The shadow economy causes tax authorities worldwide to lose a lot of revenue. According to the IMF, it accounts for about one-third of the global economy. Cash transactions are a big part of the problem because they don’t leave a paper trail, which allows businesses and consumers to dodge reporting sales and taxes.

Many consumers are tempted to buy goods and services without receiving a receipt to avoid paying value-added tax (VAT) or sales tax. For example, when paying cash for services like plumbing or carpentry, consumers don’t realize that VAT should be included in the service fee. Because consumers don’t claim VAT or report these expenses for income tax, they have no reason to ask for receipts. This benefits both consumers and businesses but makes it hard for authorities to detect and address unreported transactions.

To combat this, many countries are implementing tax policies and administrative measures to discourage cash transactions and the subsequent shadow economy. In addition, governments can introduce digital transformation tools that simplify and automate a number of tasks tax authorities are responsible for.

What Is the Shadow Economy?

The World Bank defines the shadow economy as a combination of activities that are legal but intentionally kept hidden from the government for several reasons, such as:

-

To avoid payment of all kinds of taxes.

-

To skip paying into social security.

-

To dodge following certain rules like minimum wage laws.

-

To bypass administrative procedures like filling out forms.

Source: Leandro Medina & Mr. Friedrich Schneider, 2018. "Shadow Economies Around the World: What Did We Learn Over the Last 20 Years?," IMF Working Papers 2018/017, International Monetary Fund, https://www.imf.org/en/Publications/WP/Issues/2018/01/25/Shadow-Economies-Around-the-World-What-Did-We-Learn-Over-the-Last-20-Years-45583

Source: Leandro Medina & Mr. Friedrich Schneider, 2018. "Shadow Economies Around the World: What Did We Learn Over the Last 20 Years?," IMF Working Papers 2018/017, International Monetary Fund, https://www.imf.org/en/Publications/WP/Issues/2018/01/25/Shadow-Economies-Around-the-World-What-Did-We-Learn-Over-the-Last-20-Years-45583

In this post, we specifically look at the part of the shadow economy where businesses conceal their earnings to avoid paying income or value-added taxes. However, this category overlaps with other reasons for hiding income, like dodging social security payments or ignoring legal standards. Therefore, when policies target this type of tax evasion, they also unintentionally address these other issues.

For example, small unregistered businesses avoid paying taxes altogether and also skirt around rules like minimum wage laws and social security contributions. So, if policies are put in place to bring these businesses into the formal economy and make them pay taxes, it will also tackle other forms of noncompliance.

Key Drivers of the Shadow Economy

Economic Underdevelopment

A country’s progress in improving living standards and reducing poverty is one of the most important factors. In countries with high poverty and unemployment rates people are more prone to turn to the shadow economy for their survival.

Low-Quality Institutions

When governments lack transparency or don’t do much to combat corruption, they lose the public’s trust. Research studies have shown that people in such countries are more likely to engage in informal work, tax evasion, and other activities of this nature.

Tax Burdens

People’s economic decisions depend on their countries’ tax burdens and social security contributions. When taxes are overwhelmingly high and a government doesn’t offer enough benefits, citizens often turn to informal economic practices.

Excessive Regulations

If the regulations on the labor market, trade and business are too severe, it leads to higher prices and wages as well as a larger shadow economy. In addition, administrative burdens and bureaucracy appear that only make everything worse and deter people from tax compliance.

Lack of Deterrence

The severity of penalties and fines for engaging in informal sector activities and public awareness directly affect the growth of the shadow economy. The higher probability of getting caught and punished for such activities is, the less people choose to be involved in them.

Cash Transactions

If cash transactions are prevalent in a certain country, the shadow economy grows as it becomes easy to avoid using traceable methods like bank transfers or credit cards. This preference for cash makes it difficult for tax authorities to catch instances of tax evasion.

Categories of the Shadow Economy

According to a 2016 EY report, there are two categories of the shadow economy, and each of them requires different measures: committed shadow economy and passive shadow economy. The main difference between these two categories is the causal relationship between cash payments and the shadow economy.

Committed shadow economy refers to situations where cash is a consequence of the shadow economy as both sides of the transaction (the seller and the consumer) are “committed” to using a cash payment to avoid reporting a transaction and benefit from a lower price by evading tax payments.

Passive shadow economy describes the shadow economy that emerged because of cash (and possibly other reasons). It’s called “passive” because one of the sides of the transaction — the consumer — does not benefit from the transaction being unreported and may not even know that they are contributing to the growth of the shadow economy when paying by cash.

Source: EY Poland Economic Analysis Team & Business Tax Advisory, 2016. "Reducing the Shadow Economy through Electronic Payments," EY, https://assets.ey.com/content/dam/ey-sites/ey-com/en_pl/topics/eat/pdf/ey-report-2016-reducing-the-shadow-economy-through-electronic-payments.pdf

Deterrent Measures Against Shadow Economy

Depending on the category of the shadow economy, different deterrent measures can be used against it.

When attempting to reduce the committed shadow economy, putting effort into lowering the demand for cash and increasing the use of electronic payments is definitely important. However, in this case a government’s focus should also be on other important measures, such as increasing labor inspections at building sides, introducing more severe penalty sanctions for counterfeiting of excise products, reducing the administrative burden related to compliance with the regulations, and more.

The passive shadow economy is caused by cash payments, and that’s why it could be limited by promoting electronic payments or increasing the share of registered cash transactions. Some other good examples of possible solutions — introducing receipt lotteries and organizing information campaigns (like promoting the collection of receipts).

Source: Schneider F., 2013. “The shadow economy in Europe. Using payment systems to combat the shadow economy,” https://feelingeurope.eu/Pages/Shadow_Economy_in_Europe.pdf

Challenges in Implementation and Enforcement

For deterrent measures to work well, there should be specific laws in place that allow authorities to successfully implement them. For example, putting limits on cash transactions might be in line with certain regulations, but without consistent laws across countries, it’s difficult to enforce them effectively. Without the right legal framework, tax authorities might struggle to monitor electronic transactions properly. Also, enforcing these limits is challenging, especially considering the secretive nature of cash deals that bypass financial tracking.

The European Central Bank stresses the need to find a balance between limiting cash payments for positive reasons and the potential drawbacks for the public. While these restrictions target things like the shadow economy and aim to make things more transparent, policymakers need to think about how they might affect economic freedom and people’s well-being.

If the limits are too strict, they could unintentionally hold back legal economic activities and hit certain groups harder, like small businesses and people who don’t have much access to banking.

Ways to Overcome These Challenges

To tackle enforcement challenges, authorities should create strong plans to catch and punish violations effectively. This could mean using better monitoring tech, improving cooperation between tax authorities, and giving serious penalties for breaking the rules.

If authorities manage to make enforcement better, they can stop businesses and consumers from trying to get around cash limits and achieve greater compliance with regulations.

Furthermore, policymakers should think about ways to help businesses and individuals switch to electronic payments. Small businesses might need help learning how to use electronic methods and dealing with any problems that come up. It’s crucial to provide inclusivity during the shift away from cash, particularly by considering the needs of older individuals and those with limited access to banking services.

To help countries improve tax compliance and reduce the shadow economy, traceCORE offers several digital tax solutions that significantly simplify tax authorities’ routine work and automate various tasks. For example, traceCORE B2C E-Invoicing revolutionizes VAT collection in retail by enabling automated transmission of B2C sales data from online electronic cash registers (OECRs) to tax authorities.

Incentive Policy Measures to Reduce the Shadow Economy

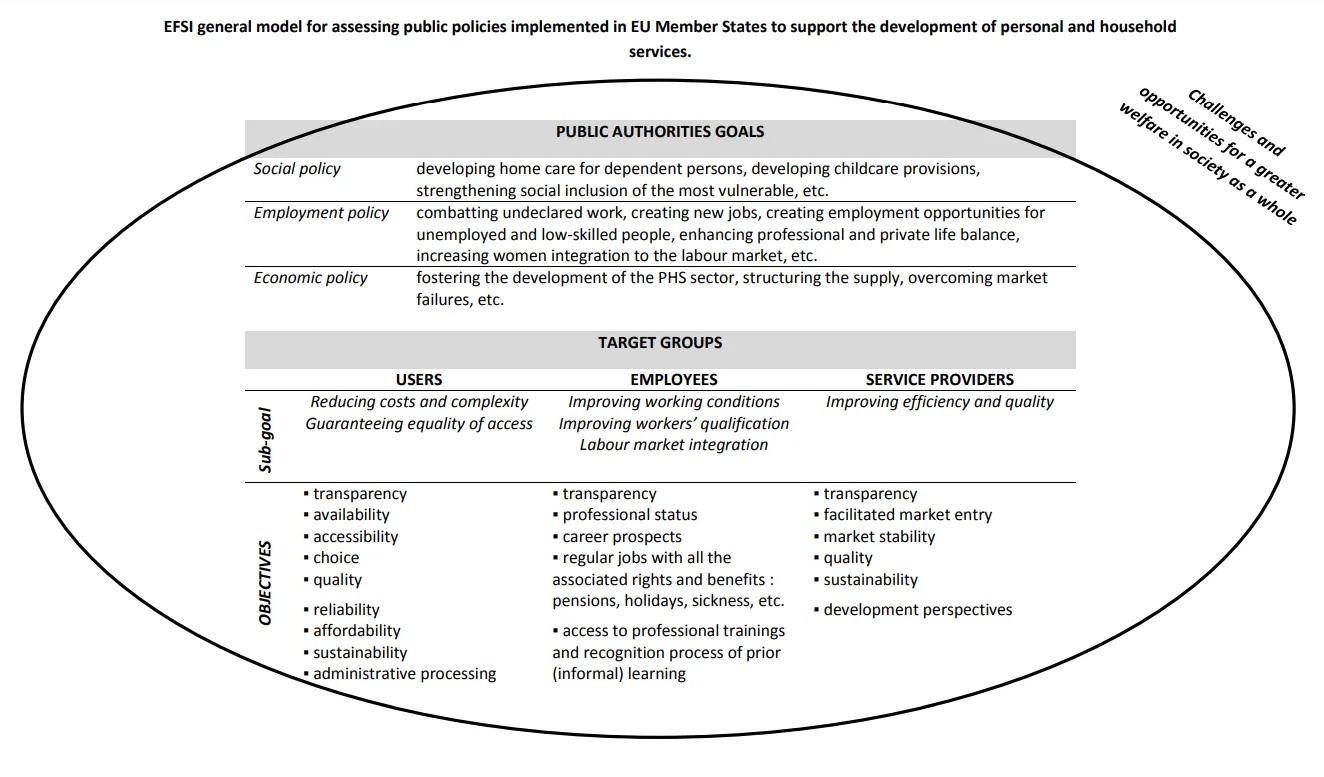

Some countries have implemented measures to encourage individuals to report their work and comply with tax regulations. One notable initiative focuses on household services, often conducted off the books. Over the past decade, various nations have offered tax incentives or direct subsidies to individuals who hire cleaners, cooks, caregivers, or other household service providers. The objective is to formalize this informal sector and generate more employment opportunities. The details of these incentives — such as eligible services, the level of support, and conditions — vary from country to country.

The overarching goal is to make it economically advantageous for individuals to utilize formal services rather than informal ones. This means giving money directly to service providers or customers, offering tax breaks, exemptions, or lowering VAT rates.

Assessments of Incentive Programs

There have been differing assessments regarding financial support for household services. In 1998, the European Commission viewed tax deductions and subsidies for home improvements favorably. They noted their success in encouraging legal repairs and transitioning informal work into the formal sector.

However, a later European Commission publication in 2012 presented a more cautious perspective. They acknowledged potential benefits for formal employment but also highlighted the high cost in terms of lost tax revenue and questioned the effectiveness of these measures in reducing the informal economy. Concerns were also raised about the potential entrapment of individuals in certain household jobs.

In other cases, the outcomes are largely positive. The World Bank, in partnership with the Government of Mexico, ran a trial with students about to graduate from 13 high schools in the San Luis Potosí metropolitan area. The program gave these students a cash reward, equivalent to 20% of the typical starting wage for formal jobs, for up to six months, as long as they kept a formal job.

During the two-year period from June 2019 onwards, researchers examined how this cash incentive impacted the employment status of these students. They discovered that it increased the rate of formal employment among eligible vocational school graduates by 14.5%. Also, among students who initially secured temporary jobs, the probability of quitting was 26% lower, and their likelihood of transitioning to a permanent job was 70% higher.

Cost Implications of Incentives Against Shadow Economy

Tax Simplification and Reduction

Simplifying tax systems and reducing tax rates lower the cost of compliance and encourage businesses to transition from the informal to the formal economy. While the initial cost of tax reform is high, the long-term benefits include higher tax compliance and revenue.

Incentives for Formalization

t’s also possible to provide financial incentives, such as grants, subsidies, or tax credits to businesses that register formally. These measures require upfront government spending, too.

Technological Investments

Implementing digital solutions to improve tax enforcement, such as electronic payment systems and digital tracking of transactions, is costly. However, these technologies increase transparency and reduce opportunities for tax evasion.

Institutional Quality Improvements

Enhancing the quality of institutions, such as improving regulatory frameworks and combating corruption, requires substantial investment in governance and administrative capacity. That said, improved governance builds public trust and reduces the tendency to operate in the shadow economy.

Incentives specifically appeal to cases of voluntary exit, one of the two broad categories of why individuals and businesses leave the formal economy as described by this paper. This choice is usually driven by specific preferences, such as a strong inclination towards individualism or a higher propensity for risk-taking. These actors seek to maximize their profits or personal income by avoiding taxes and regulations. The allure of higher immediate gains outweighs the benefits of formal employment, especially if the penal policies are weak or poorly enforced.

Informal employment often keeps people trapped in low-income, vulnerable situations, particularly affecting younger and less educated individuals. Rather than coercing them into formal jobs, governments should provide support to facilitate a voluntary transition. This could involve offering training, reducing entry barriers, and providing financial assistance to offset the costs.

Normative Tax Policy Measures and Their Role

Countries are now exploring a dual approach to taxation. Traditional economic incentives and disincentives are being considered alongside softer strategies that intend to boost tax morale, establish fairness in the tax system, and encourage social norms for tax compliance. Although these softer measures are recognized as effective in academic literature, many nations still heavily rely on traditional methods of rewards and penalties.

Fewer countries have adopted normative compliance measures, such as encouraging voluntary declaration of activities, launching campaigns to promote a culture of tax honesty, and addressing perceptions of fairness in the tax system.

Formalizing Informal Employment and Small-Scale Entrepreneurship

To make informal employment more legitimate, some countries have introduced simplified rules for small jobs done for friends or family. For instance, in Slovenia, certain household tasks are exempt from taxes up to a certain limit. This helps people who might otherwise feel forced to do these jobs under the table because they’re worried about the paperwork or taxes involved.

Similar approaches can be applied in other countries, too. For example, unemployed individuals could be allowed to earn a certain amount without it affecting their benefits as long as it’s declared annually rather than weekly.

This concept of making certain earnings “disregarded” from taxes or benefits doesn’t just apply to small jobs. It can also extend to situations where family and friends provide funding to start businesses. In the Netherlands, there’s a scheme allowing loans from loved ones to new businesses without tax implications.

Governments can effectively combat the informal employment issue by implementing innovative traceCORE Self-Employment Tax Solution and thus bringing millions of workers out of the shadow.

Formalization Support Services

It’s widely understood that the support and guidance needed to transition informal businesses into legitimate ones are different from those needed by startups or growing businesses following formal planning processes. However, currently, such support is not widely available for those seeking to formalize their operations.

One approach to address this gap is through the development of “formalization services,” such as the CUORE initiative, which provides assistance and advice to enterprises on becoming formal.

In Australia, the Australian Tax Office provides extensive support for formalizing businesses, including free record-keeping software, assessment tools, and sector-specific guidance on record-keeping requirements. This level of support could be replicated in other countries to facilitate the move to the formal sector.

However, some initiatives have faced challenges. For example, in the UK, a pilot project offered individuals engaged in the shadow economy a confidential assessment of their tax liabilities. Unfortunately, it had limited success due to low awareness, lack of trust, and unappealing communication.

Tackling the Shadow Economy with Society-Wide Amnesties

Governments can combat the shadow economy by implementing society-wide amnesties. These programs forgive past violations of tax or employment laws in exchange for individuals coming forward and declaring their previously unreported income or activities.

For instance, in Italy, amnesties held in 2001 and 2003 led to significant increases in tax revenue and encouraged many undocumented workers to step out of the shadows.

Similarly, the United States has implemented over sixty amnesty programs since 1982, with varying success in recovering unpaid taxes.

One approach is to implement an amnesty period where individuals involved in undeclared activities can gradually transition towards operating legally over a couple of years without facing penalties. After this period, stricter penalties would be enforced for those who continue to operate in the underground economy.

Promoting Tax Morale

Research shows that people’s willingness to pay taxes is linked to their moral beliefs. So, to tackle the shadow economy, it’s important to boost tax morale. This means convincing people to pay taxes willingly rather than just threatening them with punishments.

To do this, governments can run campaigns to raise awareness about the risks of informal employment and the benefits of going legit. For example, in the UK, advertising campaigns led to thousands more people registering to pay taxes. However, the effectiveness of these campaigns depends on factors like social norms and perceptions of fairness.

Fairness in the tax system is crucial, too. People are more likely to pay taxes if they feel they’re treated fairly by tax authorities.

Countries like Australia and New Zealand are leading the way in this approach, which involves a cultural shift within tax administrations. However, there are challenges, like resistance to change and ensuring fairness. Ultimately, transitioning from enforcing compliance to fostering commitment requires a fair and straightforward tax system, along with a change in how tax authorities operate.

Comparing Strategies for Improving Tax Compliance

The differences between the various measures described may still not be clear. To better understand them, let’s compare how these strategies approach tax compliance, particularly in the shadow economy:

Deterrent Measures

Deterrent measures focus on enforcing compliance through legal and financial penalties.

For Retailers

-

Criminalization — Making it illegal to employ unregistered workers.

-

Monitoring and auditing — Conducting inspections of business records to verify adherence to tax laws, covering both registered and unregistered workers.

-

Penalties for not issuing invoices — Imposing fines on businesses that fail to provide invoices, applicable to both registered and unregistered workers.

-

Mandatory use of electronic payment systems — Requiring businesses to use electronic cash registers or POS systems, mainly targeting registered workers.

For Consumers

-

Criminalization — Making it unlawful for consumers to engage with unregistered workers.

-

Penalties for not collecting receipts — Fining consumers who don’t obtain receipts for their purchases; affects both registered and unregistered workers.

-

Limits on cash payments — Setting maximum limits on cash transactions; impacts both registered and unregistered workers.

Incentives

Incentives aim to encourage voluntary compliance by offering financial benefits.

For Retailers

-

Simplified registration processes — Easing and reducing the cost of registering a business, including tax reductions and fewer employment regulations; aimed at unregistered workers.

-

Tax benefits for electronic transactions — Offering tax incentives for businesses that use electronic payment methods; benefits both registered and unregistered workers.

For Consumers

-

Subsidies for home-based services — Providing financial support or tax breaks for using home services; aimed at unregistered workers.

-

Tax incentives for trackable payments — Encouraging the use of electronic payments that can be tracked by offering tax benefits; targets registered workers.

-

Cash rebates for obtaining receipts — Offering cashback rewards to consumers who get receipts; targets registered workers.

-

Receipt lotteries — Entering consumers into prize lotteries for collecting receipts; mainly meant for registered workers.

Normative Measures

Normative measures seek to change public attitudes and build trust towards the tax system to foster a culture of compliance.

For everyone, targeting both registered and unregistered workers:

Tax education and public awareness

Educating the public about the importance of taxes and their role.

Promoting a positive tax culture

Encouraging a positive attitude towards paying taxes and fostering a culture of compliance.

Building trust in tax systems

Establishing and maintaining public trust in the fairness and efficiency of tax policies and administration.

Measures Against Underreporting

Many OECD countries are now addressing underreporting in the business-to-consumer retail sectors. These sectors are prone to falling into the shadow economy due to their high volume of cash transactions. Worldwide, electronic cash registers and electronic point-of-sale systems are often manipulated to underreport sales using software like Phantomware and Zappers.

To address these and other instances of underreporting, countries employ various methods:

Mandating Electronic Record-Keeping and Certified POS Systems

The Irish government mandated in July 2008 that electronic cash registers must record and retain sales entries in electronic format with unique sequential numbers, dates, and times. They also issued guidelines for proper record-keeping to secure data integrity.

Similar measures have been adopted in other countries, such as Argentina, Brazil, Bulgaria, Greece, Hungary, Latvia, Lithuania, Malta, Poland, Russia, Turkey, Venezuela, and Canada (namely in Quebec). These measures include the mandatory use of certified ECRs or POS systems in targeted sectors like restaurants. These systems feature monitoring devices, digital signatures for data security, or direct data transfers to tax authorities.

However, this approach doesn’t entirely eliminate underreporting, especially when businesses and customers agree on cash transactions off the record or when businesses fail to register cash sales. Also, there are concerns about excessive government interference in private businesses and the high costs of these systems, which limits their widespread adoption.

Compulsory E-Invoicing

In business, while POS systems are great for tracking cash sales to consumers, electronic invoicing is even better for keeping tabs on transactions between businesses. For tax authorities, e-invoicing is a useful tool for spotting businesses involved in cash transactions under the radar or those trying to pull off scams with fake invoices.

E-invoicing has a big advantage over traditional paper invoices because it can spot discrepancies between recorded supplies and actual sales more efficiently. Although using paper invoices for cross-checking has been tricky, electronic invoicing makes it much simpler, as long as there’s enough IT support and a reliable system for identifying taxpayers.

Countries like South Korea and Chile were among the first to adopt e-invoicing, and now it’s becoming mandatory, especially for businesses registered for VAT. But switching to e-invoicing might mean businesses need to change their processes and invest in IT systems to handle the data.

Some countries have made e-invoicing compulsory for certain business activities, like dealings with the government or specific sectors such as finance or telecoms. While not every country has made it mandatory, many are encouraging its use to simplify tax compliance. To help businesses make the switch, some countries offer incentives like tax credits, as seen in South Korea where businesses get tax credits for using electronic invoices.

While implementing changes into businesses might seem daunting, the benefits of e-invoicing between businesses are undeniable. traceCORE B2B E-Invoicing automates VAT reporting and tax accrual for transactions between legal entities and entrepreneurs subject to VAT, thus helping increase VAT collection by up to 150%.

Receipt Lotteries

An alternative approach to counter underreporting is to incentivize customers to request receipts. Taiwan introduced a “receipt lottery” in 1951, where they offer lottery prizes to encourage people to ask for receipts and prompt businesses to report sales accurately. Mainland China adopted similar measures in 1989, with mandatory lottery receipts implemented nationwide in 2009, which managed to increase tax revenue in trial areas.

Puerto Rico introduced a sales-and-use tax lottery in 2011. In Sao Paulo, Brazil, the Nota Fiscal Paulista program offers VAT rebates of up to 20% to consumers who collect receipts and provides lottery tickets for every US$50 purchase. This program increased reported revenues by at least 22%.

Conclusion

Addressing participation in the shadow economy requires both incentives and deterrents. While deterrents discourage informal activities through penalties, incentives make formal employment more attractive.

Important note: informal employment is often the only option for people who are excluded from the formal economy or pushed out during economic transitions. So, when trying to formalize informal employment, it is more effective to use incentives rather than punishments.

Also, clear guidelines and standards are key to establishing fairness and compliance in the formal economy.

An underrated instrument in addressing these challenges is technology. Data shows that using technology helps curb hidden economic activities and encourage businesses to operate formally. This is because digitization makes it easier and cheaper to formalize businesses, access business-related information, and improve tax processes. This aligns with research findings suggesting that for every 0.1-point increase in digitalization, the shadow economy shrinks by 4%.

In many ways, technology-related measures like traceCORE digital transformation solutions represent “win-win” policies because they require minimal financial investment. These measures mainly focus on creating a practical business environment — streamlining administrative processes, making reporting requirements clearer, and improving compliance enforcement.