Mobile Transaction Tracking

Challenges Behind Mobile Money Transaction Control and Ways to Solve Them

Mobile money has revolutionized financial inclusion, especially in regions with limited access to traditional banking. However, the rapid growth of mobile money services has introduced significant challenges for governments worldwide. Uncontrolled mobile money transactions can undermine economic stability, facilitate illicit activities, and erode public trust in financial systems.

In this post, we explore the most critical problems posed by unregulated mobile money transactions and how traceCORE Mobile Transaction Tracking offers a robust solution.

What Is Mobile Money?

According to the IMF, mobile money is a digital payment and savings system that operates on a pay-as-you-go basis, using mobile accounts and supported by a network of local agents.

Mobile money and mobile banking are not the same thing. Mobile money is a financial service provided by mobile network operators or their partners, independent of traditional banks. It requires only a basic mobile phone, not a bank account.

In contrast, mobile banking uses apps to access traditional bank services like deposits and transfers. If a service simply offers mobile access to bank accounts, it’s classified as mobile banking, not mobile money.

Mobile money refers to a variety of digital financial services available via mobile devices, including options for transferring funds, paying bills, topping up airtime, and accessing microloans.

How Widespread Is Mobile Money?

Once merely a tool for storing and accessing funds remotely, mobile money has now evolved into a vibrant market set for substantial growth in the coming years.

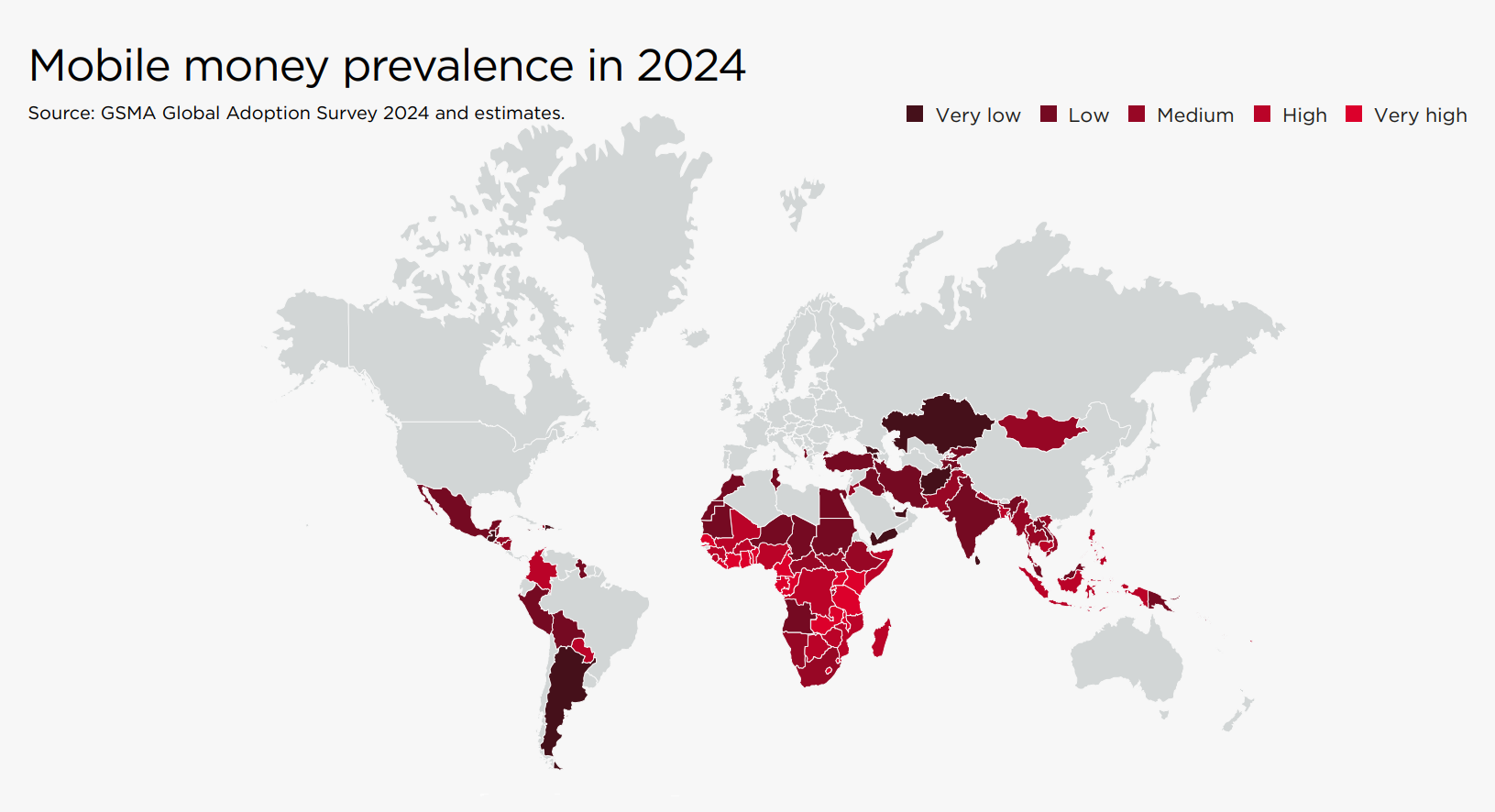

As in 2023, mobile money adoption and active usage experienced double-digit growth in 2024. A 2025 GSMA report states that the mobile money industry reached over 500 million monthly active users and 2 billion registered accounts.

The volumes and values of transactions saw double-digit growth too. Nearly $1.7 trillion moved through mobile money accounts, translating to transactions worth $3.2 million every minute.

Source: GSMA, 2025. The State of the Industry Report on Mobile Money 2025, https://www.gsma.com/sotir/wp-content/uploads/2025/04/The-State-of-the-Industry-Report-2025_English.pdf

Source: GSMA, 2025. The State of the Industry Report on Mobile Money 2025, https://www.gsma.com/sotir/wp-content/uploads/2025/04/The-State-of-the-Industry-Report-2025_English.pdf

Where Is Mobile Money Most Commonly Used?

Currently, Sub-Saharan Africa is the global leader in mobile money, particularly in countries like Kenya, Ghana, and Nigeria, where it has become a vital tool for financial inclusion. According to GSMA, the region has over 1.1 billion registered accounts. This growth contributed to the increased reach of mobile money agent networks across the world.

East Asia and the Pacific, as well as the Middle East and North Africa, are emerging as regions to watch in the future. Both areas experienced significant growth last year in the number of mobile money accounts, active users, and transaction volumes.

Problems Caused by Uncontrolled Mobile Money Transactions

While it’s obvious that mobile money drives financial inclusion and unlocks new opportunities, it’s also important to note that uncontrolled transactions lead to several challenges.

Tax Evasion and Informality

The absence of oversight in mobile money transactions allows individuals and businesses to operate outside formal economic systems, leading to substantial tax evasion. This informality deprives governments of essential revenue needed for public services and infrastructure development.

Fraud and Cybersecurity Risks

Unregulated platforms are prime targets for fraud and cyberattacks. Without stringent monitoring, users are vulnerable to scams, unauthorized transactions, and data breaches, undermining the integrity of financial systems.

Money Laundering and Terrorism Financing

The lack of Know Your Customer (KYC) protocols and transaction monitoring facilitates money laundering and the financing of terrorism. Criminal organizations exploit mobile money services to move illicit funds across borders with minimal detection.

Consumer Protection Issues

Without regulatory oversight, consumers face exploitation through hidden fees, unauthorized charges, and inadequate dispute resolution mechanisms. This lack of protection erodes trust in mobile financial services.

Economic Instability

The unregulated flow of funds can lead to economic instability, as large sums of money move unpredictably, affecting currency valuation and monetary policy effectiveness.

Barriers to Financial Inclusion

Ironically, the absence of regulation can hinder financial inclusion. Without proper oversight, mobile money services may not reach underserved populations effectively, or they may exploit them through high fees and limited services.

6 Effective Solutions to Address Those Challenges

In order to avoid issues that may occur after the implementation of mobile money, governments are advised to consider the following points:

Centralized Transaction Monitoring

Establishing centralized systems to monitor and analyze mobile money transactions ensures real-time oversight, enabling prompt detection of irregular activities and compliance breaches.

Robust KYC and AML Regulations

Mandating comprehensive Know Your Customer (KYC) procedures and Anti-Money Laundering (AML) regulations for mobile money providers helps prevent illicit activities and ensures accountability.

Reporting and Compliance Frameworks

Developing standardized reporting protocols and compliance frameworks for mobile money services promotes transparency and uniformity across the sector.

.png)

Public-Private Partnerships

Partnering with mobile money providers through public-private initiatives can drive innovation, balancing regulation with growth to build a secure and inclusive financial system.

Consumer Protection Laws

Strengthening consumer protection laws to include mobile money services ensures that users are safeguarded against fraud, unfair practices, and have access to effective grievance redress mechanisms.

Financial Literacy and Awareness

Educating the public about mobile money services, their rights, and potential risks empowers consumers to make informed decisions and reduces vulnerability to exploitation.

traceCORE Mobile Transaction Tracking provides a centralized reporting and monitoring system to track and verify all activities in the telecom sector.

For more information, visit this page: https://tracecore.solutions/mobile-transaction-tracking

Learning from Tanzania’s Unsuccessful Case of Mobile Money Levy Implementation

In July 2021, Tanzania introduced a new levy on mobile money transactions, aiming to generate revenue for infrastructure projects. However, the implementation of this "patriotic levy" has had unintended consequences, particularly for small businesses and low-income citizens who rely heavily on mobile money services.

Financial Burden on Small Enterprises

Small businesses, especially those operating online or from home, have reported significant challenges due to the increased transaction costs.

For instance, Rahel Farahani, who runs a home-based bakery, expressed concerns that the new charges were discouraging customers from using mobile money, potentially forcing her to relocate her business. Similarly, Anastazia Goronga, an entrepreneur selling aromatherapy products, noted a decline in customer engagement as the increased costs made mobile payments less attractive.

Decline in Mobile Money Usage

The introduction of the levy led to a noticeable decrease in mobile money transactions. Reports indicated a 38% drop in person-to-person transactions and a 25% reduction in cash-out transactions between June and September 2021.

This decline was attributed to the higher costs associated with mobile money services, prompting users to revert to cash transactions to avoid additional fees.

Reversal of Financial Inclusion Gains

Mobile money services have been instrumental in promoting financial inclusion, particularly among rural populations and women. However, the increased transaction costs have had the opposite effect.

Many users, especially those in rural areas, have returned to cash-based transactions, losing access to essential financial services such as savings, loans, and insurance. This regression undermines the progress made in integrating underserved communities into the financial system.

Government Response and Public Sentiment

In response to public outcry, the Tanzanian government reduced the mobile money levy by 43% in July 2022. While this move was welcomed by many, including small business owners and citizens, some experts argue that a complete removal of the levy would be more beneficial in fostering economic growth and financial inclusion.

The situation in Tanzania underscores the delicate balance governments must maintain when implementing taxes on digital financial services. While such levies can generate revenue, they should be carefully designed to avoid stifling the very economic activities they aim to support.

Current Challenges

Currently, there are several government institutions in Tanzania that are involved in mobile money transaction control and regulation:

-

Ministry of Information, Communication and Information Technology

-

Tanzania Communications Regulatory Authority

-

Bank of Tanzania

Because there is no central database for mobile money transactions, the regulatory authorities obtain different data on the number and the volume of mobile money transactions in Tanzania:

-

According to the Tanzania Communications Regulatory Authority, in 2022 there were 4.2 billion transactions worth US $54.4 billion.

-

According to the Bank of Tanzania, in 2022, 3.6 billion transactions were completed with a value of US $44.4 billion.

The difference between the data amounts to 0.6 billion transactions worth US $10 billion.

Similar Issues in Other African Countries

Not only Tanzania, many African countries have increasingly moved to introduce taxes on rapidly expanding digital financial services such as mobile money.

According to The Conversation, Cameroon implemented a 0.2% tax on mobile money transactions in January 2022. Just a few months later, in May, Ghana followed suit with a 1.5% electronic levy (e-levy) on mobile transactions — a measure that has disproportionately affected low-income individuals who rely heavily on these services for everyday financial activities.

Zimbabwe Independent reported that Ugandans have been subjected to a 0.5% mobile money tax since 2018, while Zimbabweans have faced a much higher levy of 2% since 2019 — the steepest among African nations imposing such taxes.

Governments are seeking to boost revenue by introducing new taxes on mobile money, in addition to existing VAT and excise taxes. However, this places an added burden on small businesses and low-income individuals, who lack access to traditional banking services and rely heavily on mobile money for everyday transactions.

As a result, these taxes can harm business activity and lead to a decline in mobile money usage — ultimately creating a negative impact that benefits no one.

The Solution

The most effective approach for governments in this case is not to introduce new taxes, but to improve the collection of existing ones — such as VAT and excise taxes — from mobile money transactions.

To do that, governments need visibility into mobile money transfers, which is impossible without a robust digital solution.

By implementing traceCORE Mobile Transaction Tracking, supported by a centralized database, regulatory authorities can gain access to accurate, real-time data — enabling efficient tax collection and reducing revenue leakage.

Benefits of Using traceCORE Mobile Transaction Tracking

Enhanced Tax Compliance

The solution enables governments to track and tax digital transactions effectively, increasing national revenue and reducing the informal economy.

Improved Consumer Protection

By standardizing reporting and enforcing compliance, traceCORE Mobile Transaction Tracking ensures fair practices in the telecom sector, safeguarding consumers from exploitation.

Increased Transparency

The system provides complete oversight of all mobile transactions, fostering transparency and trust in the financial system.

Promotion of Economic Growth

By enabling greater productivity and creating employment opportunities, the solution contributes to overall economic development.

Support for Financial Inclusion

The centralized reporting mechanism enhances financial inclusion by ensuring that underserved populations have access to secure and regulated mobile money services.

Facilitation of Regulatory Compliance

traceCORE Mobile Transaction Tracking assists in implementing clear guidelines and standards for reporting and compliance, simplifying the regulatory process for governments and telecom operators.

For more information on how traceCORE Mobile Transaction Tracking can assist in regulating mobile money transactions, visit tracecore.solutions/mobile-transaction-tracking

Conclusion

Uncontrolled mobile money transactions present significant challenges to governments worldwide, including tax evasion, fraud, and threats to economic stability.

The experience of Tanzania and other African countries highlights the critical need for governments to consider the broader implications of taxing mobile money services. Ensuring that such policies do not disproportionately affect small businesses and low-income citizens is essential for sustaining economic development and promoting financial inclusion.

Implementing solutions like traceCORE Mobile Transaction Tracking can provide governments with the tools needed to regulate and monitor mobile money services effectively. By enhancing tax compliance, consumer protection, and financial inclusion, the solution contributes to a more transparent, secure, and prosperous financial ecosystem.

.jpg)