To respond to the evolving digital landscape, governments are innovating to combat fraud and streamline their economies. One powerful tool is mandatory e-invoicing.

The e-invoicing initiative is a crucial step toward implementing continuous transaction controls. As government agencies closely monitor e-invoices from start to finish, they can leverage CTC (Continuous Transaction Control) for real-time tax and data reporting.

State Goals with E-Invoicing Implementation

Implementing e-invoicing is essential for governments to meet crucial objectives.

Minimize the Tax Gap

Firstly, it helps in minimising the tax gap, which is the disparity between owed and collected taxes. By optimising invoicing processes and creating a more efficient and equitable tax system, the state curbs revenue loss that comes from non-compliance.

Automate VAT administration

E-invoicing simplifies value-added tax administration through automation. This streamlines VAT collection and enables tax authorities to better monitor transactions. In turn, it improves transparency and accountability in VAT reporting.

Combat VAT-evasion

E-invoicing is essential in combating fraud schemes linked to VAT evasion. Electronic systems authenticate invoices, which helps governments detect irregularities more efficiently. Such a proactive approach strengthens tax system integrity and promotes fair taxation.

Understanding Continuous Transaction Control (CTC)

Continuous transaction controls enable tax administrations to access real-time or near-real-time financial data from businesses in their countries.

Previously, tax owed from transactions was tracked using methods that did not offer immediate access to data. The main limitations of conventional tax control and liquidation methods are:

- Assessments rely on taxpayer declarations and documents provided during verification, which limits control effectiveness.

- Assessments occur after transactions are complete and invoices are issued. This requires authorities to reconstruct steps and verify legal compliance based on provided reports and documents.

CTC systems transform this process. Authorities can monitor ongoing transactions and pre-emptively check compliance with legal requirements. Also, moving operations to the cloud streamlines management and monitoring and capitalises on the benefits of digitisation.

Exploring Five E-Invoicing Models

E-invoicing systems and CTC models, while tailored to individual countries, can be broadly categorised based on their typical features

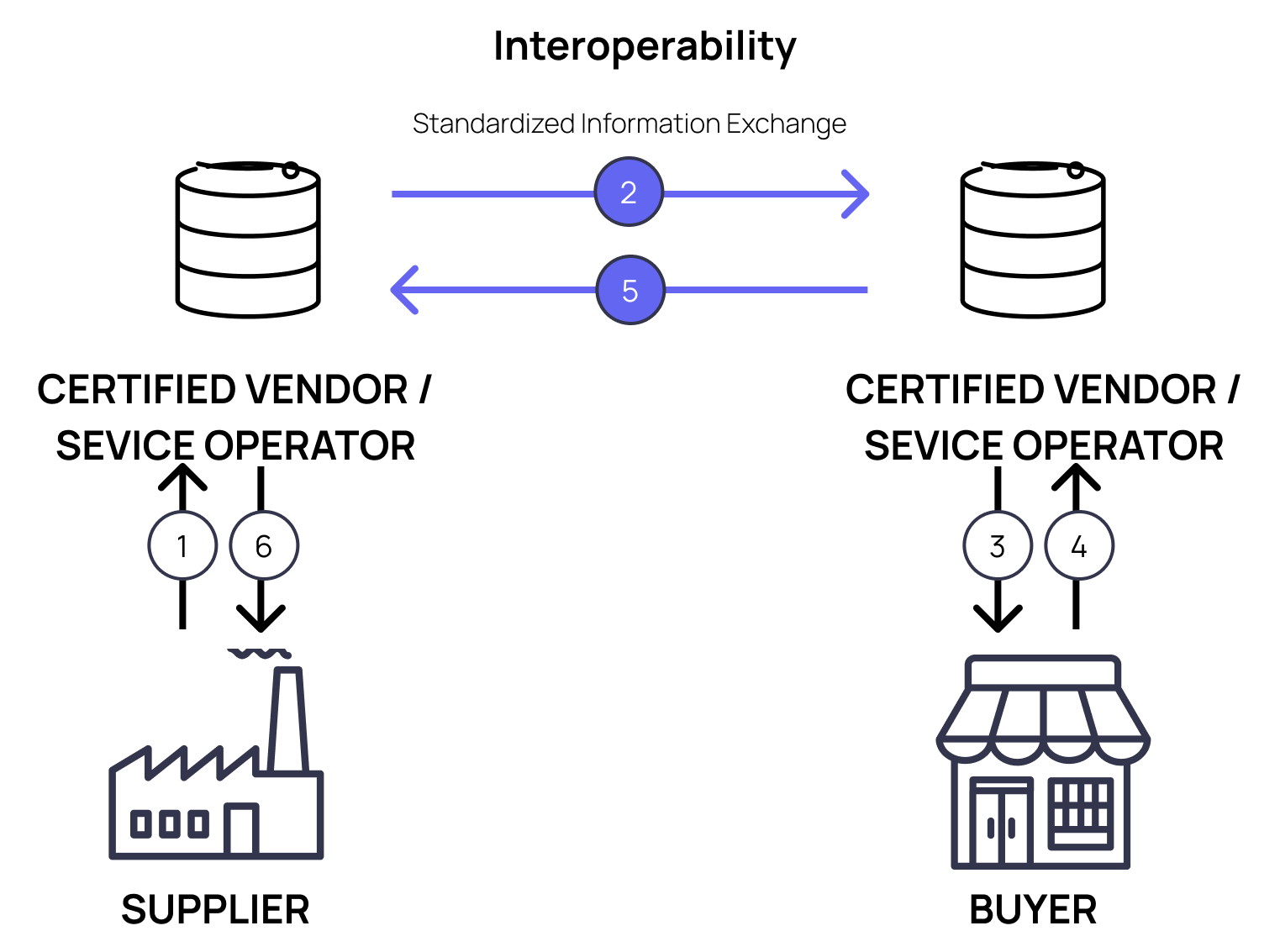

Interoperability Model

The interoperability model allows companies to choose from different software providers and exchange different types of documents as they manage their supply chains.

- Tax administrations establish fiscal rules for compliant e-invoices.

- A network governing entity, whether public or private, defines guidelines and technical specifications for how businesses should format their documents and exchange messages.

- Technical standards may vary nationally, regionally, or internationally, with variations based on country-specific needs.

- Data is structured and accessible for audit by end-users or their service providers.

Peppol exemplifies this model and allows global businesses to connect and exchange electronic documents independently of government or tax authority oversight. Businesses bypass specific format or regulation variations imposed by authorities by connecting directly to Peppol’s decentralised system using their software provider’s access point.

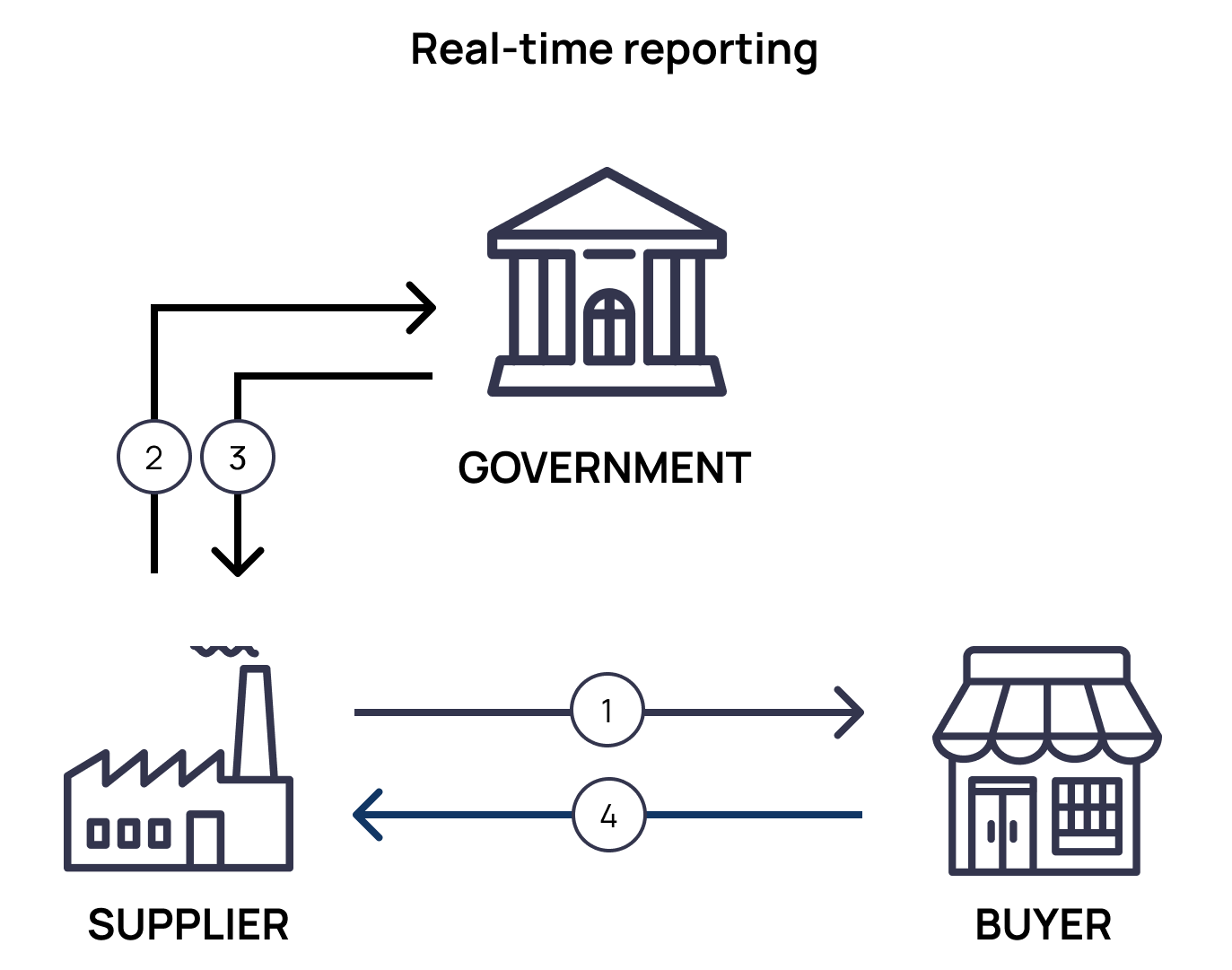

Real-Time Invoice Reporting Model

The real-time reporting model is the first of its kind to directly connect with the tax authority, offering a proactive approach to invoice reporting.

- The tax administration establishes a centralised processing platform for processing invoice data.

- Access and processing on this platform are restricted to accredited software solutions.

- Taxpayers are required to submit the invoice or a subset of invoice data within 24-72 hours of issuance, with varying frequency intervals.

- While mandatory for larger economic operators and multinational corporations, the system is extendable to SMEs.

Apart from fiscal regulations, the invoicing process is unregulated, which allows economic operators to choose between formatted electronic invoices or more conventional formats like PDFs or traditional paper, although e-invoicing is encouraged for its efficiency.

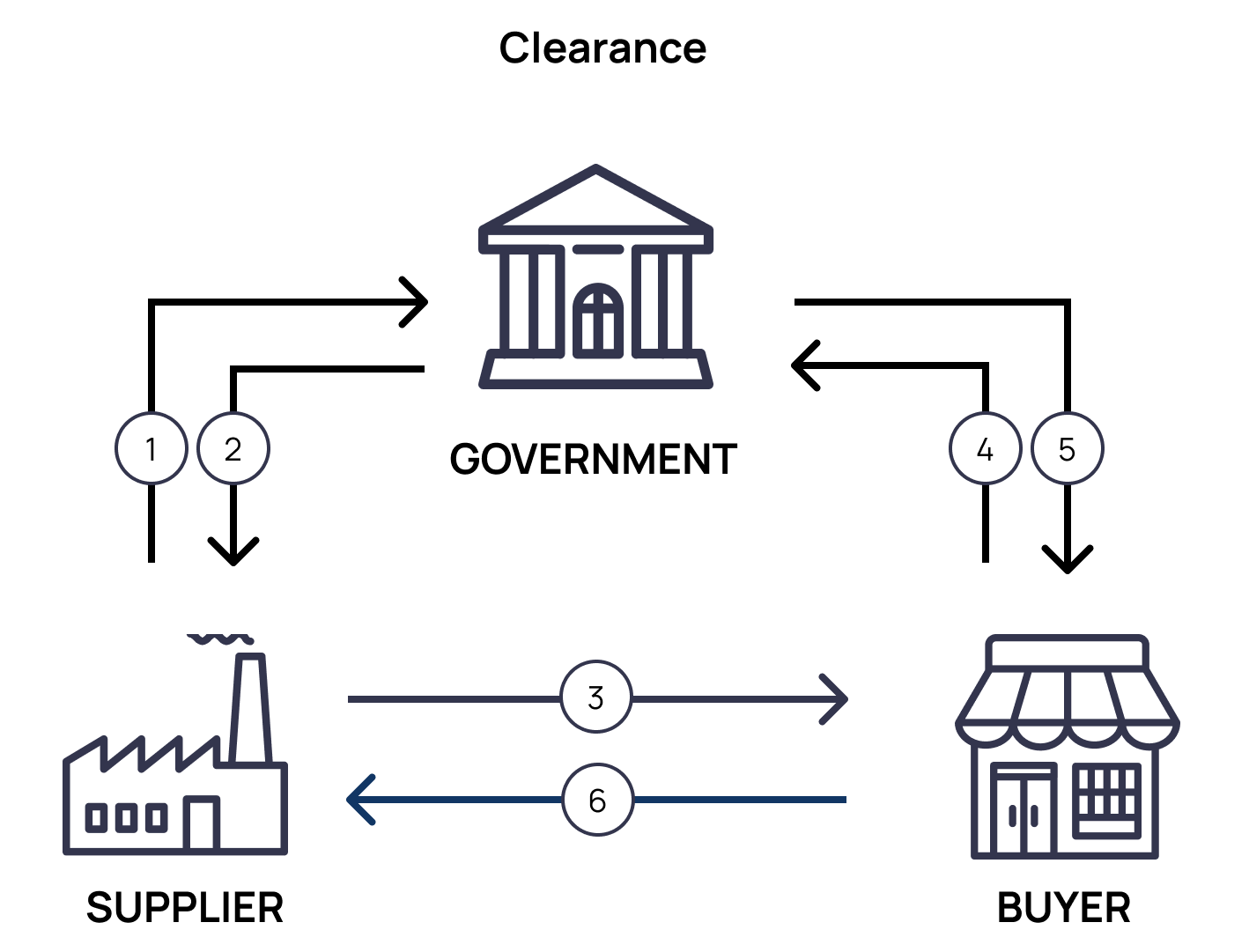

Clearance Model

In this model, invoices undergo clearance by a government CTC platform or certified service providers before being exchanged between trading parties.

- Tax authorities specify a structured invoice format for taxpayer use.

- Suppliers submit invoices to the designated platform for fiscal validity clearance.

- The designated platform clears the invoice and confirms its fiscal validity for clearance.

- Buyers validate the invoice on the platform before payment.

The seller then directly sends the cleared invoice to the buyer for verification. The clearance model has a few variations in terms of timing and centralisation:

- Pre-clearance (hard clearance) — Involves clearing invoices before they are exchanged between economic operators.

- Post-clearance (soft clearance) — This occurs shortly after invoice exchange between economic operators.

- Centralised clearance — Carried out using a centralised platform managed by the tax authority.

Decentralised clearance — The tax authority delegates clearance tasks to authorised service providers, who transmit invoice data to the tax authority’s central platform for recording in the repository.

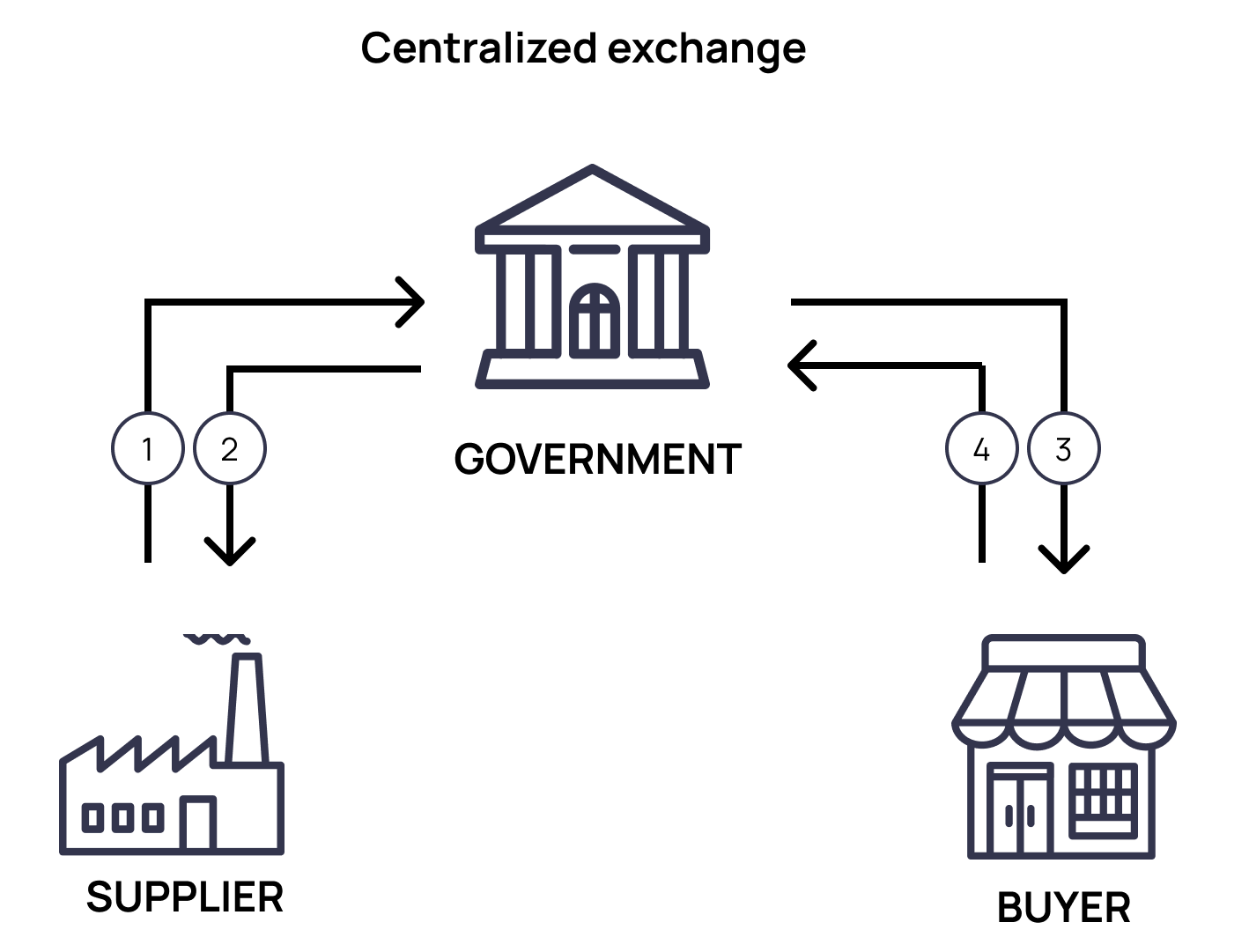

Centralised Exchange Model

The centralised exchange model is an additional feature that complements the clearance model or serves specific purposes like public procurement. It is government-provided and replaces direct document exchanges between economic operators in certain situations.

- Establishment of a central platform or network by a government agency

- Exchange of e-invoices between buyers and sellers facilitated through the central platform or network.

- Integration with clearance models, which allows the central platform to fiscally validate transactions.

Variations may include connectivity to interoperability networks to support domestic and non-domestic flows.

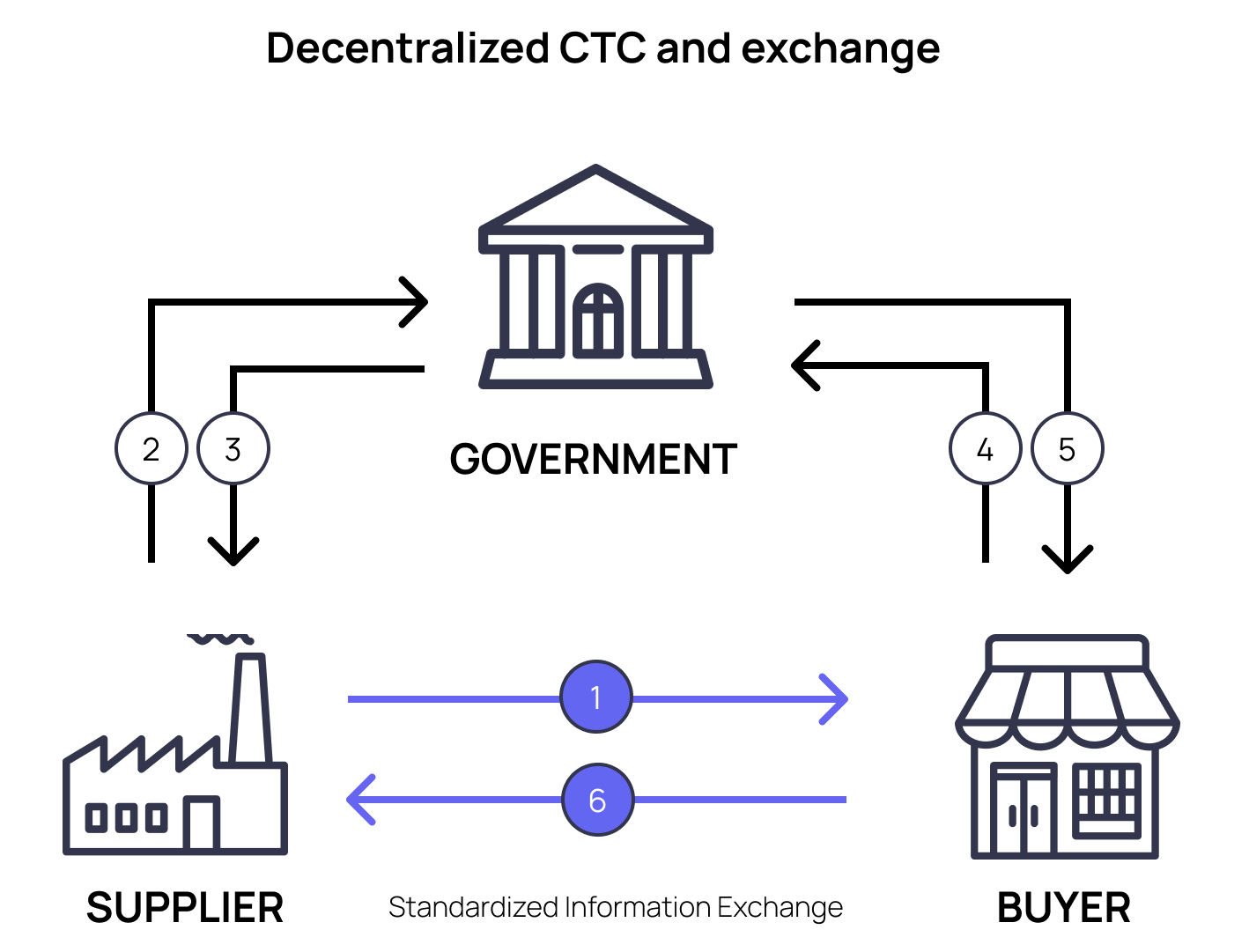

Decentralised CTC and Exchange (DCTCE)

The decentralised CTC and exchange model combines features of both the interoperability and CTC models.

DCTCE builds on the four-corner model by introducing a five-corner model. It functions by utilising a decentralised system of approved access points, which oversee the flow of invoices between businesses engaged in trade. These access points relay all essential invoice details to a central platform governed by tax authorities and act as a crucial component of the model’s structure.

- Businesses select approved service providers certified by tax authorities for validating and exchanging data.

- Businesses and governments continue using existing infrastructure for data exchange, taxation and procurement.

- Minimal data transfer. Only a portion of the exchanged document is submitted to the central platform.

- Data subset submission occurs immediately after document issuance and exchange.

What is NOT considered an e-invoice are paper or printed documents, or PDFs and image files. PDFs or image files sent via email are, of course, a step toward digitalisation but are not the whole way there. Recipients still need to manually input or use OCR technology to extract data, and they may still need to be printed for record-keeping.

traceCORE bot

Pros and Cons of E-Invoicing Models

Interoperability

+ Essential for digital adoption

+ Accommodates various interests

+ Seamless integration

- Accommodates various interests

- Introduces dependencies

Real-Time Invoice Reporting

+ Flexibility in invoicing formats

+ Data confidentiality

+ Encourages economic efficiency

- Requires separate solutions

- Increases investment and maintenance costs

Clearance

+ Flexibility in invoice exchange methods

+ Tax authorities access all invoice info before client receipt

- Non-standardised invoice format

- Limited buyer-seller interoperability

- Dependence on intermediaries

- Lack of automation for accounts

Centralised Exchange

+ Ease of implementation

+ Integration with clearance models

- Limited interoperability hinders full automation

- Requires separate solutions for related documents

DCTCE

+ Incremental deployment

+ Supply chain automation

+ Innovation and value-added

+ No single point of failure or dependency

- Variations among countries

- Higher complexity in model implementation

Global Adoption of E-Invoicing Models

- Interoperability

- Australia, New Zealand, Singapore, Japan, Finland

- Centralised exchange

- Turkey, Italy, Belgium, Portugal, Kazakhstan

- Real-time reporting

- Hungary, South Korea, Thailand

- Clearance

- India, China, Chile, Mexico, Indonesia, Egypt, Uganda, Kenya, Peru, Saudi Arabia

- DCTCE

- Spain, France

In many instances, B2G transactions have been the initial focus, with B2B transactions following suit.

traceCORE bot

In summary, countries are continuing to implement new e-invoicing rules, and this trend is expected to grow. New proposals aim to create an operational environment that achieves both fiscal integrity and economic efficiency for everyone involved. That is why they are likely to receive significant support.