B2C E-Invoicing

How a Fiscal Data Operator Can Reduce the Workload of Tax Authorities

The main mission of tax authorities is to collect revenues from taxpayers in a timely manner according to the countries’ laws, without negatively affecting economic activity. It can be quite challenging for tax administrations to achieve and maintain a high degree of self-assessment and voluntary compliance by taxpayers. For the most part, it can be done by implementing well-designed taxpayer services that can help address the noncompliance.

In today’s fast-paced world, governments worldwide have to make sure that their public finance management methods are transparent, accurate, and efficient. Traditional ways of tracking and reporting fiscal data are often slow and error-prone. However, by implementing a Fiscal Data Operator (FDO), governments can transform their methods of collecting, analyzing, and reporting fiscal data. Using this solution, it’s possible to improve tax compliance and enable real-time monitoring of public finances.

In this post, we will explore the significant advantages of implementing a Fiscal Data Operator as a way to reduce the workload of tax authorities, as well as the reasons why traceCORE FDO is a great choice for governments across the globe.

What is a Fiscal Data Operator (FDO)?

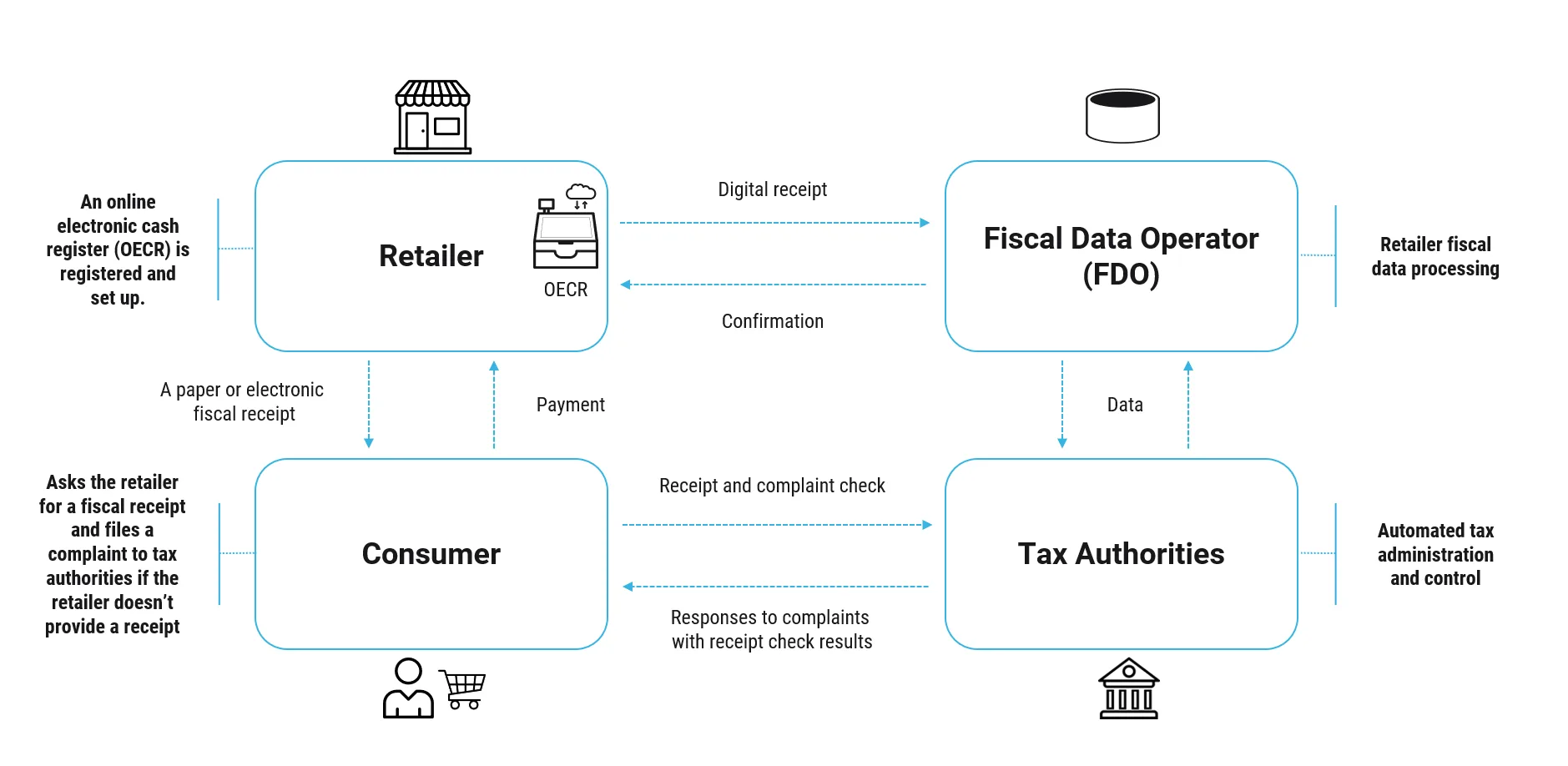

A Fiscal Data Operator is a digital solution and a service provider performing independent and permanent reception, processing, cryptographic protection and storage of accepted fiscal data online. After its implementation, tax authorities don’t have to manually collect and manage fiscal data, support users of online sales registers and invest in developing software and infrastructure.

.webp)

A Fiscal Data Operator can seamlessly integrate with the core tax authority information system and provide opportunities for analytics, forecasting and decision-making based on fiscal data.

The main role of an FDO is to collect, validate, store, and make fiscal data accessible to relevant stakeholders, such as governments, financial institutions, international organizations, policymakers, and the general public.

A Fiscal Data Operator can manage the following types of fiscal data:

-

Taxation data: Revenue collection from various forms of taxation, such as income tax, VAT, corporate taxes.

-

Expenditure data: Public sector spending, such as government investments, subsidies, and social benefits.

-

Debt data: Government borrowing, debt servicing, and fiscal sustainability metrics.

-

Budgeting data: Government financial planning, including projected revenue and expenditure for the fiscal year.

traceCORE Fiscal Data Operator is a reliable solution that collects, processes, protects, stores and securely transfers fiscal data to tax authorities, regardless of the chosen cash register type. To learn more, check out our Fiscal Data Operator page.

Key Functions of a Fiscal Data Operator

Data Reception and Storage

Using an FDO, it’s possible to ensure secure acquisition and storage of fiscal data from cash registers, while maintaining its integrity and availability for tax authorities.

Data Analysis

Fiscal Data Operators can conduct preliminary data analysis to detect anomalies and violations, enabling prompt action by tax authorities.

Security Assurance

FDOs utilize advanced cryptographic technologies to protect data from unauthorized access and alterations, including specialized chips for authentication and data integrity.

System Integration

By implementing a Fiscal Data Operator, it becomes possible to integrate online fiscalization with popular e-commerce and financial platforms, streamlining the fiscalization process for users.

Support for Various Cash Registers

FDOs support traditional and modern cash register solutions, such as software-based registers on mobile devices and computers, allowing businesses to choose suitable options.

Economic Forecasting Support

By using an FDO, it’s possible to support economic forecasting, which is critical for understanding future fiscal pressures (debt sustainability, economic growth prospects, etc.) and for formulating long-term financial policies.

Importance of Implementing a Fiscal Data Operator

According to the OECD, governments need to have reliable public financial management frameworks in order to build trust in budgetary governance, as well as maintain enough fiscal space to support crisis responses when necessary.

Through the years, it’s been proven that countries around the world need to preserve the resilience of public finances to manage large and unexpected expenditures — the aftermath of natural disasters or a major pandemic and to support a distressed sector. However, the graph below shows that debt levels in OECD countries have risen significantly recently.

The implementation of a fiscal data operator can help countries preserve the resilience of public finances. Moreover, it’s critical in modern governance for these 4 key reasons:

How Using an FDO Can Help Reduce the Workload of Tax Authorities

Implementing a Fiscal Data Operator allows tax authorities to automate processes, improve data accuracy, and streamline communication between various government departments. An FDO can centralize fiscal data, providing tax authorities with real-time insights and reducing the need for manual interventions.

Here are the key ways in which a Fiscal Data Operator can reduce the workload of tax authorities:

Automating Data Collection and Reporting

Traditional systems often require tax authorities to manually process large amounts of fiscal data, such as tax returns, financial reports, and audit data. By using an FDO, these tasks are automated, ensuring that data is collected and reported in real time with minimal human intervention.

That can help reduce human errors, save time, and enable tax authorities to focus on more complex tasks, such as policy formulation and risk management.

Streamlining Data Sharing Between Tax Agencies

By using an FDO, it’s possible to achieve seamless data integration and sharing across various government agencies, such as tax departments, customs, treasury, and central banks. That results in tax authorities spending less time gathering information from different sources and ensures that all fiscal data is up-to-date and consistent.

Improved Data Accuracy and Consistency

An FDO can help implement standardized data collection methods and thus ensure that fiscal data is consistent and accurate. This reduces the reliance on paper-based data submissions and the need for manual data verification, as well as minimizes errors in tax assessments or reporting.

As a result, tax authorities can instantly notice that certain data are incorrect or incomplete, as the system flags discrepancies automatically.

Real-Time Monitoring and Reporting

Using a Fiscal Data Operator allows tax authorities to access real-time fiscal data, such as sales transactions, VAT collections, or corporate tax filings. This reduces the need for manual monitoring and allows tax administrations to instantly identify discrepancies or noncompliance. And if tax evasion or fraud is detected earlier, it can be possible to avoid lengthy investigations or manual audits.

Reducing Taxpayer Burden and Improving Compliance

By implementing an FDO, taxpayers will be provided with user-friendly digital platforms for filing taxes and submitting documentation. As a result, tax authorities won’t have to deal with a high volume of inquiries, errors, and disputes related to tax filings anymore as all of that will be significantly reduced.

Better Risk Management and Fraud Detection

An FDO can enable advanced data analytics and machine learning tools to help tax authorities analyze patterns and identify high-risk taxpayers or potential fraud. By automating fraud detection and flagging suspicious transactions, tax authorities can focus their efforts on higher-priority cases rather than manually checking everything.

Reducing the Need for Physical Audits

Using a Fiscal Data Operator, tax authorities can automate the auditing process by collecting and cross-referencing data from multiple sources. Automated audits based on digital records and patterns reduce the need for manual, on-site audits, allowing tax authorities to use their resources more effectively.

By automating routine checks, tax authorities can focus only on cases that require more in-depth investigation.

Enhancing Taxpayer Services and Support

As a rule, FDOs have a self-service portal for taxpayers, which allows them to access information, file returns, and make payments without contacting tax authorities directly and resolve routine issues on their own.

This reduces the workload of customer service representatives within tax authorities and allows them to focus on more complex cases.

One Fiscal Data Operator vs. Multiple FDOs

Depending on their needs, countries can implement either one or multiple Fiscal Data Operators.

Here are a few reasons why implementing just one Fiscal Data Operator can be more convenient:

-

Efficient data consolidation

-

Lower infrastructure costs

-

Quick access to analytics

-

Reduced workload for tax authorities

-

Lower public expenditure

-

Less paperwork for small and midsize businesses

Why Choose traceCORE Fiscal Data Operator

traceCORE Fiscal Data Operator allows tax authorities to receive information regarding goods sold and services provided by businesses in real time. It performs independent and permanent reception, processing, cryptographic protection and storage of accepted fiscal data online.

After seamlessly integrating with tax administration systems, traceCORE FDO provides opportunities for analytics, forecasting and decision-making based on fiscal data.

The implementation of online fiscalization becomes possible, which can help modernize the tax system, effectively administer taxes, enhance transparency and trust among taxpayers, and reduce the shadow economy.

With adopted traceCORE FDO, business owners can register their cash registers online, set tax regimes and other vital parameters. The Fiscal Data Operator will collect, process, and store sales data, providing tax authorities with up-to-date financial information.

Here are 4 key reasons why traceCORE Fiscal Data Operator stands out among competitor solutions:

-

Active support: We keep maintenance of cash registers, as well as train, support and consult cash register owners, reducing the tax authorities burden.

-

Product improvements: We improve analytics, forecasting and decision-making capabilities based on fiscal data.

-

Partnership with stakeholders: We provide aggregated anonymized fiscal data for stakeholders.

-

Easily scaled technology: Our solution is easily scaled and exported, being tailored to the needs of the tax authority.

For more information on traceCORE Fiscal Data Operator, please check out our product page.

Conclusion

By automating data collection, improving data accuracy, streamlining communication between agencies, and reducing the manual workload for tax authorities, the implementation of a Fiscal Data Operator significantly enhances the efficiency of tax administration. It allows tax authorities to focus on high-value tasks like policy development, fraud detection, and strategic planning, all while improving taxpayer compliance.

In addition, by implementing traceCORE FDO in particular, governments across the world can uncover even more benefits, such as cash register maintenance and active support for cash register owners provided by our team, improved analytics, forecasting and decision-making capabilities, close partnership with stakeholders, and working with easily scaled solution.

.webp)

.webp)