to learn more about this technology and how traceCORE FDO stands out among competitor solutions on the market.

.webp)