B2C E-Invoicing

Top 6 Benefits of Online Electronic Cash Registers

Traditional cash registers are simple mechanical devices that ring up sales, conduct basic calculations, and store money. However, we live in a digital world where business technology keeps evolving every day. Cash registers are not an exception: through the years, different types of electronic cash registers have been developed, and these devices have forever changed how businesses manage their finances and sales. Unlike traditional devices, electronic cash registers offer retailers a broad range of tools to manage their stock levels. It doesn’t matter whether it’s a small store or a spacious supermarket that’s a part of a huge retail chain, as electronic cash registers have become a crucial part of modern transactions.

In addition to business management, electronic cash registers play a significant role when it comes to tax compliance. Many tax administrations have been implementing various strategies to prevent tax fraud and tax evasion, the adoption of online electronic cash registers being one of them.

Let’s break down the types of electronic cash registers, the benefits of using online cash registers, and how this technology can transform tax compliance around the world.

Types of Electronic Cash Registers

Non-Secure Electronic Registers

These cash registers contain paper records of transactions that can be accessed by tax authorities in an audit. Unfortunately, unscrupulous retailers can often manipulate these records by under-recording of sales as well as physical deletion of records or creation of fake records.

Secure Electronic Tax Registers

Also known as fiscal tills, secure electronic tax registers have a secure memory that captures transaction details – the amounts, time of the transaction, applicable tax, classification of goods. The secure memory works even when a device isn’t connected to power and, in theory, can be accessed by tax authorities only. These cash registers are protected with seals, which means that records can’t be deleted physically without damaging the device. However, there are still risks because now those records can be wiped, altered or even stopped from being stored using special software.

Electronic Signature Devices

Used with secure electronic tax registers, these devices create records that contain transaction details along with unique electronic signatures. These digital signatures make it possible to find and verify each transaction, and the fact that they are unique serves as a guarantee that transactions that contain them are real and haven’t been altered in any way.

Online Electronic Cash Registers

When using online cash registers, the information is transmitted to tax authorities in encrypted form either in real-time or close to real-time. That means that tax authorities can get an authentic copy of all files as soon (or nearly as soon) as transactions happen. Moreover, data encryption protects records from alteration – neither business owners nor their employees can access them.

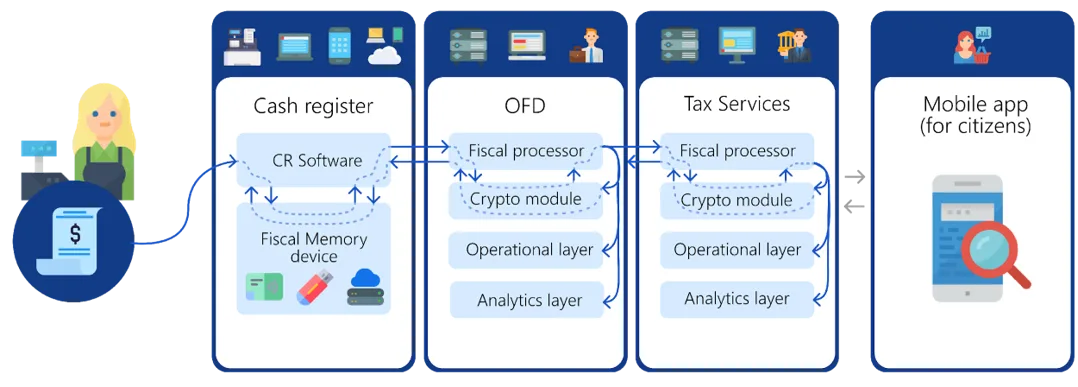

traceCORE B2C E-Invoicing enables automated and systematic transmission of B2C sales data from online electronic cash registers (OECRs) to the tax authority database directly or through a certified Fiscal Data Operator. As a result, tax authorities can receive that data in real-time.

Challenges in Traditional Retail Tax Administration

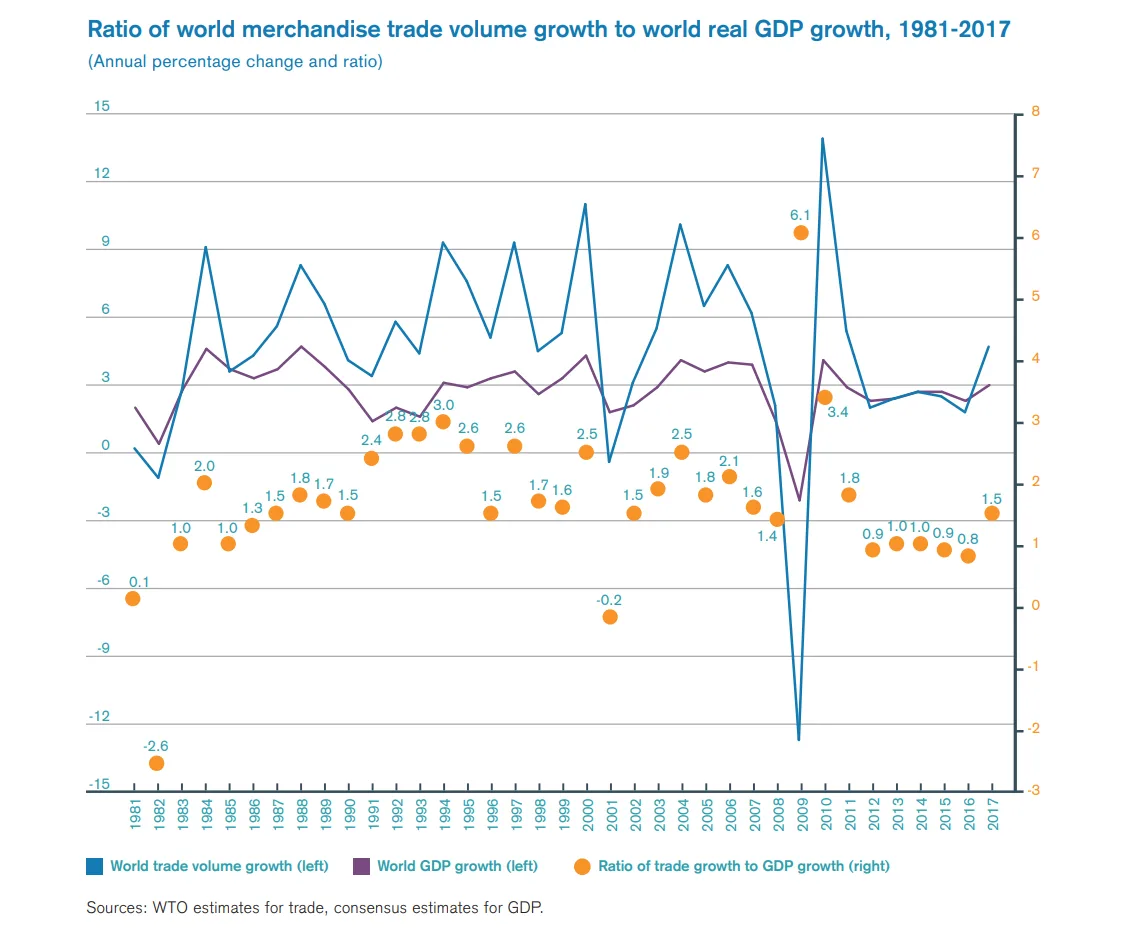

WTO’s data shows that the retail industry is one of the key contributors to the global GDP growth, has a major share of micro and small businesses but at the same time minor share in taxes and duties paid.

Key Reasons Why Traditional Retail Tax Administration Is Inefficient

Manual Chronometric Surveys of Cash Processing at POS

The process is very time-consuming, expensive and error-prone as it requires a lot of human and other resources. Long delays in tax reporting are quite common due to the lack of online data and human resources in tax authorities.

Annual Manual Administration of Millions of Offline Cash Registers

Taxpayers have to bring cash registers to tax authorities for manual inspection. As a result, the procedure is complex and expensive for both taxpayers and tax authorities.

Attempts to Increase Share of Non-Cash Payments

Tax authorities need to have full access to taxpayers’ bank accounts as well as Internet connectivity to access the necessary data. It’s also very difficult to substantially decrease cash circulation considering that the use of cash is on the rise globally, non-cash payments are still not that common in many countries.

6 Main Benefits of Implementing Online Electronic Cash Registers for Governments

Online Retail Tax Administration

Automated violation monitoring helps tax authorities detect such issues and respond to them quickly, as data processing and reporting happens almost in real-time.

Increased Tax and Duties Collection

Governments can reduce financial, operational, and crime risks as well as lower tax authorities’ costs.

Online Monitoring

Online monitoring helps tax authorities check all cash registers, retail prices, product availability and retail compliance according to current government regulations.

Improved Tax Compliance

When OECRs are combined with an effective digital track and trace system (traceCORE Track and Trace for Governments, for example), combating illegal trade becomes much easier. It also helps improve tax compliance even more due to additional tax collection (especially when it comes to excise goods).

Public Control

To eliminate illegal transactions and goods circulation in retail, governments can encourage consumers to verify their purchase receipts via mobile app, loyalty programs, state lotteries, and more, thus enforcing public control.

Economic Statistics

Using real-time or close to real-time retail data, economic policymakers can have a vast source of data to conduct economic analyses.

By implementing traceCORE B2C E-Invoicing (OECRs included), governments can reduce cash circulation risks and start collecting more taxes.

Online Electronic Cash Registers: Use Cases

Hungary

After the implementation of OECRs in Hungary in 2014, VAT paid by the covered businesses increased by around 15% in the first nine months compared to 2013. It was especially noticeable in sectors that had many businesses that didn’t provide receipts. In the case of grocery stores, VAT payments increased by 23%. The introduction of online electronic cash registers led to an increase in revenue equivalent to seven times the total Hungarian government costs spent on this project.

As a result, an additional HUF 280 billion (around EUR 900 million) in VAT was collected in comparison to the previous year. The Ministry of National Economy estimates that the implementation of OECRs alone helped the government generate around HUF 180-190 billion (around EUR 580-612 million).

South Korea

Online electronic cash registers and the accompanying cash receipt program were implemented in South Korea in 2005. Following that, the estimated visibility of cash and credit card payments to total expenditure in the private sector has increased gradually by more than 5% each year. It was 37.7% in 2004 but rose to 96.5% in 2016.

The number of cash receipts issued has increased eleven-fold since the introduction of OECRs, rising to around 5 billion cash receipts issued in 2016. The implementation of the online cash register system helped South Korea increase tax compliance and contributed to the assurance of a stable national revenue.

Russia

After implementing online electronic cash registers in Russia in 2017, a significant part of the retail market has come out of the informal sector. It’s estimated that revenue per cash register increased significantly (in some cases by 100%). In 2017, it was revealed that VAT collection from the retail sector increased by 38% compared to 2016.

Because of the implementation of OECRs, a new and competitive market for online cash registers was developed in Russia. More than 52 domestic manufacturers offer over 150 models of online cash registers that can fit all the business needs in the retail and service sectors.

Moreover, annual VAT income in retail has increased by 103% in 4 years, from US $2.6 billion in 2017 to US $5.3 billion in 2021, and the number of cash registers increased more than threefold in 4 years, from 1.1 million in 2017 to 3.7 million in 2021.

Conclusion

By implementing online electronic cash registers, it’s possible to reduce opportunities for under-reporting, enable more effective and timely enforcement, thus improving fiscal transparency and tax compliance.

Tools like traceCORE B2C E-Invoicing that include the introduction of OECRs help governments double revenue from VAT, achieve public control to eliminate non-compliance, and get valuable transaction data that can be used for reporting, analysis, and fraud prevention.

.webp)

.webp)