Tax Compliance

Which Countries Experience the Most Revenue Losses from Tax Avoidance?

Tax avoidance is a major issue for many countries around the world, especially those with developing economies, as it leads to substantial revenue losses. As a result, governments of those countries are deprived of the basic resources needed to fund public services, infrastructure, and social welfare programs.

Countries that experience the most revenue losses due to tax avoidance often face even bigger challenges such as poverty, inequality, and underdeveloped infrastructure. However, with the right reforms and digital transformation, these countries can tackle tax avoidance, improve their ability to achieve sustainable growth and development, and achieve the United Nations' Sustainable Development Goals (SDGs).

In this post, we will talk about the countries that are most affected by tax avoidance. We are going to discuss the challenges these countries face due to tax avoidance, and what role can digital transformation products by traceCORE play in those situations.

Why Should the Tax-to-GDP Ratio Be Above 15%?

Before going into detail, let’s determine what the tax-to-GDP ratio actually is.

What Is the Tax-to-GDP Ratio?

The tax-to-GDP ratio compares a country's tax revenue to the overall size of its economy while taking gross domestic product as a measure.

Along with other metrics, this ratio helps assess how efficient a country’s government is while using taxation to allocate its economic resources.

If a country is developed, its tax-to-GDP ratio is definitely higher than a still developing one’s.

When a nation’s tax revenues are high enough, it can allow investing more in infrastructure, healthcare, and education. And all those things are extremely important when it comes to sustained development of the economy and the welfare of its citizens.

How High Should the Tax-to-GDP Ratio Be?

According to the World Bank, if a country’s tax revenues are over 15%, then it will have many more opportunities for driving economic growth and reducing poverty.

At the 15% level, governments are able to develop and improve their countries’ infrastructure, healthcare, and education, while achieving the United Nations Sustainable Development Goals (SDGs). Countries below that level have to increase domestic revenue mobilization (DRM) in order to reach those goals.

What Are the United Nations Sustainable Development Goals (SDGs)?

The United Nations adopted 17 Sustainable Development Goals (SDGs) back in 2015 to combat poverty, protect the planet, and ensure peace and prosperity for everyone on this planet.

All the goals are connected, so if you put effort into one of them, it will change outcomes in others. All sustainability directions are important: social, economic, and environmental.

Nations that are the furthest behind with their progress receive help from other countries to end poverty, hunger, healthcare and environmental crises, violence against women and children, etc.

traceCORE B2B E-Invoicing and B2C E-Invoicing help countries around the world effectively decrease their VAT gaps and start collecting more revenue.

Tax Capacity Building in Developing Countries: Current Challenges

According to IMF, the average additional annual spending needed for emerging market economies in 2030 to achieve key SDGs is equivalent to 4% of GDP, whereas for the average low-income developing country, it stands at 15% of GDP.

Since many developing countries still generate minimal tax revenue, it’s important to start with building tax capacity to improve fiscal sustainability. Raising the tax-to-GDP ratio by 5% of GDP over the next decade is an ambitious yet achievable goal for many countries. This additional tax revenue can help most emerging market economies.

The infographic show shows that for low-income countries, whose combined needs total half a trillion USD (or 0.5% of global GDP), the additional tax revenues could cover one-third of the total extra needs, leaving a gap of 0.3% of global GDP.

However, it’s not enough. Countries should not only spend more, they must do it efficiently. They must foster political and societal consensus, strengthen public institutions, and embed principles such as transparency, accountability, and responsiveness across both the public and private sectors.

It’s clear that developing countries should focus on achieving the SDGs, but the remaining stakeholders, such as the private sector, official development assistance, philanthropists, and international financial institutions can significantly help close the remaining gap.

Which Countries Have the Lowest Tax-to-GDP Ratios?

Unfortunately, a lot of countries’ tax-to-GDP ratios are below 15%. Those countries can be divided into two categories: those that have major non-tax revenue sources and those that have not. For example, this group includes Kuwait and Saudi Arabia that got wealthy due to their oil exports, as well as oil exporters like Nigeria, which faces significant revenue shortfalls.

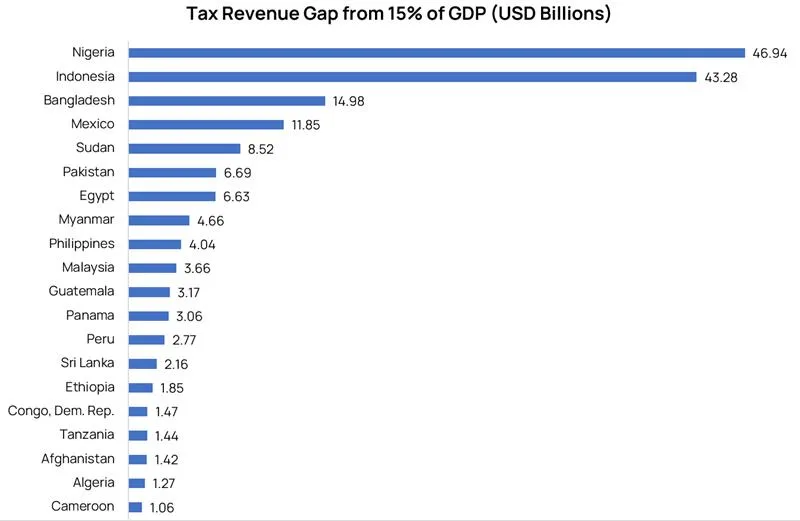

Let’s see which countries have the largest absolute tax-revenue gaps. Specifically, this refers to the total gap between current tax revenues and the target of 15 % of GDP.

The total tax-revenue gap for this group of countries is substantial, amounting to $180.8 billion. Nigeria faces the largest gap, with $46.9 billion, followed by Indonesia at $43.3 billion, and Bangladesh at $14.9 billion.

The first 10 countries on this list represent $151.2 billion, which accounts for approximately 84% of the global tax-revenue gap.

Countries Most Affected By Tax Avoidance

Nigeria

Nigeria, the largest economy in Africa, suffers greatly from tax avoidance due to a heavy reliance on oil revenues and a relatively underdeveloped tax collection system. With a tax-to-GDP ratio consistently below 10%, much of the economy operates in the informal sector, contributing to widespread tax evasion.

Indonesia

Indonesia, Southeast Asia's largest economy, also experiences severe revenue losses due to tax avoidance. Despite ongoing tax reforms, the country has a tax-to-GDP ratio below 15%, which is considered low for an emerging economy. The informal economy is large, and tax evasion remains rampant among both individuals and businesses.

Bangladesh

Bangladesh is another country heavily affected by tax avoidance, with its tax-to-GDP ratio consistently under 15%. The country’s reliance on a large informal economy, combined with an inefficient tax system, contributes to a loss of significant revenue.

Challenges Nigeria, Indonesia, and Bangladesh Face Due to Tax Avoidance

Key Steps Nigeria, Indonesia, and Bangladesh Have to Take to Achieve the Sustainable Development Goals

Strengthen Tax Administration and Enforcement

Nigeria, Indonesia, and Bangladesh must modernize their tax systems by implementing advanced technology and improving the capacity of tax authorities. Strengthening tax administration and enforcement would help identify and prevent tax evasion, ensuring that more people and businesses pay their fair share. This increased revenue can then be directed toward essential public services, contributing to SDGs 1 (No Poverty), 3 (Good Health and Well-Being), and 4 (Quality Education).

Expand the Tax Base by Formalizing the Informal Economy

A large proportion of the economies in Nigeria, Indonesia, and Bangladesh is informal, with many businesses and workers avoiding taxes. These countries must implement policies to encourage the formalization of the informal economy, such as simplifying business registration processes, offering incentives for small businesses, and providing social benefits for formally employed workers. This will help expand the tax base and contribute to SDG 8 (Decent Work and Economic Growth) by fostering job creation and economic development.

Diversify Revenue Sources to Manage Price Fluctuations

Relying heavily on a single source of income, such as oil (in Nigeria) or other volatile resources, can leave countries vulnerable to price fluctuations. These nations need to diversify their revenue sources by strengthening other sectors such as agriculture, manufacturing, and services. By boosting economic diversification, they can ensure a more stable revenue stream and reduce vulnerability to external shocks, which will support SDG 9 (Industry, Innovation, and Infrastructure) and SDG 13 (Climate Action) for sustainable development.

Promote Public Awareness and Civic Engagement

Public education about the role of taxes in financing public services is critical. Governments must launch awareness campaigns to explain the direct benefits of taxes, such as improved healthcare, infrastructure, and social safety nets. Encouraging citizens to comply with tax laws by highlighting the impact on national development can help increase tax compliance and contribute to SDG 16 (Peace, Justice, and Strong Institutions) through greater citizen participation and institutional transparency.

How traceCORE Can Help Countries Generate More Revenue

traceCORE offers various digital transformation tools that can help countries worldwide reduce their tax-revenue gaps.

For example:

-

traceCORE B2B E-Invocing combats VAT underreporting and fraud that can do significant damage to government revenues. This solution enables seamless exchange of electronic invoices between organizations. When the electronic invoice information is transmitted to the tax authority's information system, VAT is automatically accrued based on the provided data. It is important to implement Continuous Transaction Controls (CTC) in the B2B segment — one of the most efficient tools to combat fraud and digitalize the country’s economy. To do that, mandatory B2B E-Invoicing is essential.

-

traceCORE B2C E-Invoicing reduces the number of unreported transactions at POS and boosts VAT collection in retail. This solution enables automated and systematic transmission of B2C sales data from online electronic cash registers (OECRs) to the tax authority’s information system. The information is sent directly or through a certified Fiscal Data Operator and can be received by the tax authority in real-time. Encryption of data at all stages does not allow owners or employees of businesses to alter records which are stored in the OECR’s internal memory.

-

Self-Employment Tax Solution allows governments to bring millions of workers out of the shadow by revolutionizing the taxation of self-employed workers. It’s a system for tax administration of commercial transactions conducted by self-employed workers. The solution creates a simple and convenient mechanism for registering self-employed taxpayers, automating monthly tax calculations, invoicing, and receiving payment. It supports agent-based transactions involving intermediaries, such as online platforms, service aggregators, and marketplaces.

-

Track and Trace for Governments helps develop a positive investment climate by combatting illicit trade and protecting brands from counterfeiting. It is a system designed to monitor the movement of products through all stages of the supply chain using unique digital codes. Those unique codes are issued by the National Traceability System and protected with advanced encryption technologies, and it’s impossible to forge or edit them. Every movement of products starting from manufacturing or importing and ending with the purchase by the final consumer is reported to the National Traceability System, which is controlled by the government.

These are not all products for governments that we offer. Check out the main page of our website to learn more.

Conclusion

Tax avoidance poses significant challenges to emerging market economies, especially those that have the largest tax-revenue gaps, such as Nigeria, Indonesia, and Bangladesh. As a result, those countries’ ability to generate the revenue necessary to achieve the United Nations Sustainable Development Goals.

By strengthening tax administration, combating fraud, diversifying their economies, and improving public awareness, these countries can address the root causes of tax avoidance and make critical strides toward sustainable development. Implementing traceCORE digital transformation products can help developing countries achieve those goals.