AI Tools for Governments

How to Transform Tax Compliance Using AI-Powered Tax Software

Modern technologies continue to evolve every day, which creates both opportunities and challenges for businesses. Additionally, artificial intelligence (AI) tools have clearly taken the world by storm. They offer endless possibilities for transforming how businesses create content, engage users, develop software, and analyze data. According to Precedence Research, the global AI market size is calculated at $638.23 billion in 2024 and is expected to reach approximately $3,680.47 by 2034, with a CAGR of 19.1% within the next decade.

Tax authorities, like many other areas, are now figuring out how to use AI and integrate it into their processes to meet new demands. From tax filing and compliance to risk assessment to document analysis and reporting, AI tools automate and speed up daily tax compliance tasks. Being able to use these capabilities will ultimately empower tax administrations in developing countries and help them prioritize value creation and strategic initiatives.

At the same time, it’s crucial for tax authorities to be cautious when deploying AI in a financially and legally sensitive area like tax. In this post, we will talk about how tax authorities implement AI into their work and why traceCORE tax solutions are a great choice for that.

What Is AI?

Generally speaking, AI is technology that allows computers and machines to collect information and provide solutions in ways that are similar to the human thought process.

When implementing AI into devices and apps, they gain the ability to learn from new information and experiences, make detailed recommendations, identify objects, and even replace the need for human intervention completely. By using AI, businesses can automate and accelerate their processes, achieve better accuracy, and reduce costs.

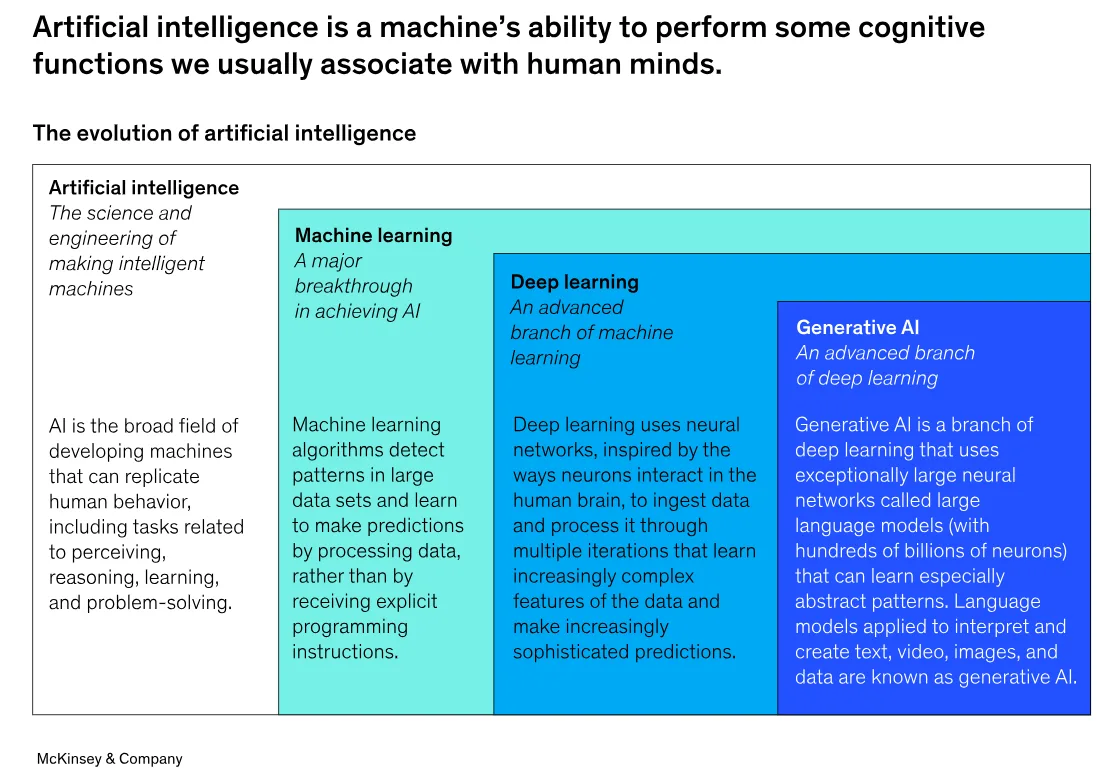

There is an extensive range of AI subsets and approaches that relate to the term artificial intelligence, including machine learning, deep learning, and generative AI.

McKinsey described those subsets in a clear way by showcasing the evolution of artificial intelligence in the exhibit below.

Machine Learning

Machine learning is used to analyze huge amounts of information to learn to determine patterns, make recommendations, and find errors. Systems are not explicitly programmed for specific tasks in the process.

Deep Learning

Deep learning is an advanced branch of machine learning, it uses deep neural networks that more closely imitate the human brain’s decision-making power.

Generative AI

Generative AI, also known as gen AI, evolved from deep learning. On a user’s request, it can create complex original content — long-form text, realistic images, video and audio, software code, and more. ChatGPT is one of the most popular examples of generative AI, although this technology has been around and widely used for many years (customer service chatbots, photo editing software, etc.).

How AI Impacts Business

The rapid evolution of artificial intelligence and specifically gen AI is changing businesses’ whole operational processes and the ways they work with data and technology.

The EY 2024 CEO Outlook Pulse survey has shown that the current main concern for global CEO respondents is emerging technologies, including AI, which is going to drive the most change across all industries and key markets over the next 12 months.

Source: EY (2024), CEO Confidence Index: CEO survey,

Source: EY (2024), CEO Confidence Index: CEO survey,

https://www.ey.com/en_us/ceo/ceo-outlook-global-report.

Because AI can efficiently automate processes, revolutionize decision-making and help create innovative products and services, business owners are determined to re-evaluate their strategies. The fear of being unable to keep up with the trends is what drives substantial investment and focus.

If you would like to learn more about all the ways AI-powered tax software can help improve tax collection and raise tax revenue, check out traceCORE tax solutions. For example, traceCORE B2B E-Invoicing automates VAT reporting and tax accrual for transactions between legal entities and entrepreneurs subject to VAT. In this case, the AI feature helps promptly detect VAT fraud. In addition, businesses can also make great use of traceCORE AI-powered Shelf Management Software and revolutionize inventory management and shelf monitoring to boost their sales.

Benefits of AI in Tax Collection

The 2023 EY Tax and Finance Operations survey respondents say that currently their tax personnel have to dedicate 72% of their time to routine tasks, such as data collection and cleansing, tax return compliance, etc., meanwhile 28% of their time is spent on high-value activities — data analysis, tax planning, general strategy, tax controversy and risk management. According to them, their workflow would be more efficient if those figures were 62% and 38% instead.

Source: EY (2023), Why five years of transforming tax and finance functions is paying off, https://www.ey.com/content/dam/ey-unified-site/ey-com/en-gl/campaigns/tfo-survey/documents/ey-2023-tfo-survey-article.pdf.

Transforming tax and finance functions can help achieve those goals, and AI is one of the most effective instruments for that.

Below are some ways tax collection systems can benefit from AI now and in the future.

Tax Fraud Detection

Tax agencies can use sophisticated AI algorithms to detect potential instances of tax fraud. One method involves employing a tax file model containing various data points, such as family situation, income, assets, and expenditures. By analyzing tax files against this database, AI algorithms can flag suspicious cases based on predefined criteria.

These criteria can include:

-

Discrepancies between reported expenses/assets and income

-

Unusually low expenses/assets relative to reported income

-

High wealth compared to individuals in similar socio-professional categories

When detecting fraud, it’s important for agencies to consider a trade-off between accuracy (how often the model is right when it predicts fraud) and sensitivity (how often the model catches actual fraudsters). A group from CentraleSupélec school suggests using a metric called AUPRC to evaluate an algorithm’s performance.

Data Analysis

With AI, tax authorities can manage data better. Here are some examples:

-

AI can prioritize delinquent accounts based on the likelihood of recovery, which optimizes the efforts of tax collection agencies.

-

Collaboration among tax jurisdictions increases transparency and efficiency. Sharing information on transfer pricing and filing inconsistencies helps conduct thorough audits and ensures fair cross-border taxation.

-

Near-real-time data reporting improves tax compliance and revenue collection. More frequent reporting, especially for sales tax and VAT, helps tax authorities quickly identify and address tax liabilities, thus creating a fairer tax system.

-

AI can predict potential discrepancies by analyzing trends and taxpayer behavior over time. For example, if a business frequently underreports sales during certain periods, AI can predict and flag similar future occurrences.

Customer Service

We can assume that tax agencies want to help people pay the right amount of tax and get the benefits they are entitled to. Governments aim for taxpayers to submit precise tax filings right from the start, which makes the process smoother for everyone and improves overall service.

According to the OECD, many tax agencies are now using chatbots. For instance, Spain uses virtual assistants to help with questions about tax law changes for both businesses and individuals. This cuts down email traffic between businesses and the tax agency by about 80%. In the US, the IRS website features multiple chatbots, and Singapore has been using them for almost ten years. With AI handling routine questions, human agents can deal with more complex issues.

Efficiency and Accuracy

AI can streamline tax administrations by automating repetitive tasks, like processing documents and reviewing returns for accuracy and compliance. This allows tax authorities to focus on analyzing flagged transactions instead of sifting through information.

Let’s say a tax agency receives thousands of returns daily. With AI, these returns are quickly scanned, extracting important details and checking them against tax laws. If there are any irregularities, only then will it be sent for further review by human experts.

There are many ways businesses can implement AI into their processes to improve tax compliance, and it’s important to find the right tools to do that. AI-enhanced traceCORE B2B E-Invoicing solution can help achieve error-free VAT data collection and detect VAT fraud schemes before they affect businesses. As a result, it’s possible to eliminate tax gaps and increase annual tax revenue up to 150%.

The Tax Administration 3.0 Vision

Because there are a number of challenges tax authorities have to face due to rapid technological change, the OECD prepared the Tax Administration 3.0 vision that describes the digital transformation tax offices are recommended to undergo.

Reducing Taxpayer Burdens

When implementing digital techniques at earlier stages of taxpayer processes, it’s possible to prevent noncompliance instead of dealing with it after tax returns have been already filed. This approach includes:

-

The complex use and manipulation of data — Nearly 95% of tax authorities report using analytics tools and techniques for better risk management and to improve tax compliance. It’s an increase of more than 20% compared to 2018.

-

Harnessing modern technologies and trends — Over 80% of tax offices report that they are implementing or already using cutting-edge technology to process data in ways that reduce the need for human intervention. In fact, it’s been already proven that AI and machine learning help businesses save time and resources.

-

Achieving more personalized interactions — Due to improved data analysis, tax authorities can make their interactions with taxpayers more efficient and focused.

Using advanced techniques in AI, machine learning and machine to machine links allows tax authorities to explore new service options and customize their approaches.

In the table below, you can see that the growth has been substantial, and self-services are widely used by many tax authorities.

Source: OECD (2023), Tax Administration 2023: Comparative Information on OECD and other Advanced and Emerging Economies, OECD Publishing, Paris, https://doi.org/10.1787/900b6382-en.

Jurisdictions have been investigating the success of services that involve using advanced AI technologies. According to the OECD, around 40% of tax authorities improve their virtual assistants’ functions with AI, which allows systems to respond to more complex questions from taxpayers and give more personalized and detailed answers.

Tax Compliance Risk Management

Another technique that has become popular recently is the combination of analytics with behavioral analysis to achieve a better understanding of tax compliance risks, behavioral patterns and effective compliance interventions. The figure below shows the percentage of tax authorities that are using behavioral insights in their work, which has grown from 62% in 2018 to 76% in 2021.

Source: OECD (2023), Tax Administration 2023: Comparative Information on OECD and other Advanced and Emerging Economies, OECD Publishing, Paris, https://doi.org/10.1787/900b6382-en.

The use of advanced analytics in risk management and targeting has become more common recently too. The OECD’s estimates show that 80% of tax authorities use big data in their work, mostly to improve tax compliance processes.

Out of 58 tax administrations that participated in the OECD’s report, 55 already use data science / analytics tools, meanwhile the remaining 3 are in the process of implementing those tools.

Additionally, the majority of tax authorities covered in the report either already work with AI tools (machine learning included) to assess risk and detect fraud or prepare for including those in their routine. The complex use of analytics of expanded data sets helps sharpen tax compliance risk management and develop intervention actions, including through automated processes.

Source: OECD (2023), Tax Administration 2023: Comparative Information on OECD and other Advanced and Emerging Economies, OECD Publishing, Paris, https://doi.org/10.1787/900b6382-en.

Challenges and Considerations for Tax Authorities

Let’s also address some disturbing issues that decision-makers will need to account for when implementing AI in tax collection.

Data Privacy and Security

Relying only on large data sets processed by tax offices for tax management raises some concerns:

Privacy and Data Ownership

Collecting data for taxes might make people feel like the government is prying into personal matters like spending habits and relationships. It is important to legally and practically protect this data.

Data Security

Tax offices make efforts to safeguard data, but there is always a risk of cyberattacks targeting large data sets, especially with older systems becoming more vulnerable as technology advances.

Data Usage and Transparency

Tax offices collect tons of data to check if people are following the rules and to spot any risks. However, not all of this data is directly needed for calculating taxes. Clarifying why all this information is needed and ensuring its worth is key. Otherwise, it is just a waste of time and could put people’s data at risk.

Forum on Tax Administration 3.0 suggests relying more on information already in trusted systems used by taxpayers instead of asking for more data. For example, if someone uses their own accounting software to do taxes, that should be okay. But it is important to make sure these systems follow the rules and keep accurate records. That way, people will trust the tax system more.

Implementation Costs

Tax administrations need consistent and long-term funding to change how they work. However, budget constraints make it challenging to go digital. Even though many administrations are spending more money overall, this does not tell the whole story. They are dealing with more tasks, technology changes, and shifts in their workforce. Plus, a large portion of the budget, about 73% on average, goes to salaries.

Spending on technology also varies a lot. Some administrations might not be spending enough on technology to keep up with the need for better services and ongoing digital changes.

Skill Gaps

Another concern is the shortage of personnel with the necessary skills. Tax authorities need to train their staff to work well with AI technologies, which is not widely achieved.

The workforce needs various skills, including:

-

Knowing complex tax rules and risks

-

Turning tax rules into instructions for systems

-

Expertise in auditing systems

-

Managing relationships for implementing tax processes

-

Designing effective communication strategies

-

Ensuring data security and compliance

Staff should know how to work with different partners in a connected system and manage networks with different goals and risks. Employees need to be flexible to handle changes in tax rules, business methods, and taxpayer behavior, as well as unexpected situations. Plus, they should understand new trends and business models to adapt tax systems accordingly.

All of this cannot happen overnight; it will require a significant investment of resources over time.

Regulatory Framework

Regulatory agencies, lawmakers, and government policy-makers have not fully tackled the implications of a world saturated with AI. With AI adoption happening rapidly, they may soon need to speed up their efforts.

For example, if an AI system used by a taxpayer provides incorrect tax advice, leading to financial penalties or errors in filings, who should bear the responsibility: the developer, operator, or user? This poses questions for the legal system, which must clarify liability either through contract agreements or legislative action to address such issues within the tax system.

AI for Tax: Case Studies and Examples

Some countries have already made substantial changes to their systems by embracing AI.

Spain

Spain has developed a Virtual Assistant tool for VAT using AI, with the goal of improving information quality and simplifying complex regulations. This system offers guidance on VAT matters like invoice registration, foreign trade obligations, and tax rates, accessible via a chatbot interface. Users can ask questions naturally and receive consistent responses with links to relevant information.

Italy

In Italy, AI-driven data analysis identified over 1 million high-risk cases. This was made possible with a cutting-edge algorithm called VeRa, which cross-references financial data to flag taxpayers potentially not meeting their obligations. VeRa compares tax filings, earnings, property records, bank accounts, and electronic payments to hunt for inconsistencies.

Taxpayers flagged as high-risk receive a letter prompting them to clarify the differences. As VeRa processes more data, it continuously improves its accuracy and effectiveness.

India

India is leveraging AI to spot fraudulent applications for input tax credits through fake GST registrations. The central government’s Business Intelligence and Fraud Analyst site, along with the e-way portal and the Rajasthan government’s Business Intelligence Unit, collaborate to identify GST numbers suspected of being false. These tools are regularly updated or modified based on feedback from field formations.

Pankaj Chaudhary, Minister of State for Finance, noted that the GST registration process includes rigorous checks, such as physical verification of premises and Aadhar authentication. These measures have facilitated the early detection of fraudulent registrations and notably reduced such occurrences.

Brazil

Brazil has implemented AI behavioral insights through a system called High Performance Inspection (FAPE) to improve how they handle tax communications. The system assesses how taxpayers respond to different types of tax letters based on their personal background and situation. By doing this, authorities can figure out the best way to communicate with each taxpayer for future queries or audits.

FAPE is integrated with a Big Data environment, which allows regional teams to work together and cross-reference various databases. This includes digital tax bookkeeping, digital accounting records, e-invoices, financial transaction data, and registration information.

Vietnam

Vietnam has adopted AI to help identify tax fraud. One of the applications is to flag firms that issue invoices too frequently, for unusually high amounts, or in other ways that suggest attempts to reduce taxable revenue.

Future Outlook

Many countries are already using big data and AI, setting examples for developing nations to follow suit and revamp their systems.

For those considering, one of the most important aspects of future AI implementation is establishing measurable goals. Drawing from discussions among fifty tax agency leaders, academics, think tanks and thought leaders from twelve countries, here are some example metrics tax agencies might use to showcase AI outcomes:

-

Improved call center success rates to [percentage], saving [amount] annually

-

Lowered refund delays for incorrect filings by [percentage]

-

Introduced new tools to enhance audit quality, resulting in a [percentage] increase in investigations and a [percentage] reduction in duration

They also stressed that each country should figure out its own risk management plans for AI, considering how complex their tax policies are and how much trust the public has.

Authors of AI specialization for pathways of economic diversification argue that the use of AI can help with economic growth in developing countries far beyond just tax collection. Take Bangladesh, for example. They suggest pinpointing AI applications closely tied to their existing industries, like garments. Even if Bangladesh can’t develop certain AI tech locally, focusing on strategic sectors can still help industries grow.

The potential of AI is vast, but so are the risks. That’s why decision-makers must examine AI from multiple angles — technical, economic, social, legal, and ethical — to maximize its benefits and mitigate risks. Regarding taxes, they need to explore how AI will shape the dynamics between taxpayers and tax authorities.